Answered step by step

Verified Expert Solution

Question

1 Approved Answer

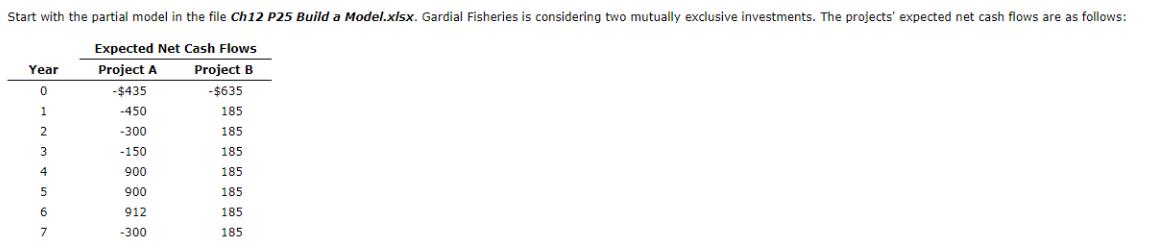

Start with the partial model in the file Ch12 P25 Build a Model.xlsx. Gardial Fisheries is considering two mutually exclusive investments. The projects' expected

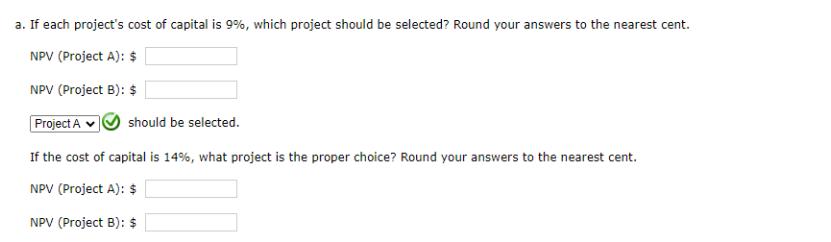

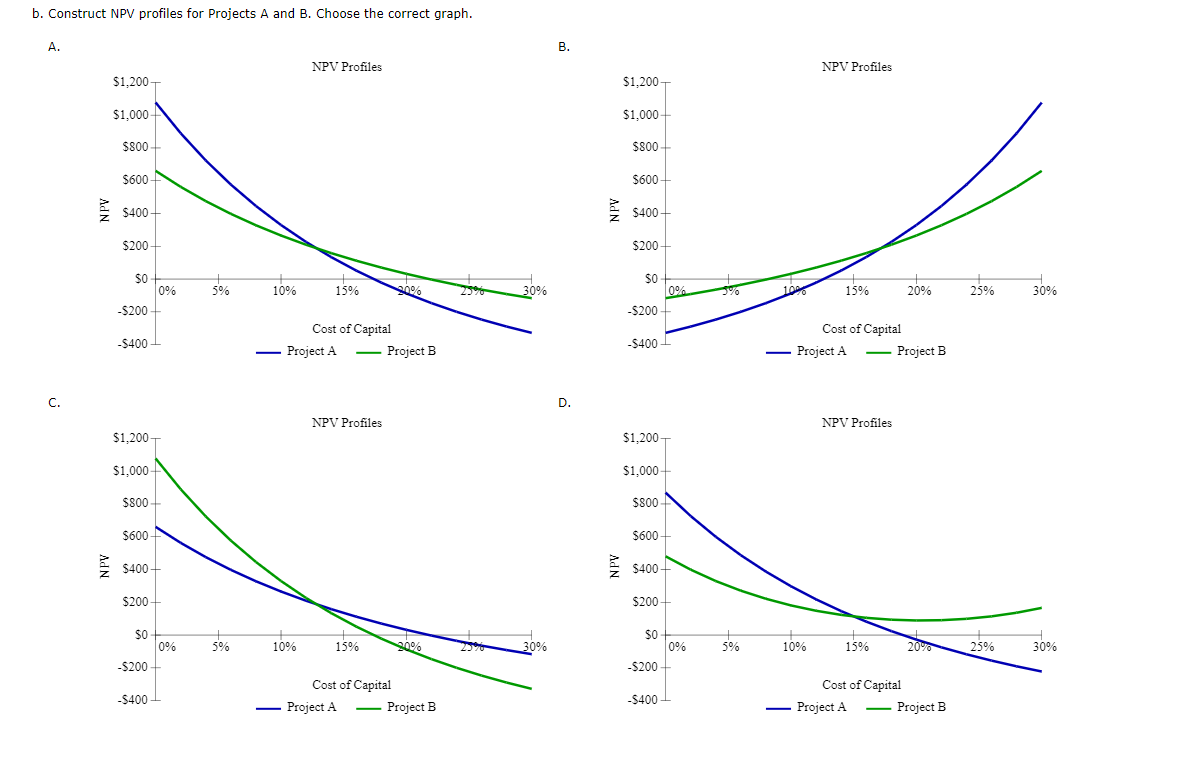

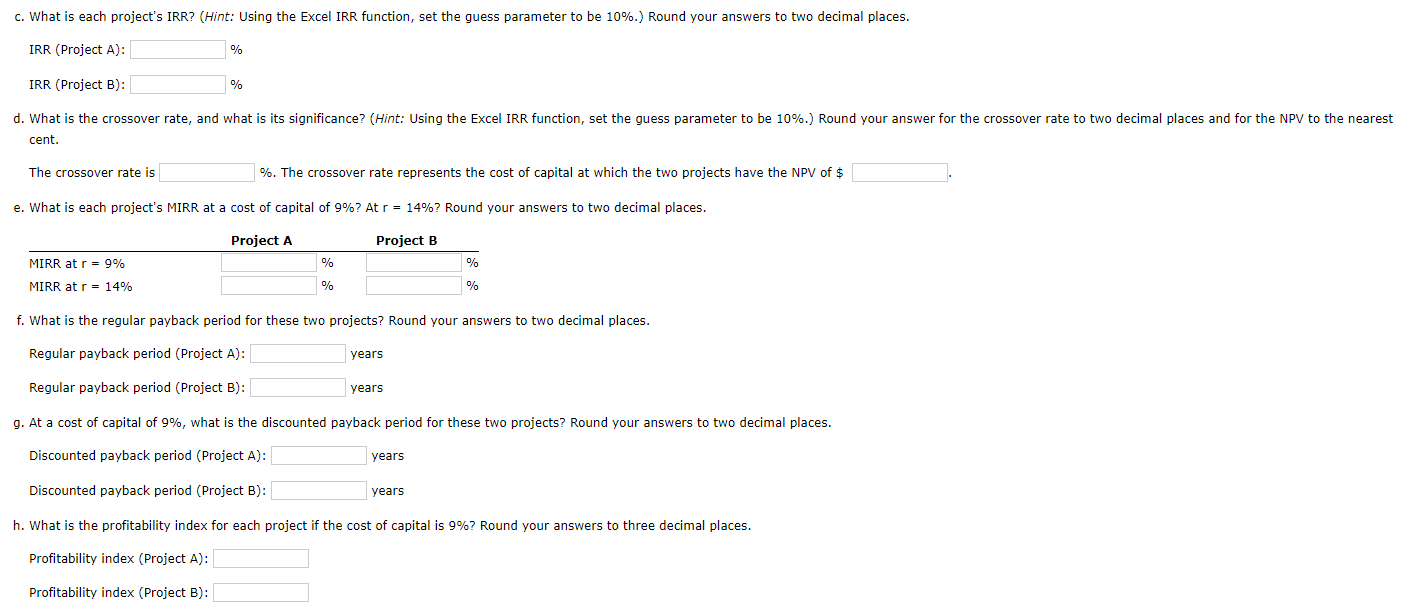

Start with the partial model in the file Ch12 P25 Build a Model.xlsx. Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: Expected Net Cash Flows Project A Project B -$435 -$635 -450 185 -300 185 -150 185. 900 185 900 185 912 185 -300 185 Year 0 1 2 3 4 5 6 7 a. If each project's cost of capital is 9%, which project should be selected? Round your answers to the nearest cent. NPV (Project A): $ NPV (Project B): $ Project A should be selected. If the cost of capital is 14%, what project is the proper choice? Round your answers to the nearest cent. NPV (Project A): $ NPV (Project B): $ b. Construct NPV profiles for Projects A and B. Choose the correct graph. A. C. Ad N $1,200 $1,000- $800- $600 $400 $200 $0 -$200 -$400 $1,200- $1,000+ $800+ $600 $400+ $200 0% $0 -$200 -$400 0% 5% 5% 10% NPV Profiles 10% 15% Cost of Capital - Project A - Project B NPV Profiles 20% 15% 20% Cost of Capital - Project A - Project B 2370 30% 30% B. D. $1,200 $1,000- $800 $600 $400 $200 SO -$200 -$400 $1,200- $1,000- $800 $600 $400 $200 SO -$200 0% -$400 0% 0% + 5% 1005 NPV Profiles 10% 15% Cost of Capital - Project A - Project B NPV Profiles 15% Cost of Capital 20% - Project A 20% - Project B 25% 25% 30% 30% c. What is each project's IRR? (Hint: Using the Excel IRR function, set the guess parameter to be 10%.) Round your answers to two decimal places. IRR (Project A): IRR (Project B): d. What is the crossover rate, and what is its significance? (Hint: Using the Excel IRR function, set the guess parameter to be 10%.) Round your answer for the crossover rate to two decimal places and for the NPV to the nearest cent. The crossover rate is % MIRR at r 9% MIRR at r = 14% % %. The crossover rate represents the cost of capital at which the two projects have the NPV of $ e. What is each project's MIRR at a cost of capital of 9% ? At r = 14% ? Round your answers to two decimal places. Project A Project B % % years f. What is the regular payback period for these two projects? Round your answers to two decimal places. Regular payback period (Project A): Regular payback period (Project B): g. At a cost of capital of 9%, what is the discounted payback period for these two projects? Round your answers to two decimal places. Discounted payback period (Project A): Discounted payback period (Project B): years years % years % h. What is the profitability index for each project if the cost of capital is 9%? Round your answers to three decimal places. Profitability index (Project A): Profitability index (Project B):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started