Answered step by step

Verified Expert Solution

Question

1 Approved Answer

start of the year, your company received a loan from a bank in the form of a note payable for $75,000 with the principal

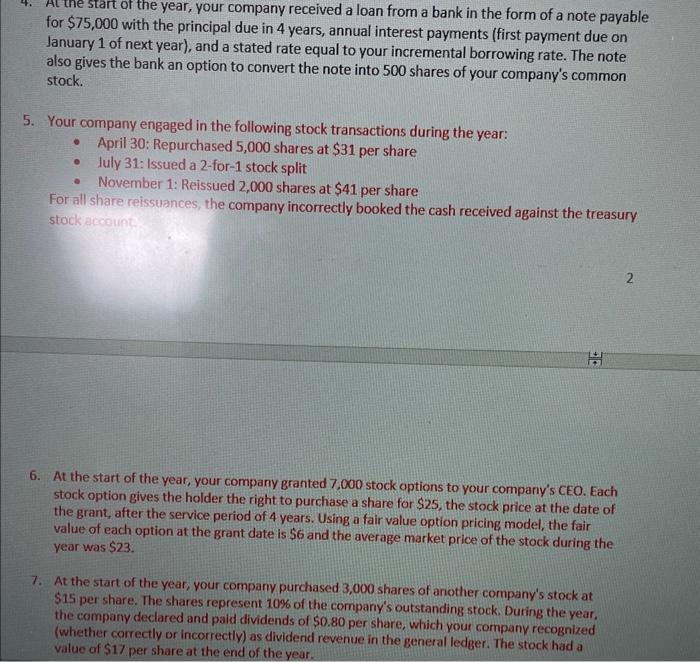

start of the year, your company received a loan from a bank in the form of a note payable for $75,000 with the principal due in 4 years, annual interest payments (first payment due on January 1 of next year), and a stated rate equal to your incremental borrowing rate. The note also gives the bank an option to convert the note into 500 shares of your company's common stock. 5. Your company engaged in the following stock transactions during the year: April 30: Repurchased 5,000 shares at $31 per share July 31: Issued a 2-for-1 stock split November 1: Reissued 2,000 shares at $41 per share For all share reissuances, the company incorrectly booked the cash received against the treasury stock account. F 6. At the start of the year, your company granted 7,000 stock options to your company's CEO. Each stock option gives the holder the right to purchase a share for $25, the stock price at the date of the grant, after the service period of 4 years. Using a fair value option pricing model, the fair value of each option at the grant date is $6 and the average market price of the stock during the year was $23. 7. At the start of the year, your company purchased 3,000 shares of another company's stock at $15 per share. The shares represent 10% of the company's outstanding stock. During the year, the company declared and paid dividends of $0.80 per share, which your company recognized (whether correctly or incorrectly) as dividend revenue in the general ledger. The stock had a value of $17 per share at the end of the year. 2

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 At the start of the year your company records the note payable as a liability on its balance sheet 2 For the stock repurchase your company records a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started