Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Start with the partial model in the file Ch 1 4 P 1 3 Build a Model.xls on the textbook's Web site. J . Clark

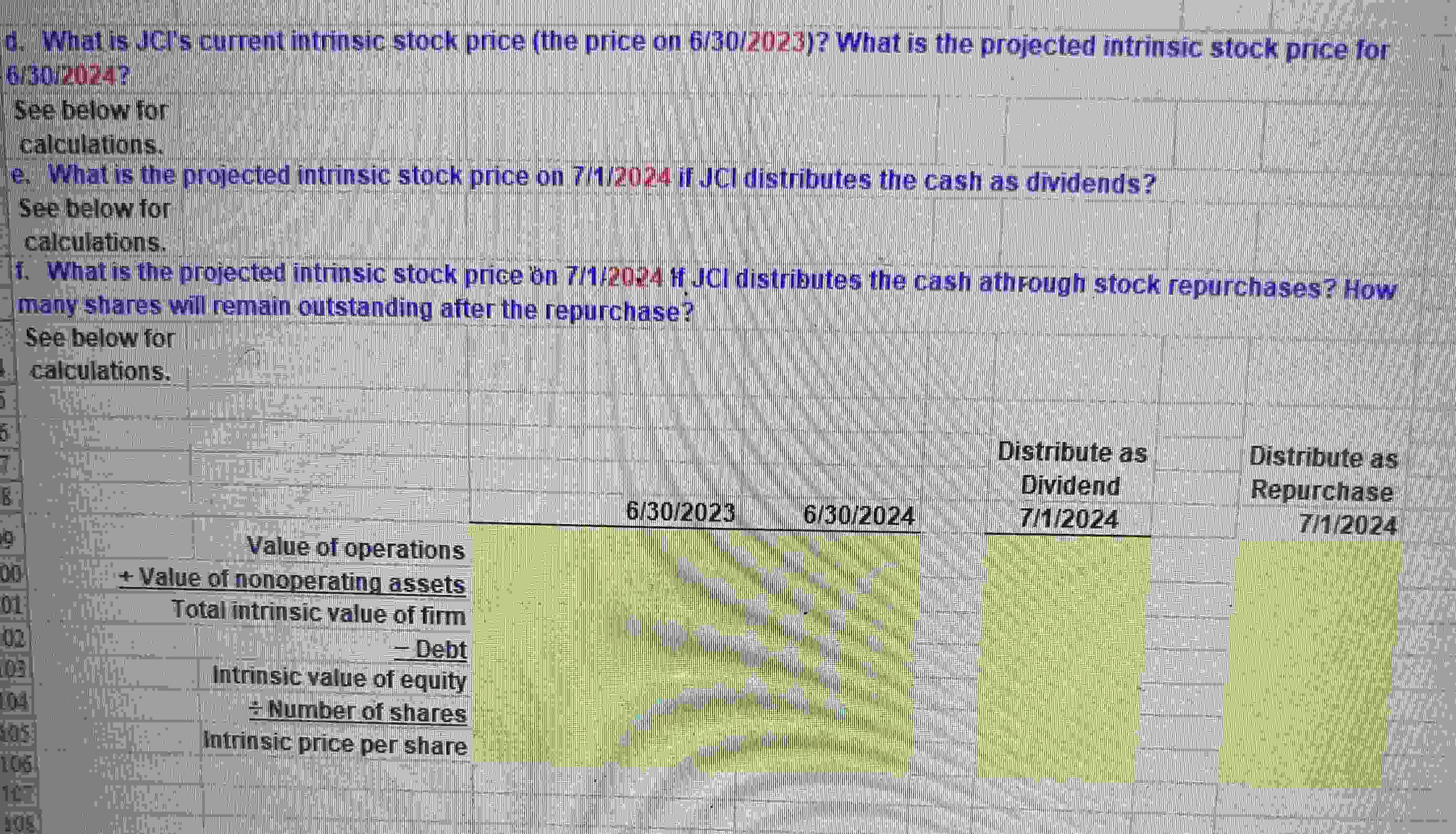

Start with the partial model in the file Ch P Build a Model.xls on the textbook's Web site. J Clark Inc. CI a manufacturer and distributor of sports equipment, has grown until it has become a stable, mature company. Now JCI is planning its first distribution to shareholders. See the file for the most recent year's financial statements and projections for the next year, ; JCls fiscal year ends on June JCI plans to liquidate and distribute $ million of its shortterm securities on July the first day of the next fiscal year, but it has not yet decided whether to distribute with dividends or with stock repurchases. DWhat is JCIs current intrinsic stock price the price on What is the projected intrinsic stock price for e What is the projected intrinsic stock price on if JCI distributes the cash as dividends? f What is the projected intrinsic stock price on if JCI distributes the cash through stock repurchases? How many shares will remain outstanding after the repurchase?d What is JCls current intrinsic stock price the price on What is the projected intrinsic stock price for

See below for

calculations.

e What is the projected intrinsic stock price on if JCI distributes the cash as dividends?

See below for

calculations.

f What is the projected intrinsic stock price in if JCl distributes the cash ath Fough stock repurchases? How

many shares will remain outstanding after the repurchase?

See below for

calculations.

Value of nonoperating assets

Total intrinsic value of firm

Debt

Intrinsic value of equity

Number of shares

Intrinsic price per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started