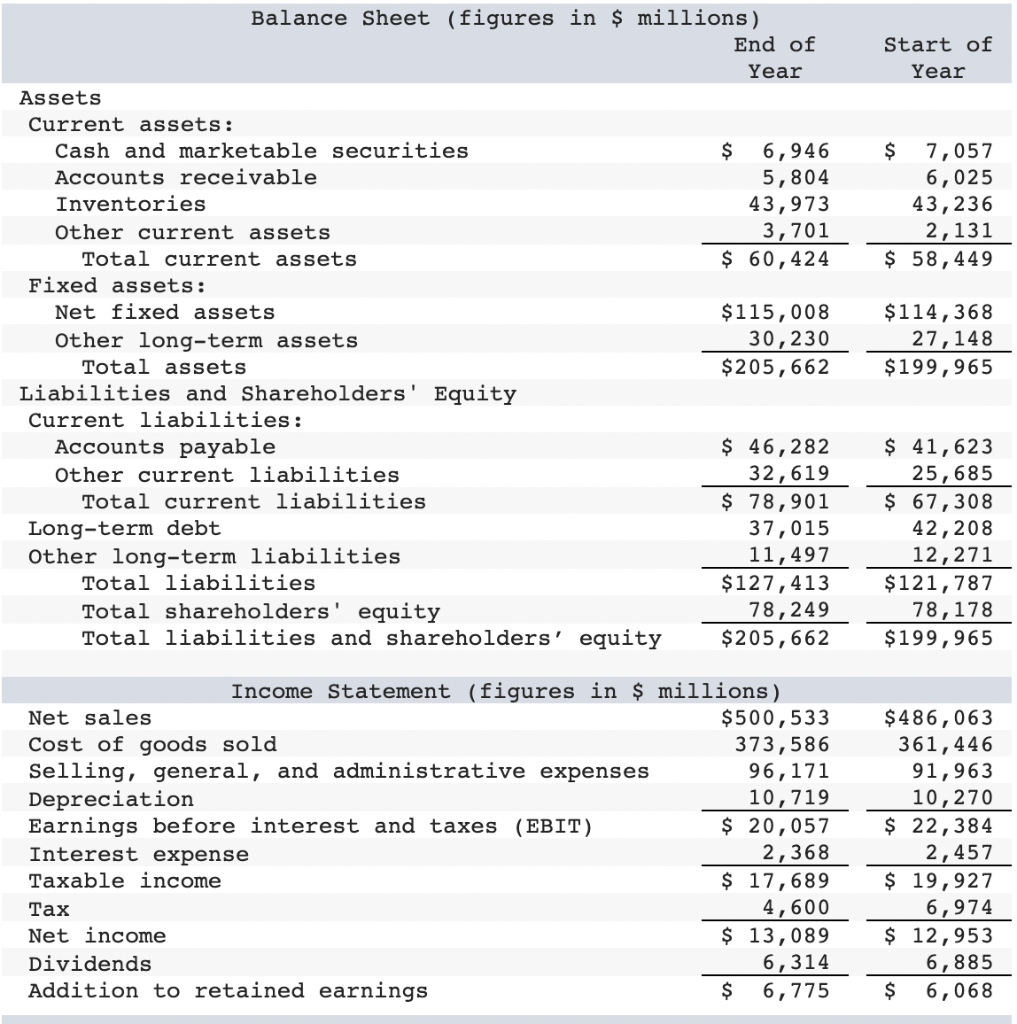

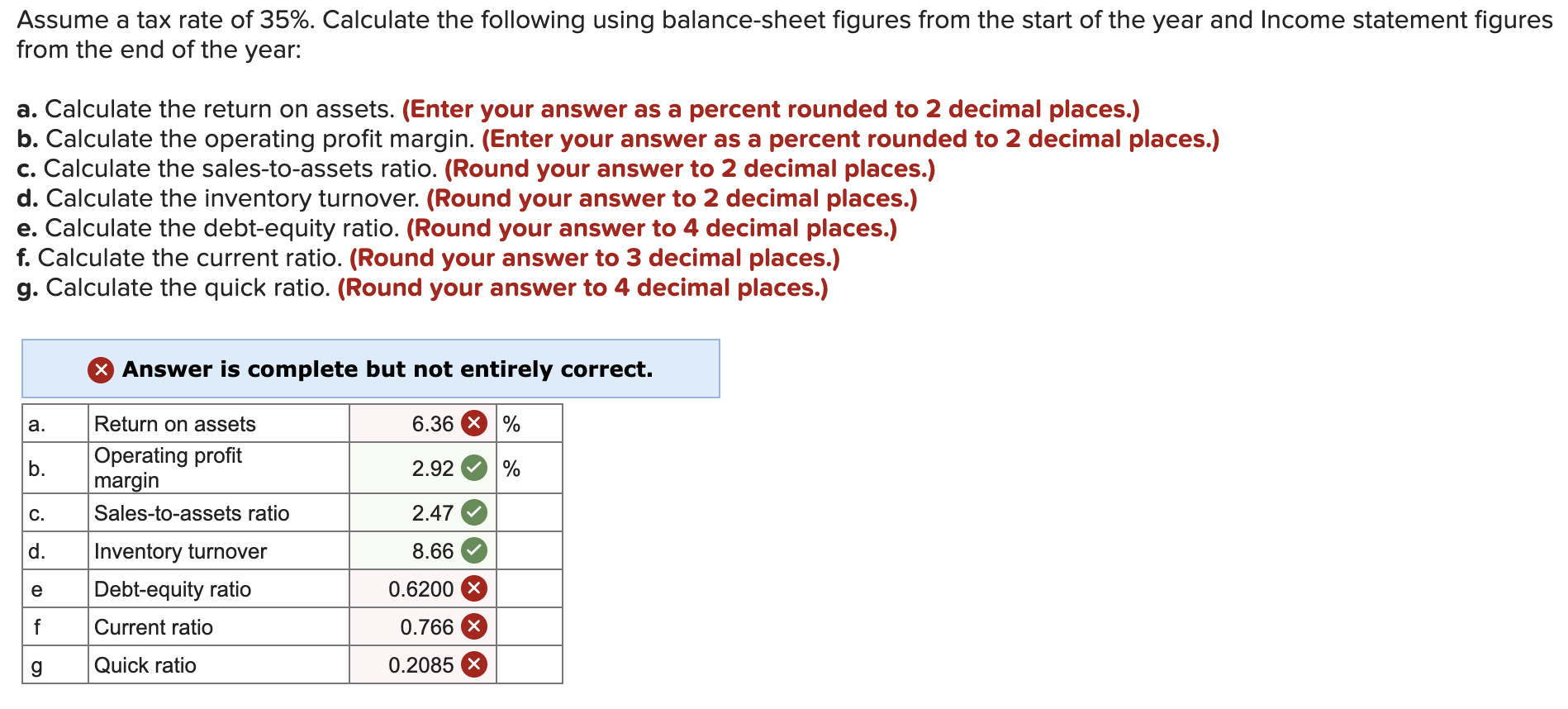

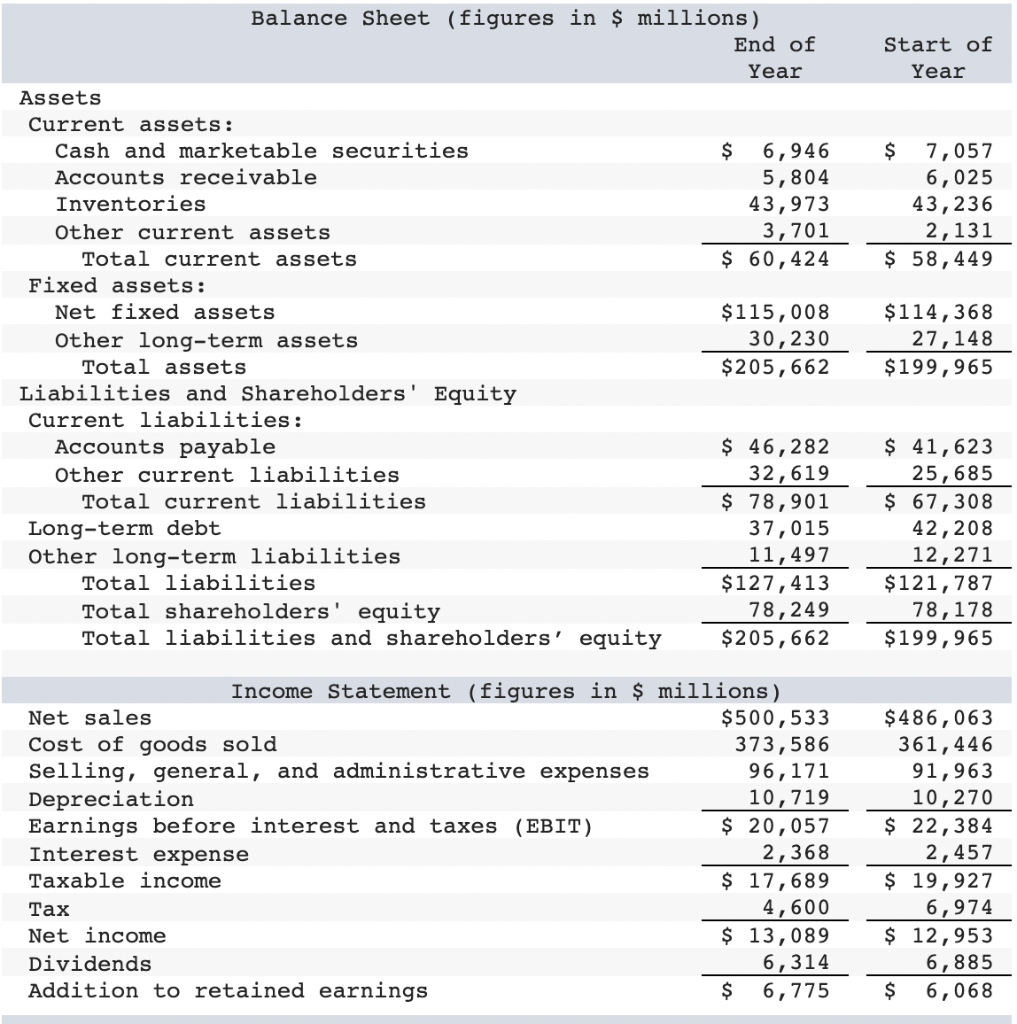

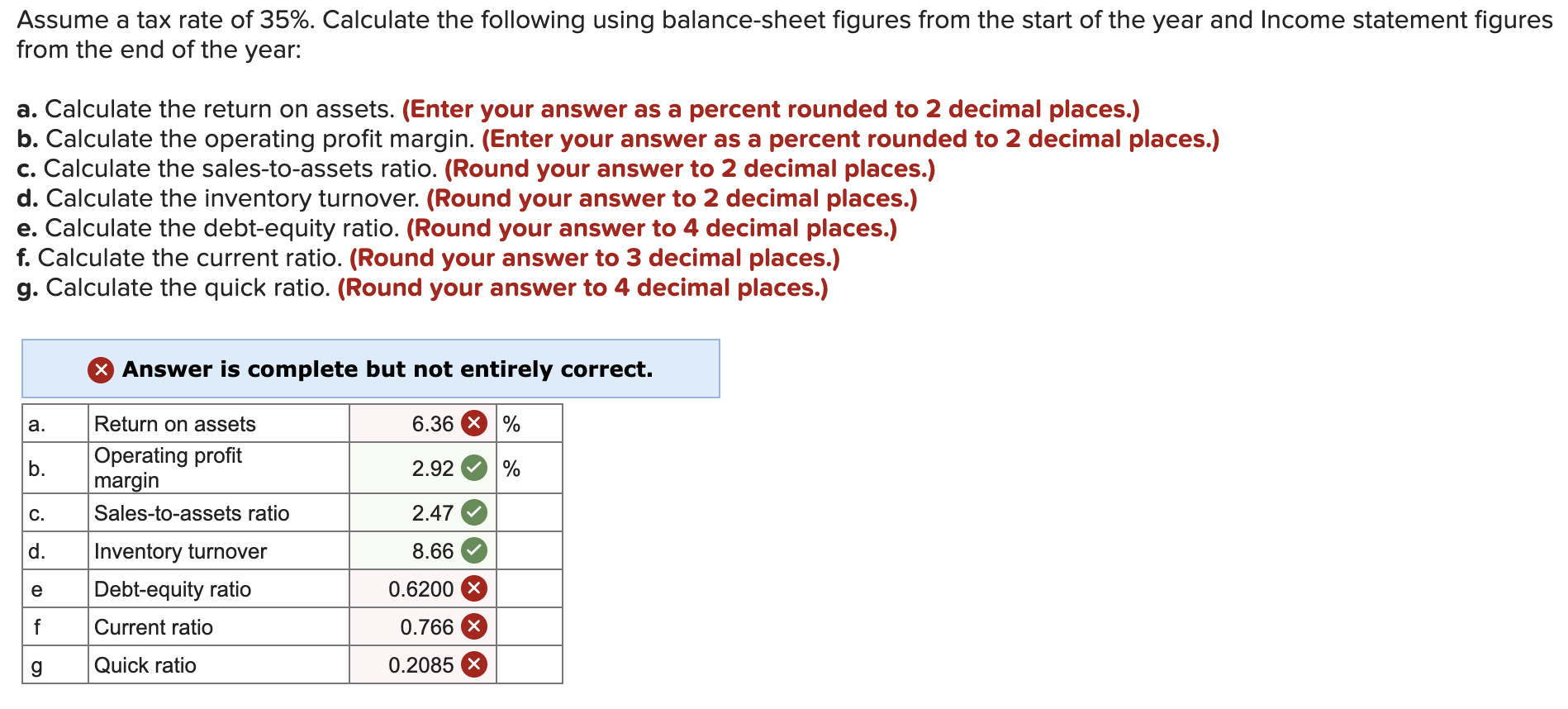

Start of Year $ 7,057 6,025 43,236 2,131 $ 58,449 Balance Sheet (figures in $ millions) End of Year Assets Current assets: Cash and marketable securities $ 6,946 Accounts receivable 5,804 Inventories 43,973 Other current assets 3,701 Total current assets $ 60, 424 Fixed assets: Net fixed assets $115,008 Other long-term assets 30,230 Total assets $ 205,662 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $ 46,282 Other current liabilities 32,619 Total current liabilities $ 78,901 Long-term debt 37,015 Other long-term liabilities 11,497 Total liabilities $127,413 Total shareholders' equity 78, 249 Total liabilities and shareholders' equity $ 205,662 $114,368 27, 148 $199,965 $ 41,623 25,685 $ 67, 308 42,208 12,271 $121,787 78,178 $199,965 Income Statement (figures in $ millions) Net sales $500,533 Cost of goods sold 373,586 Selling, general, and administrative expenses 96,171 Depreciation 10,719 Earnings before interest and taxes (EBIT) $ 20,057 Interest expense 2,368 Taxable income $ 17,689 Tax 4,600 Net income $ 13,089 Dividends 6,314 Addition to retained earnings $ 6,775 $ 486,063 361,446 91,963 10,270 $ 22,384 2,457 $ 19,927 6,974 $ 12,953 6,885 $ 6,068 Assume a tax rate of 35%. Calculate the following using balance-sheet figures from the start of the year and Income statement figures from the end of the year: a. Calculate the return on assets. (Enter your answer as a percent rounded to 2 decimal places.) b. Calculate the operating profit margin. (Enter your answer as a percent rounded to 2 decimal places.) C. Calculate the sales-to-assets ratio. (Round your answer to 2 decimal places.) d. Calculate the inventory turnover. (Round your answer to 2 decimal places.) e. Calculate the debt-equity ratio. (Round your answer to 4 decimal places.) f. Calculate the current ratio. (Round your answer to 3 decimal places.) g. Calculate the quick ratio. (Round your answer to 4 decimal places.) X Answer is complete but not entirely correct. a. 6.36 % b. Return on assets Operating profit margin Sales-to-assets ratio 2.92 % C. 2.47 d. 8.66 Inventory turnover Debt-equity ratio e e 0.6200 X f Current ratio 0.766 g Quick ratio 0.2085