Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Starco Corp. wishes to purchase 8,000 shares of Gertrom Ltd., a publicly traded company. Starco contracts to buy the shares from a related party,

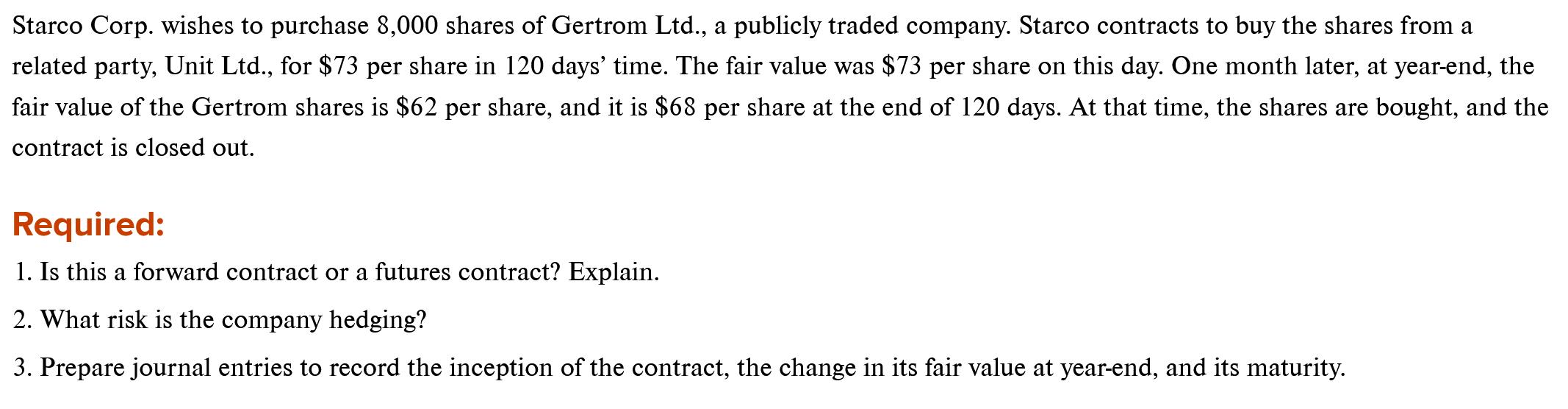

Starco Corp. wishes to purchase 8,000 shares of Gertrom Ltd., a publicly traded company. Starco contracts to buy the shares from a related party, Unit Ltd., for $73 per share in 120 days' time. The fair value was $73 per share on this day. One month later, at year-end, the fair value of the Gertrom shares is $62 per share, and it is $68 per share at the end of 120 days. At that time, the shares are bought, and the contract is closed out. Required: 1. Is this a forward contract or a futures contract? Explain. 2. What risk is the company hedging? 3. Prepare journal entries to record the inception of the contract, the change in its fair value at year-end, and its maturity. Starco Corp. wishes to purchase 8,000 shares of Gertrom Ltd., a publicly traded company. Starco contracts to buy the shares from a related party, Unit Ltd., for $73 per share in 120 days' time. The fair value was $73 per share on this day. One month later, at year-end, the fair value of the Gertrom shares is $62 per share, and it is $68 per share at the end of 120 days. At that time, the shares are bought, and the contract is closed out. Required: 1. Is this a forward contract or a futures contract? Explain. 2. What risk is the company hedging? 3. Prepare journal entries to record the inception of the contract, the change in its fair value at year-end, and its maturity.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 This is a forward contract The forward contract is an agreement in private that is generall...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started