Answered step by step

Verified Expert Solution

Question

1 Approved Answer

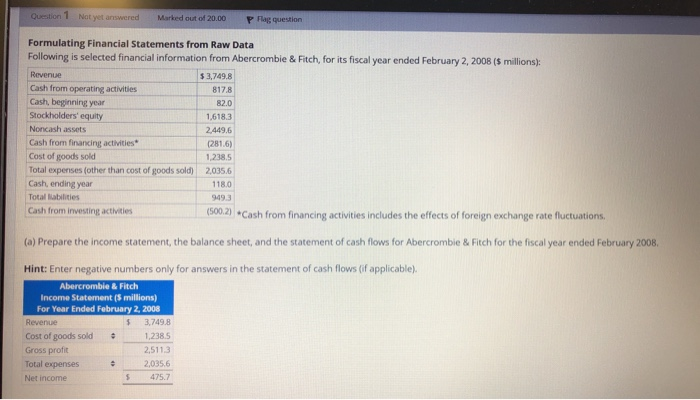

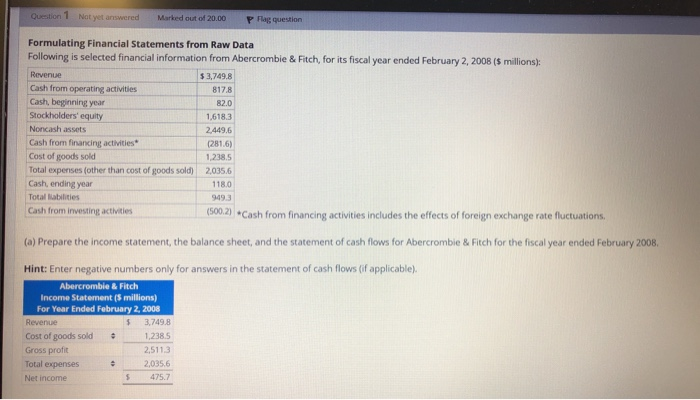

started but need some help Question 1 Not yet answered Marked out of 20.00 P Flag question Formulating Financial Statements from Raw Data Following is

started but need some help

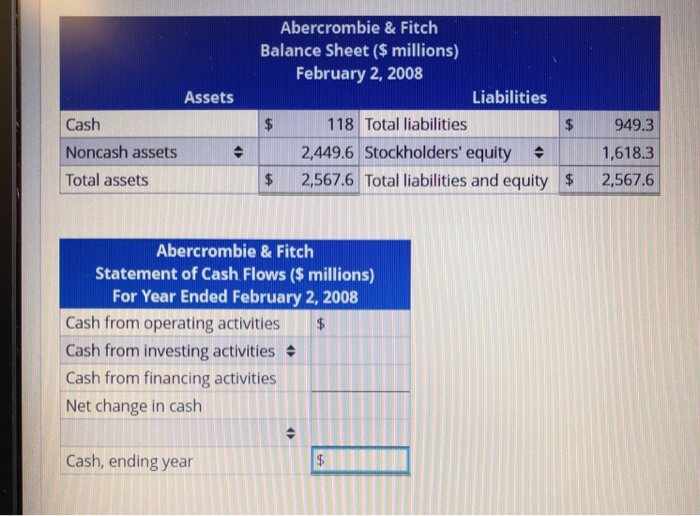

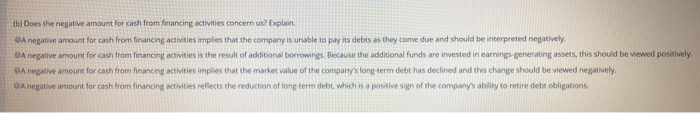

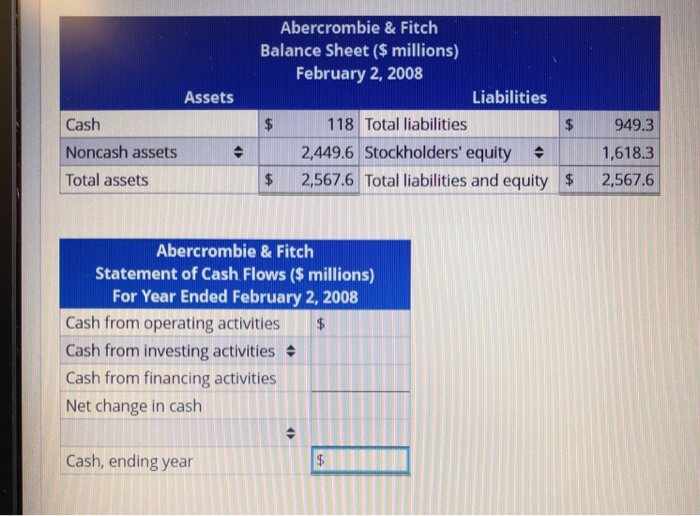

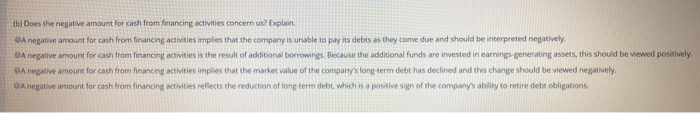

Question 1 Not yet answered Marked out of 20.00 P Flag question Formulating Financial Statements from Raw Data Following is selected financial information from Abercrombie & Fitch, for its fiscal year ended February 2, 2008 (5 millions): Revenue $ 3.749.8 Cash from operating activities 817,8 Cash, beginning year 82.0 Stockholders' equity 1.618.3 Noncash assets 2.449.6 Cash from financing activities (281.6) Cost of goods sold 1.218.5 Total expenses (other than cost of goods sold) 2,035,6 Cash, ending year 118.0 Total abilities 9493 Cash from investing activities (500.2) Cash from financing activities includes the effects of foreign exchange rate fluctuations (a) Prepare the income statement, the balance sheet, and the statement of cash flows for Abercrombie & Fitch for the fiscal year ended February 2008 Hint: Enter negative numbers only for answers in the statement of cash flows (if applicable) Abercrombie & Fitch Income Statement (5 millions) For Year Ended February 2, 2005 Revenue 3.749.8 Cost of goods sold . 1.2385 Gross profit 2.5113 Total expenses 2.035.6 Net income $ 475.7 Assets Cash Noncash assets Total assets Abercrombie & Fitch Balance Sheet($ millions) February 2, 2008 Liabilities $ 118 Total liabilities 2,449.6 Stockholders' equity $ 2,567.6 Total liabilities and equity 949.3 1,618.3 2,567.6 $ Abercrombie & Fitch Statement of Cash Flows ($ millions), For Year Ended February 2, 2008 Cash from operating activities Cash from investing activities Cash from financing activities Net change in cash Cash, ending year (b) Does the negative amount for cash from financing activities concern us? Explain A negative amount for cash from financing activities implies that the company is unable to pay its debts as they come due and should be interpreted negatively A negative amount for cash from financing activities is the result of additional borrowings. Because the additional funds are invested in earnings-generating assets, this should be viewed positively A negative amount for cash from financing activities implies that the market value of the company's long-term debt has declined and this change should be viewed negatively A negative amount for cash from financing activities reflects the reduction of long-term debt, which is a positive sign of the company's ability to retire debt obligations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started