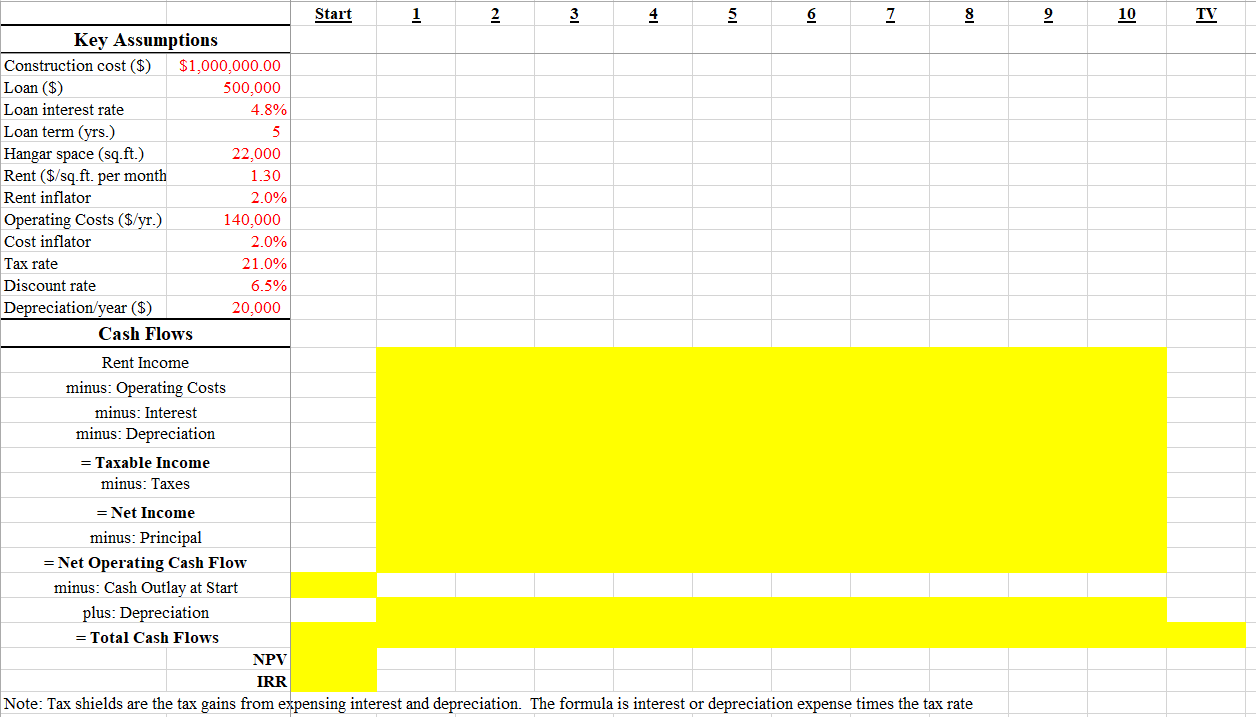

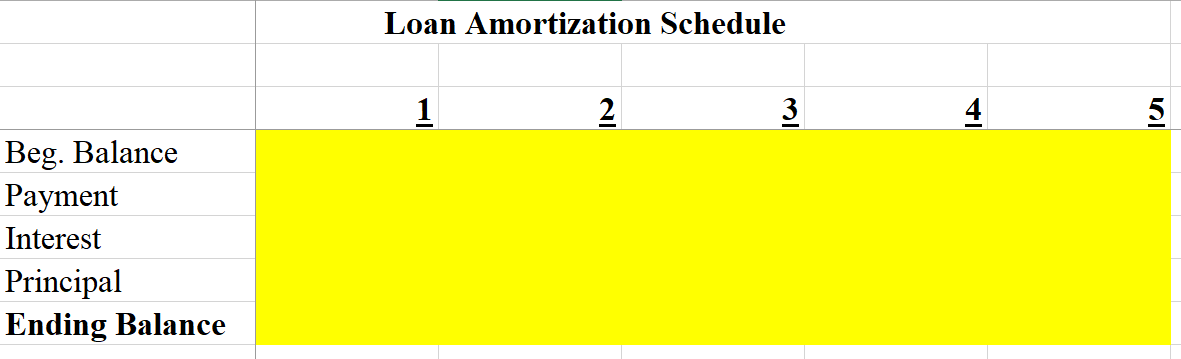

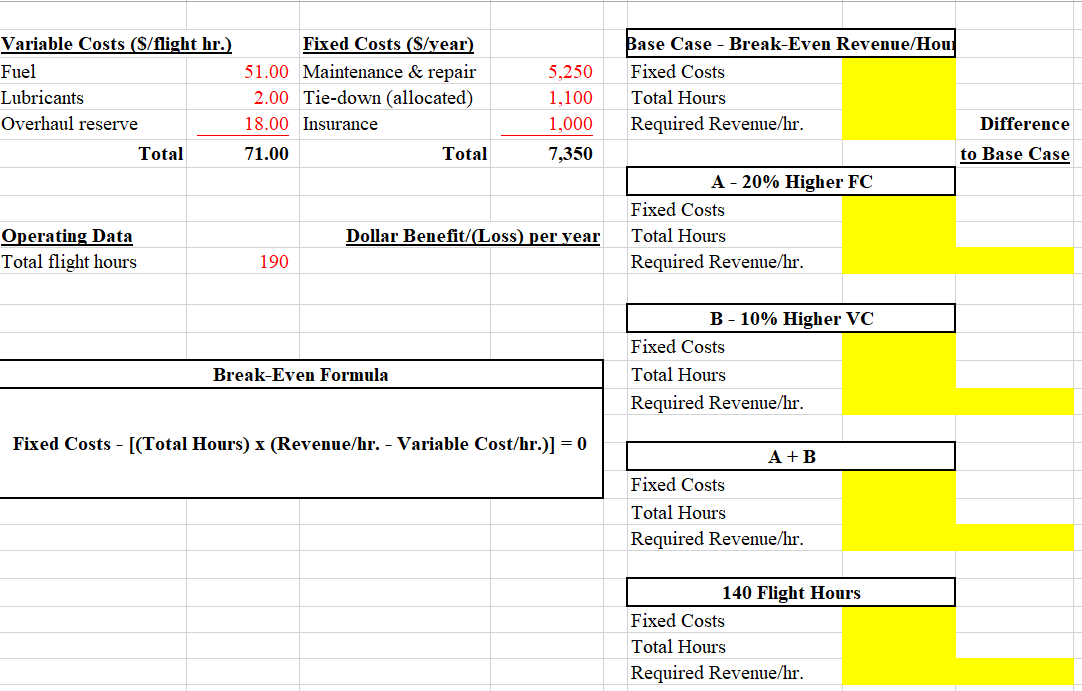

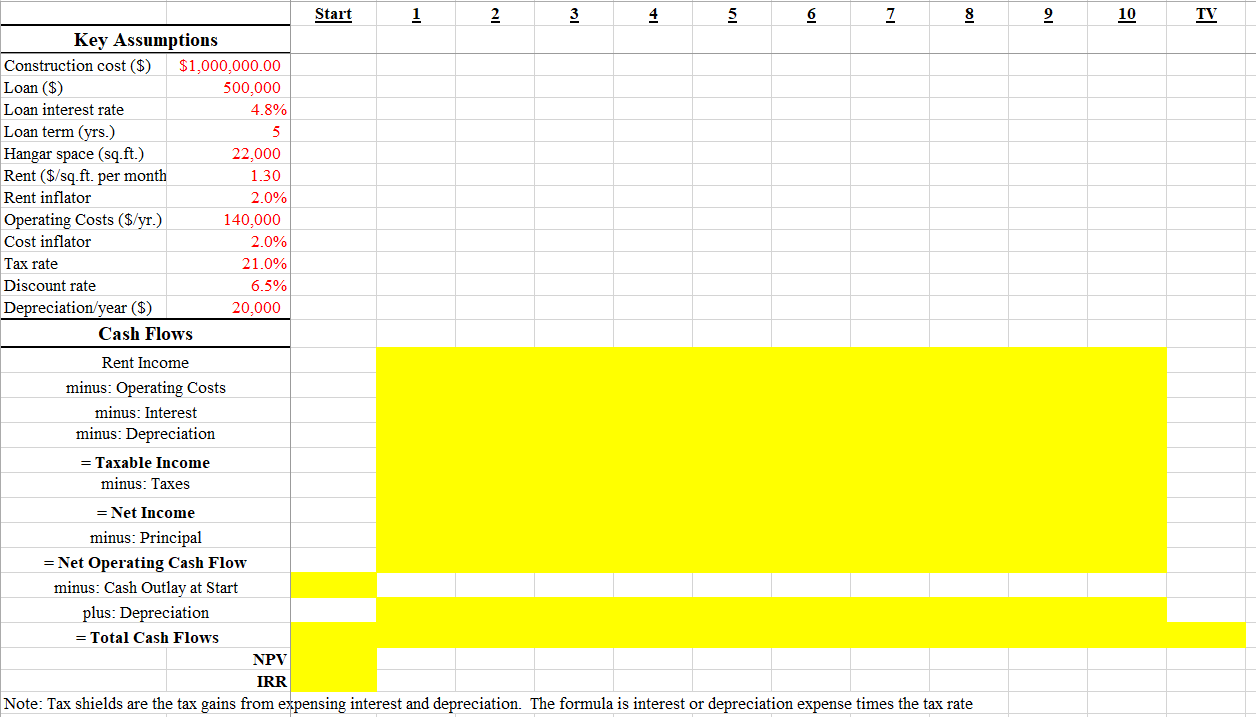

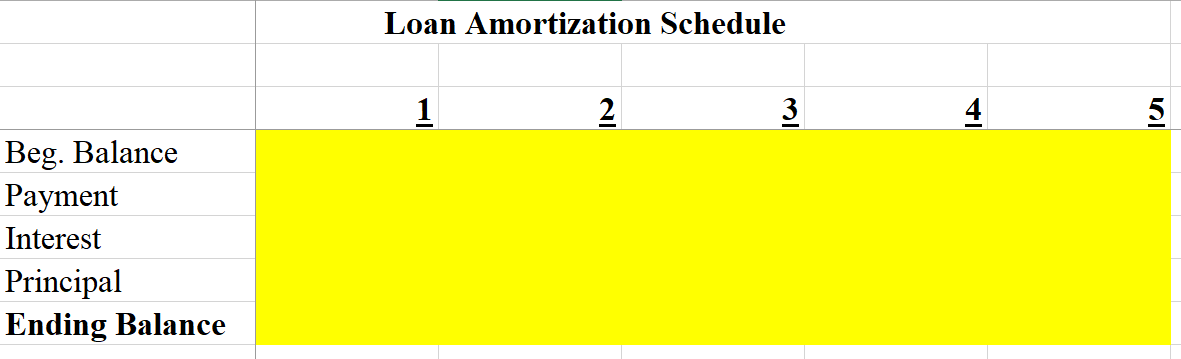

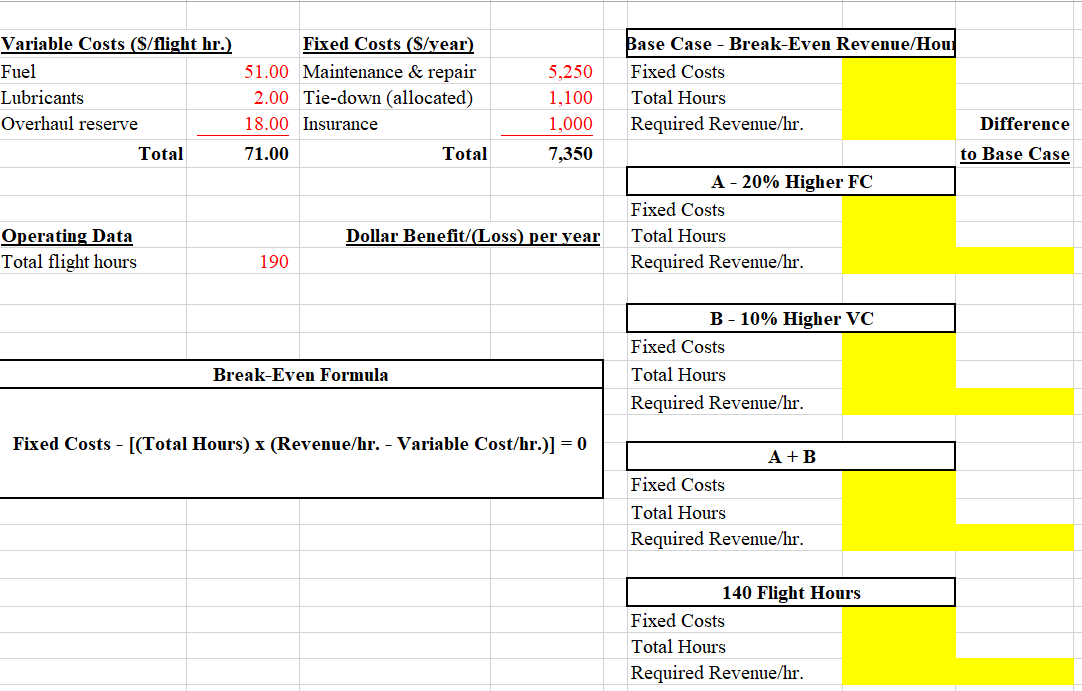

Start 1 2 3 +1 5 6 7 100 2 10 TV Key Assumptions Construction cost ($) $1,000,000.00 Loan ($) 500,000 Loan interest rate 4.8% Loan term (yrs.) 5 Hangar space (sq.ft.) 22,000 Rent ($/sq.ft. per month 1.30 Rent inflator 2.0% Operating Costs ($/yr.) 140,000 Cost inflator 2.0% Tax rate 21.0% Discount rate 6.5% Depreciation/year ($) 20,000 Cash Flows Rent Income minus: Operating Costs minus: Interest minus: Depreciation = Taxable Income minus: Taxes = Net Income minus: Principal = Net Operating Cash Flow minus: Cash Outlay at Start plus: Depreciation = Total Cash Flows NPV IRR Note: Tax shields are the tax gains from expensing interest and depreciation. The formula is interest or depreciation expense times the tax rate Loan Amortization Schedule 2 3 4 5 Beg. Balance Payment Interest Principal Ending Balance Variable Costs (S/flight hr.) Fuel Lubricants Overhaul reserve Total Fixed Costs (S/vear) 51.00 Maintenance & repair 2.00 Tie-down (allocated) 18.00 Insurance 71.00 Total 5,250 1,100 1,000 7,350 Base Case - Break-Even Revenue/Hou Fixed Costs Total Hours Required Revenue/hr. Difference to Base Case A - 20% Higher FC Fixed Costs Total Hours Required Revenue/hr. Dollar Benefit/Loss) per year Operating Data Total flight hours 190 B - 10% Higher VC Fixed Costs Total Hours Required Revenue/hr. Break-Even Formula Fixed Costs - [(Total Hours) x (Revenue/hr. - Variable Cost/hr.)] = 0 A+B Fixed Costs Total Hours Required Revenue/hr. 140 Flight Hour's Fixed Costs Total Hours Required Revenue/hr. Start 1 2 3 +1 5 6 7 100 2 10 TV Key Assumptions Construction cost ($) $1,000,000.00 Loan ($) 500,000 Loan interest rate 4.8% Loan term (yrs.) 5 Hangar space (sq.ft.) 22,000 Rent ($/sq.ft. per month 1.30 Rent inflator 2.0% Operating Costs ($/yr.) 140,000 Cost inflator 2.0% Tax rate 21.0% Discount rate 6.5% Depreciation/year ($) 20,000 Cash Flows Rent Income minus: Operating Costs minus: Interest minus: Depreciation = Taxable Income minus: Taxes = Net Income minus: Principal = Net Operating Cash Flow minus: Cash Outlay at Start plus: Depreciation = Total Cash Flows NPV IRR Note: Tax shields are the tax gains from expensing interest and depreciation. The formula is interest or depreciation expense times the tax rate Loan Amortization Schedule 2 3 4 5 Beg. Balance Payment Interest Principal Ending Balance Variable Costs (S/flight hr.) Fuel Lubricants Overhaul reserve Total Fixed Costs (S/vear) 51.00 Maintenance & repair 2.00 Tie-down (allocated) 18.00 Insurance 71.00 Total 5,250 1,100 1,000 7,350 Base Case - Break-Even Revenue/Hou Fixed Costs Total Hours Required Revenue/hr. Difference to Base Case A - 20% Higher FC Fixed Costs Total Hours Required Revenue/hr. Dollar Benefit/Loss) per year Operating Data Total flight hours 190 B - 10% Higher VC Fixed Costs Total Hours Required Revenue/hr. Break-Even Formula Fixed Costs - [(Total Hours) x (Revenue/hr. - Variable Cost/hr.)] = 0 A+B Fixed Costs Total Hours Required Revenue/hr. 140 Flight Hour's Fixed Costs Total Hours Required Revenue/hr