Question: Stark is a full - time exempt employee in Little Rock, Arkansas, where his state income tax rate is 5 . 9 % . He

Stark is a fulltime exempt employee in Little Rock, Arkansas, where his state income tax rate is He earns $ annually and is paid semimonthly. He has indicated that he is married filing jointly with dependents under the age of on his Form W He has checked the box on Step of his W and has $ additional income tax per pay period. His pretax health insurance is $ per pay period. Stark contributes of his pay to his Assuming that he has no other deductions, what is Stark's net pay for the period?

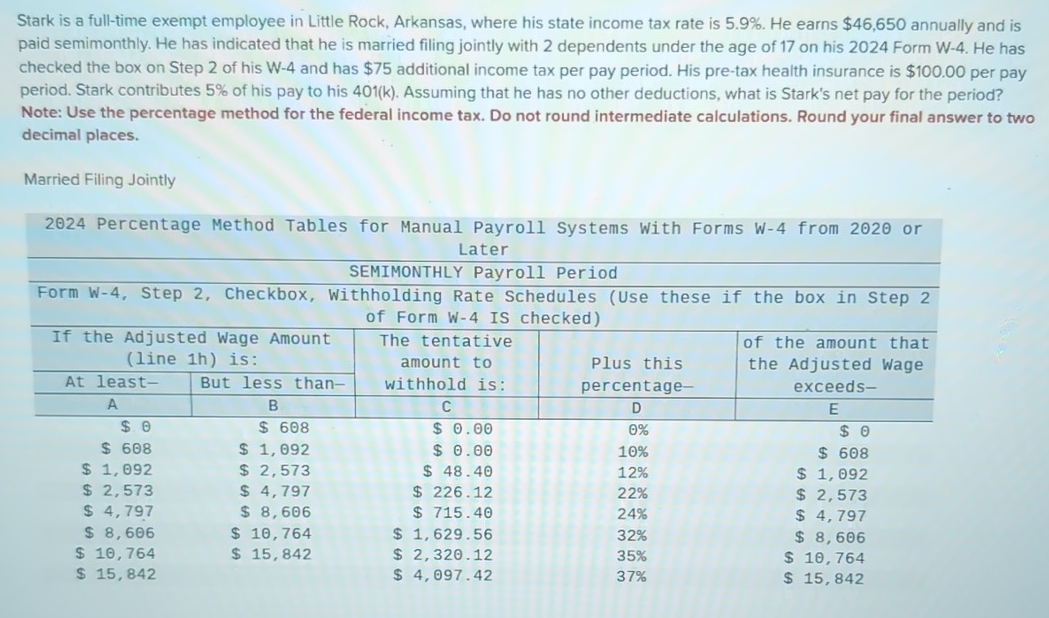

Note: Use the percentage method for the federal income tax. Do not round intermediate calculations. Round your final answer to two decimal places.

Married Filing Jointly

table Percentage Method Tables for Manual Payroll Systems With Forms W from or LaterSEMIMONTHLY Payroll PeriodtableForm W Step Checkbox, WIf the Adjusted Wage Amount line h is:tableholding Rate Sform W IStablees Use thesdthe box in Step The tentative amount to withhold is:Plus this percentageof the amount that the Adjusted Wage exceedsAt leastBut less thanABCDE$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock