Question

Stark Company has five employees. Employees paid by the hour earn $12 per hour for the regular 40-hour workweek and $18 per hour beyond the

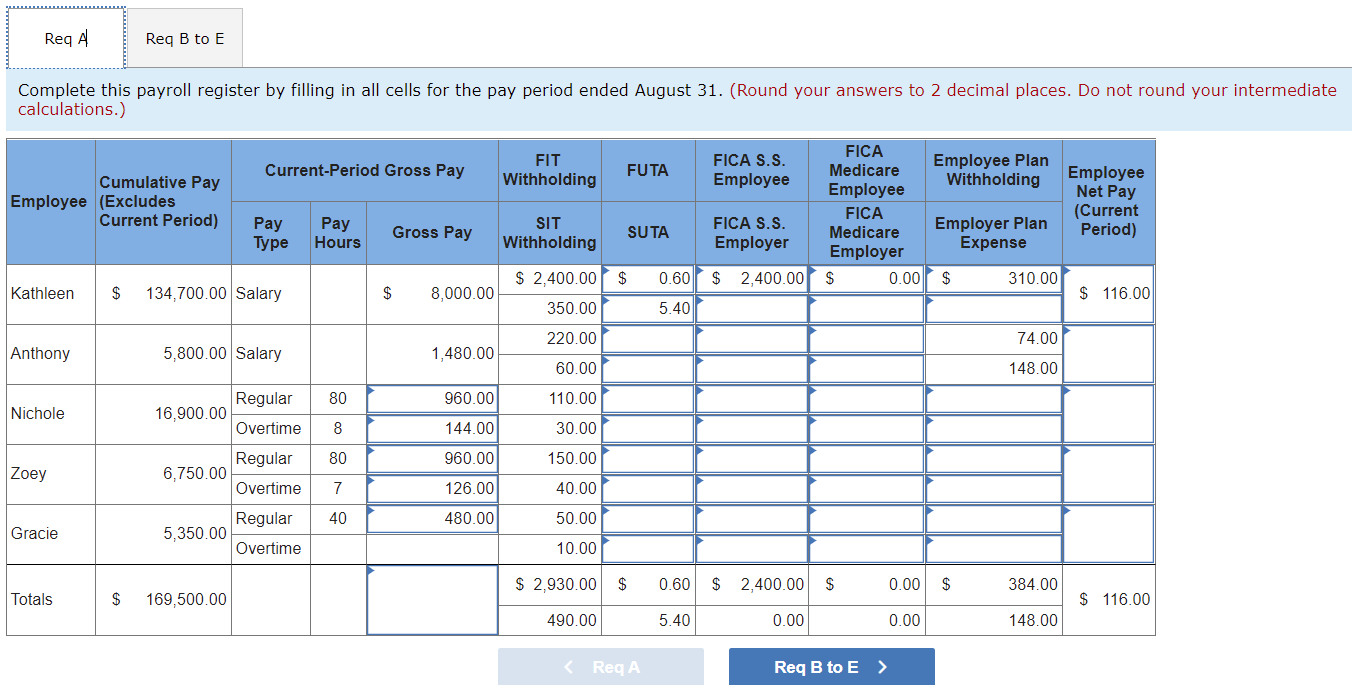

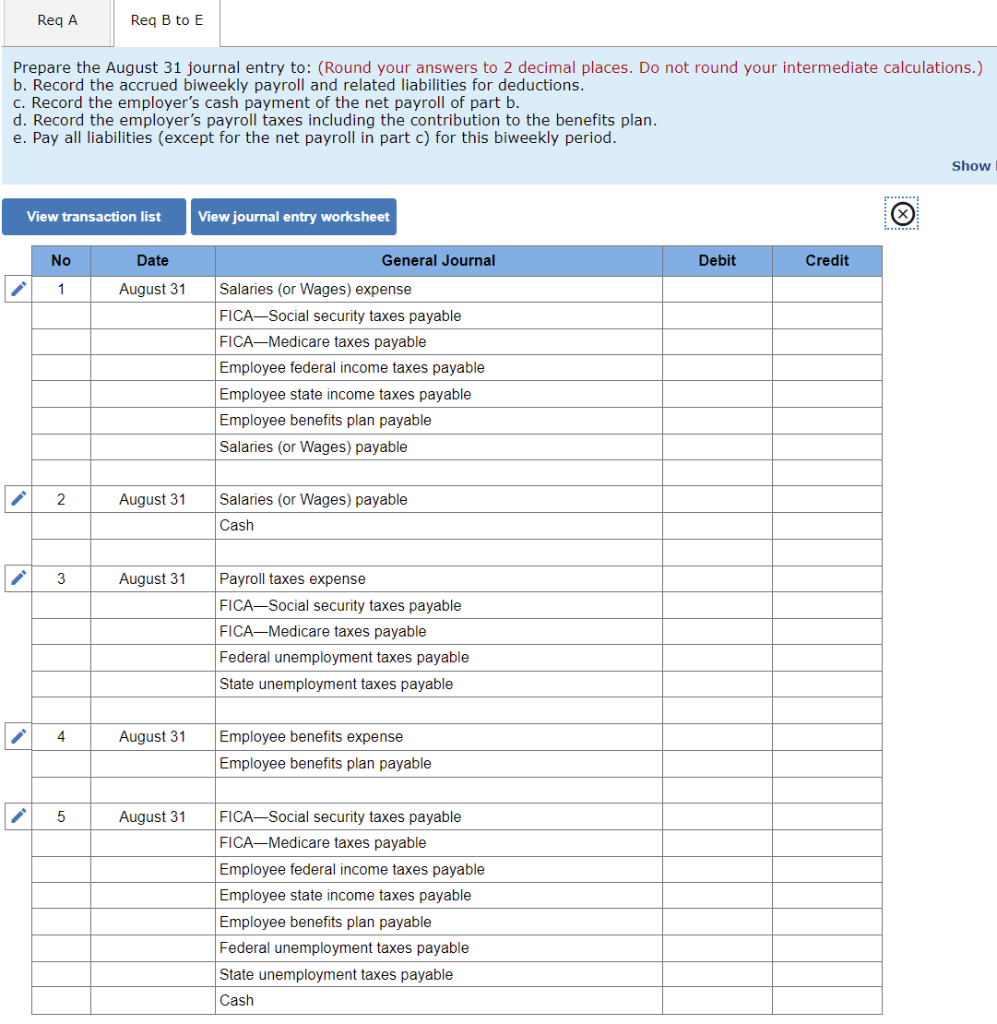

Stark Company has five employees. Employees paid by the hour earn $12 per hour for the regular 40-hour workweek and $18 per hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but salaried employees are paid monthly on the last biweekly payday of each month. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. The company has a benefits plan that includes medical insurance, life insurance, and retirement funding for employees. Under this plan, employees must contribute 5% of their gross income as a payroll withholding, which the company matches with double the amount. Following is the partially completed payroll register for the biweekly period ending August 31, which is the last payday of August. a. Complete this payroll register by filling in all cells for the pay period ended August 31. Prepare the August 31 journal entry to: b. Record the accrued biweekly payroll and related liabilities for deductions. c. Record the employers cash payment of the net payroll of part b. d. Record the employers payroll taxes including the contribution to the benefits plan. e. Pay all liabilities (except for the net payroll in part c) for this biweekly period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started