Question

Starr Company decides to establish a fund that it will use 3 years from now to replace an aging production facility. The company will

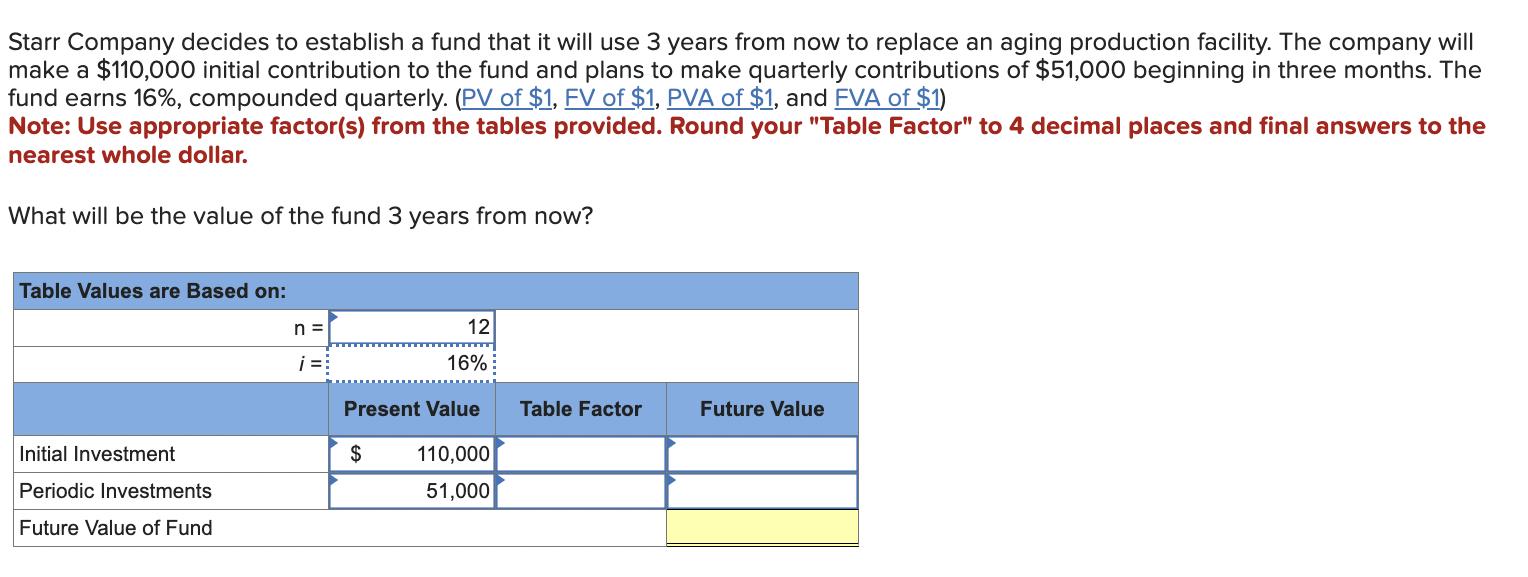

Starr Company decides to establish a fund that it will use 3 years from now to replace an aging production facility. The company will make a $110,000 initial contribution to the fund and plans to make quarterly contributions of $51,000 beginning in three months. The fund earns 16%, compounded quarterly. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Round your "Table Factor" to 4 decimal places and final answers to the nearest whole dollar. What will be the value of the fund 3 years from now? Table Values are Based on: Initial Investment Periodic Investments Future Value of Fund n = 12 16% Present Value Table Factor Future Value $ 110,000 51,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: John J. Wild, Ken W. Shaw

2010 Edition

9789813155497, 73379581, 9813155493, 978-0073379586

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App