Answered step by step

Verified Expert Solution

Question

1 Approved Answer

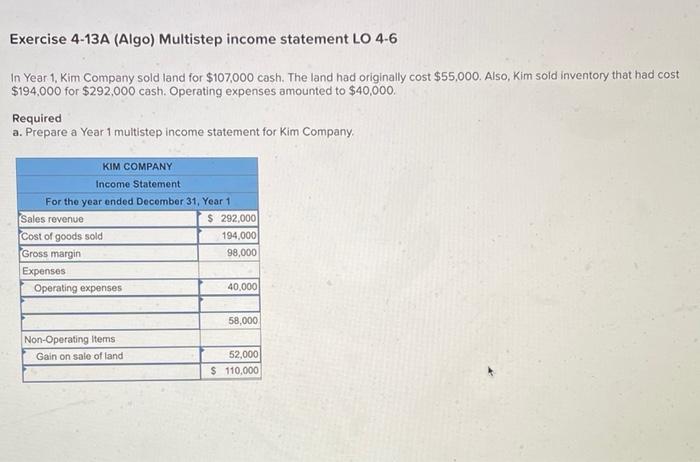

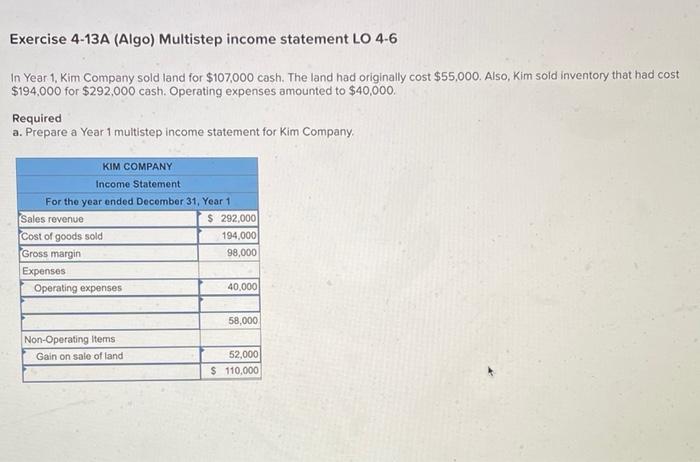

started this question but stuck on the rest Exercise 4-13A (Algo) Multistep income statement LO 4-6 In Year 1, Kim Company sold land for $107,000

started this question but stuck on the rest

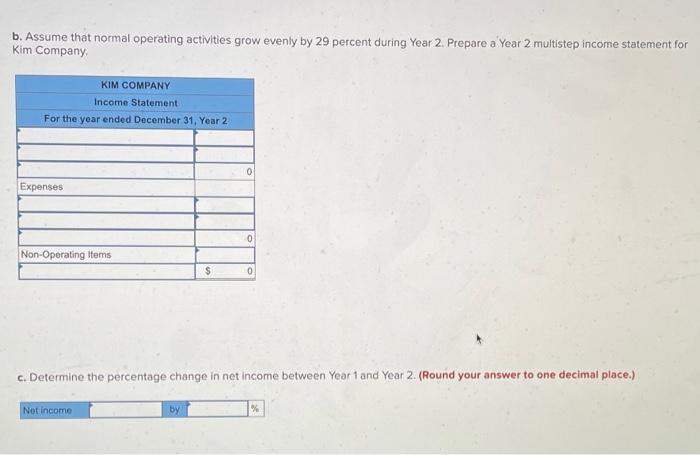

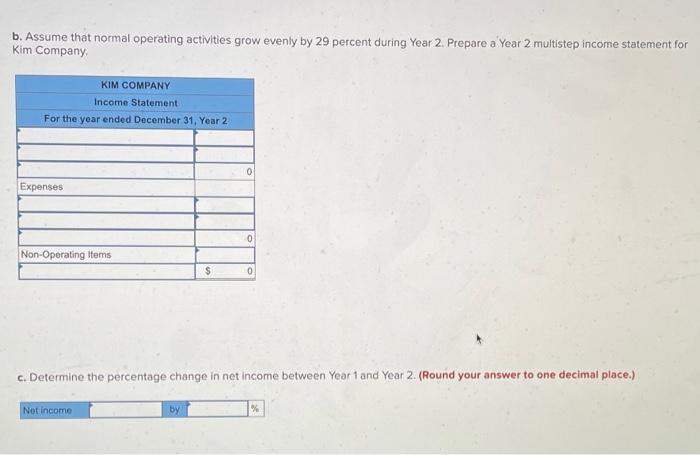

Exercise 4-13A (Algo) Multistep income statement LO 4-6 In Year 1, Kim Company sold land for $107,000 cash. The land had originally cost $55,000. Also, Kim sold inventory that had cost $194.000 for $292,000 cash. Operating expenses amounted to $40,000. Required a. Prepare a Year 1 multistep income statement for Kim Company KIM COMPANY Income Statement For the year ended December 31, Year 1 Sales revenue $ 292,000 Cost of goods sold 194,000 Gross margin 98,000 Expenses Operating expenses 40.000 58,000 Non-Operating Items Gain on sale of land 52,000 $ 110,000 b. Assume that normal operating activities grow evenly by 29 percent during Year 2. Prepare a Year 2 multistep income statement for Kim Company KIM COMPANY Income Statement For the year ended December 31, Year 2 0 Expenses 0 Non-Operating Items $ 0 c. Determine the percentage change in net income between Year 1 and Year 2. (Round your answer to one decimal place.) Not income by %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started