Answered step by step

Verified Expert Solution

Question

1 Approved Answer

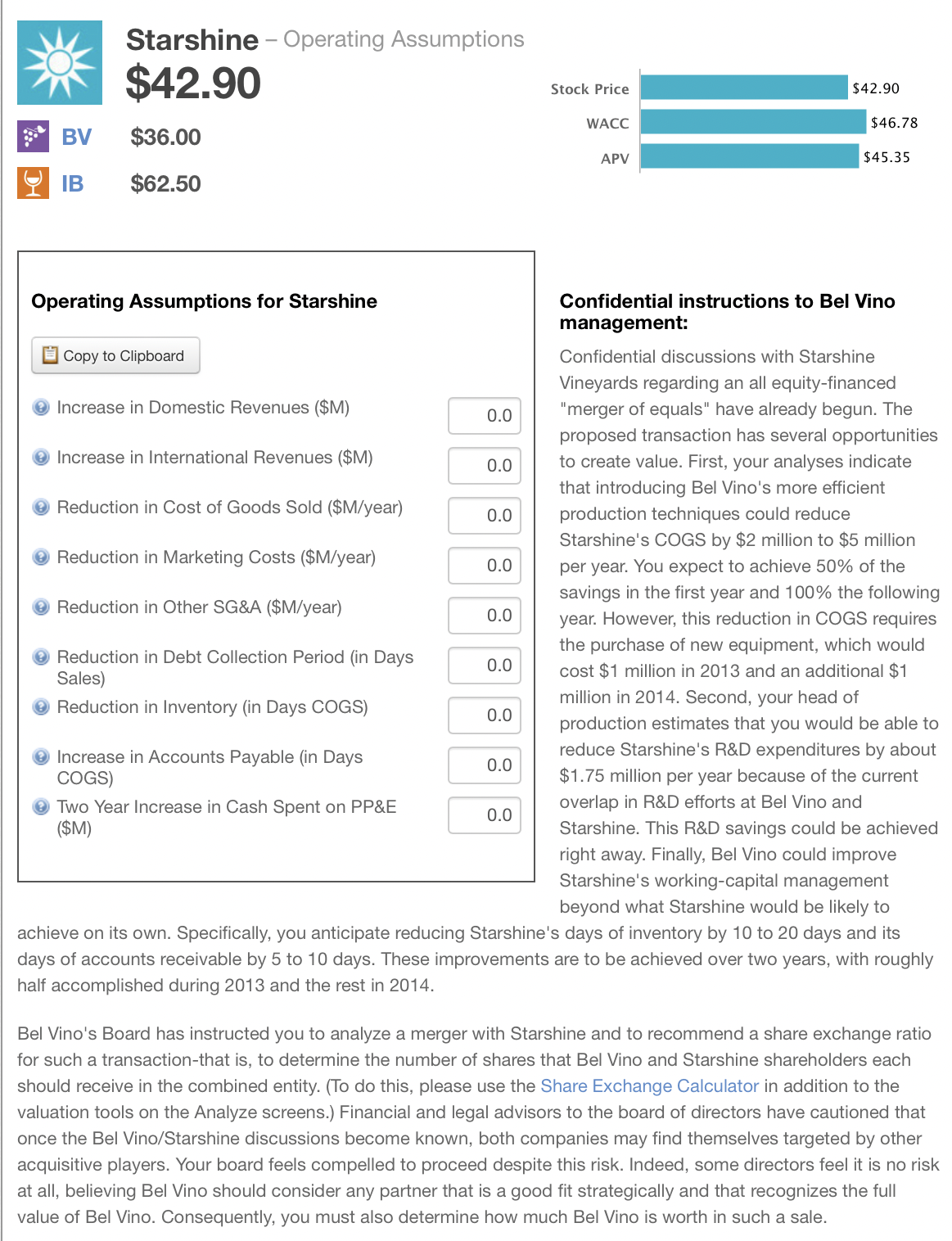

Starshine Operating Assumptions $42.90 BV $36.00 IB $62.50 Stock Price $42.90 WACC $46.78 APV $45.35 Operating Assumptions for Starshine Copy to Clipboard 0.0 Increase

Starshine Operating Assumptions $42.90 BV $36.00 IB $62.50 Stock Price $42.90 WACC $46.78 APV $45.35 Operating Assumptions for Starshine Copy to Clipboard 0.0 Increase in Domestic Revenues ($M) 0.0 Increase in International Revenues ($M) 0.0 Reduction in Cost of Goods Sold ($M/year) 0.0 Reduction in Marketing Costs ($M/year) Reduction in Other SG&A ($M/year) 0.0 Reduction in Debt Collection Period (in Days Sales) 0.0 Reduction in Inventory (in Days COGS) 0.0 Increase in Accounts Payable (in Days COGS) 0.0 Two Year Increase in Cash Spent on PP&E ($M) 0.0 Confidential instructions to Bel Vino management: Confidential discussions with Starshine Vineyards regarding an all equity-financed "merger of equals" have already begun. The proposed transaction has several opportunities to create value. First, your analyses indicate that introducing Bel Vino's more efficient production techniques could reduce Starshine's COGS by $2 million to $5 million per year. You expect to achieve 50% of the savings in the first year and 100% the following year. However, this reduction in COGS requires the purchase of new equipment, which would cost $1 million in 2013 and an additional $1 million in 2014. Second, your head of production estimates that you would be able to reduce Starshine's R&D expenditures by about $1.75 million per year because of the current overlap in R&D efforts at Bel Vino and Starshine. This R&D savings could be achieved right away. Finally, Bel Vino could improve Starshine's working-capital management beyond what Starshine would be likely to achieve on its own. Specifically, you anticipate reducing Starshine's days of inventory by 10 to 20 days and its days of accounts receivable by 5 to 10 days. These improvements are to be achieved over two years, with roughly half accomplished during 2013 and the rest in 2014. Bel Vino's Board has instructed you to analyze a merger with Starshine and to recommend a share exchange ratio for such a transaction-that is, to determine the number of shares that Bel Vino and Starshine shareholders each should receive in the combined entity. (To do this, please use the Share Exchange Calculator in addition to the valuation tools on the Analyze screens.) Financial and legal advisors to the board of directors have cautioned that once the Bel Vino/Starshine discussions become known, both companies may find themselves targeted by other acquisitive players. Your board feels compelled to proceed despite this risk. Indeed, some directors feel it is no risk at all, believing Bel Vino should consider any partner that is a good fit strategically and that recognizes the full value of Bel Vino. Consequently, you must also determine how much Bel Vino is worth in such a sale.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing the Starshine Merger 1 Starshines Operating Assumptions Based on the information provided we can analyze the potential impact of Starshines operating assumptions on its valuation Increase Do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started