Answered step by step

Verified Expert Solution

Question

1 Approved Answer

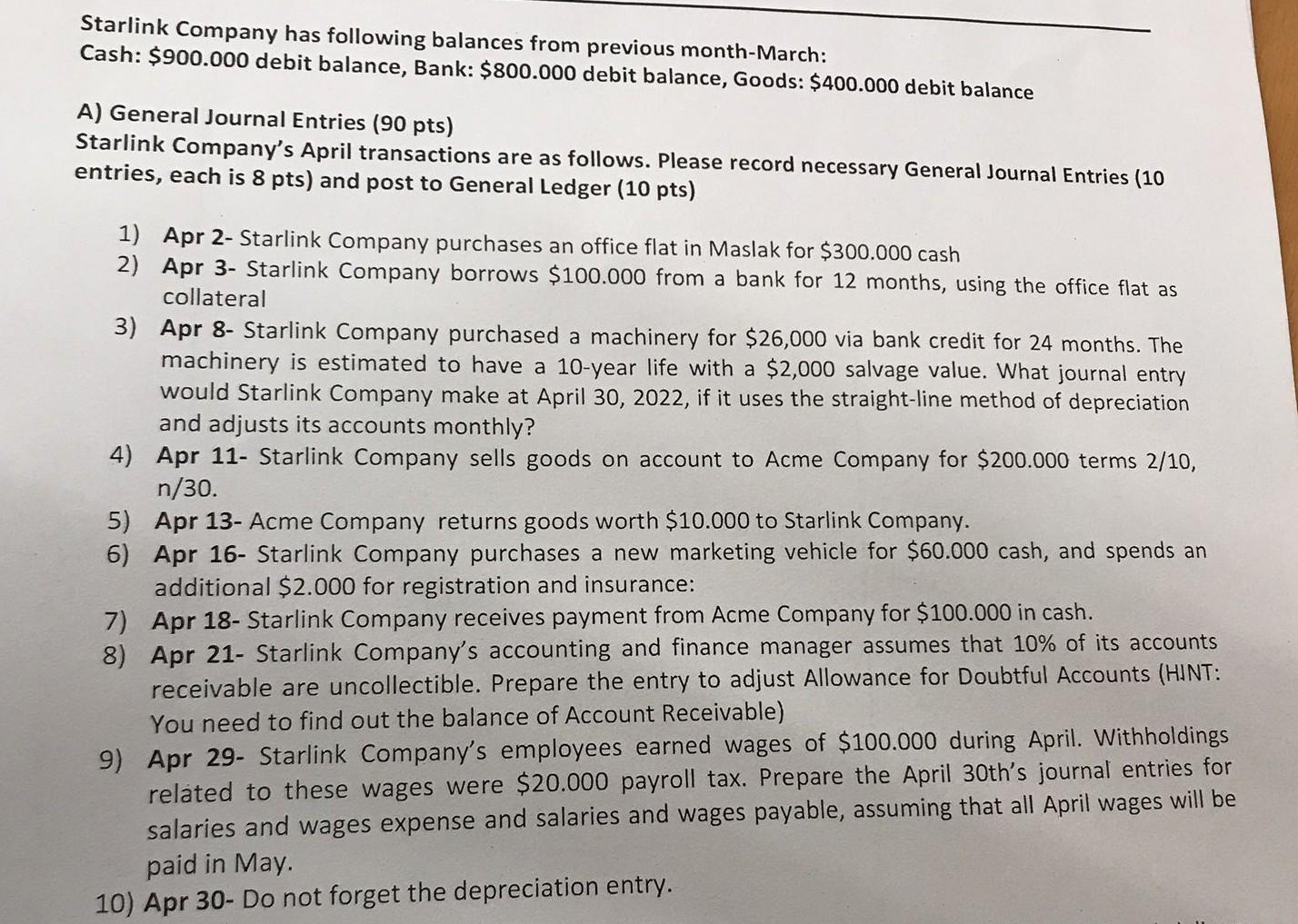

Starlink Company has following balances from previous month-March: Cash: $900.000 debit balance, Bank: $800.000 debit balance, Goods: $400.000 debit balance A) General Journal Entries (90

Starlink Company has following balances from previous month-March: Cash: $900.000 debit balance, Bank: $800.000 debit balance, Goods: $400.000 debit balance A) General Journal Entries (90 pts) Starlink Company's April transactions are as follows. Please record necessary General Journal Entries (10 entries, each is 8pts ) and post to General Ledger (10 pts) 1) Apr 2-Starlink Company purchases an office flat in Maslak for $300.000 cash 2) Apr 3- Starlink Company borrows $100.000 from a bank for 12 months, using the office flat as collateral 3) Apr 8- Starlink Company purchased a machinery for $26,000 via bank credit for 24 months. The machinery is estimated to have a 10 -year life with a $2,000 salvage value. What journal entry would Starlink Company make at April 30, 2022, if it uses the straight-line method of depreciation and adjusts its accounts monthly? 4) Apr 11-Starlink Company sells goods on account to Acme Company for $200.000 terms 2/10, n/30. 5) Apr 13-Acme Company returns goods worth $10.000 to Starlink Company. 6) Apr 16- Starlink Company purchases a new marketing vehicle for $60.000 cash, and spends an additional $2.000 for registration and insurance: 7) Apr 18-Starlink Company receives payment from Acme Company for $100.000 in cash. 8) Apr 21- Starlink Company's accounting and finance manager assumes that 10% of its accounts receivable are uncollectible. Prepare the entry to adjust Allowance for Doubtful Accounts (HINT: You need to find out the balance of Account Receivable) 9) Apr 29- Starlink Company's employees earned wages of $100.000 during April. Withholding related to these wages were $20.000 payroll tax. Prepare the April 30 th's journal entries fo salaries and wages expense and salaries and wages payable, assuming that all April wages will b paid in May. 10) Apr 30- Do not forget the depreciation entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started