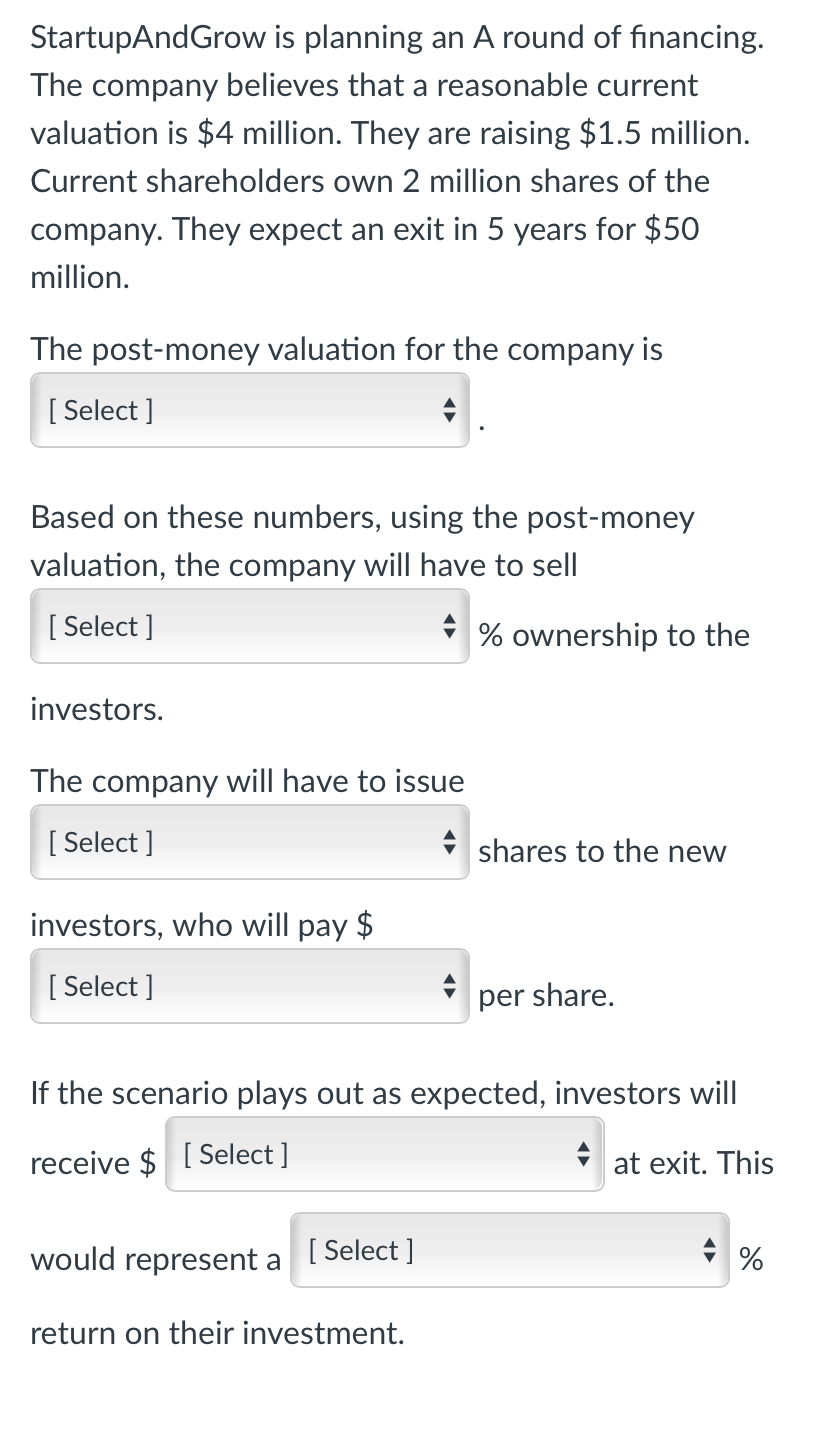

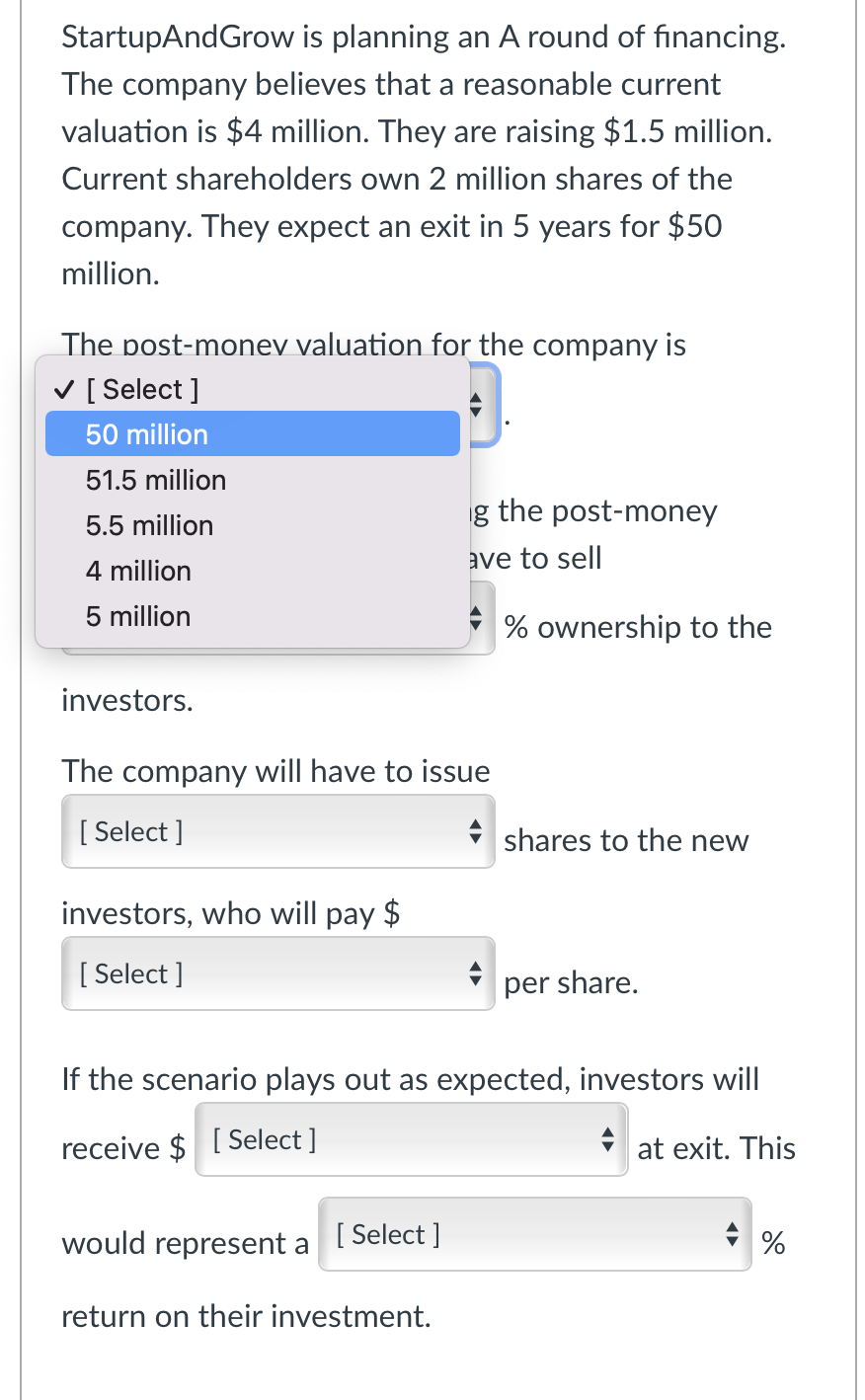

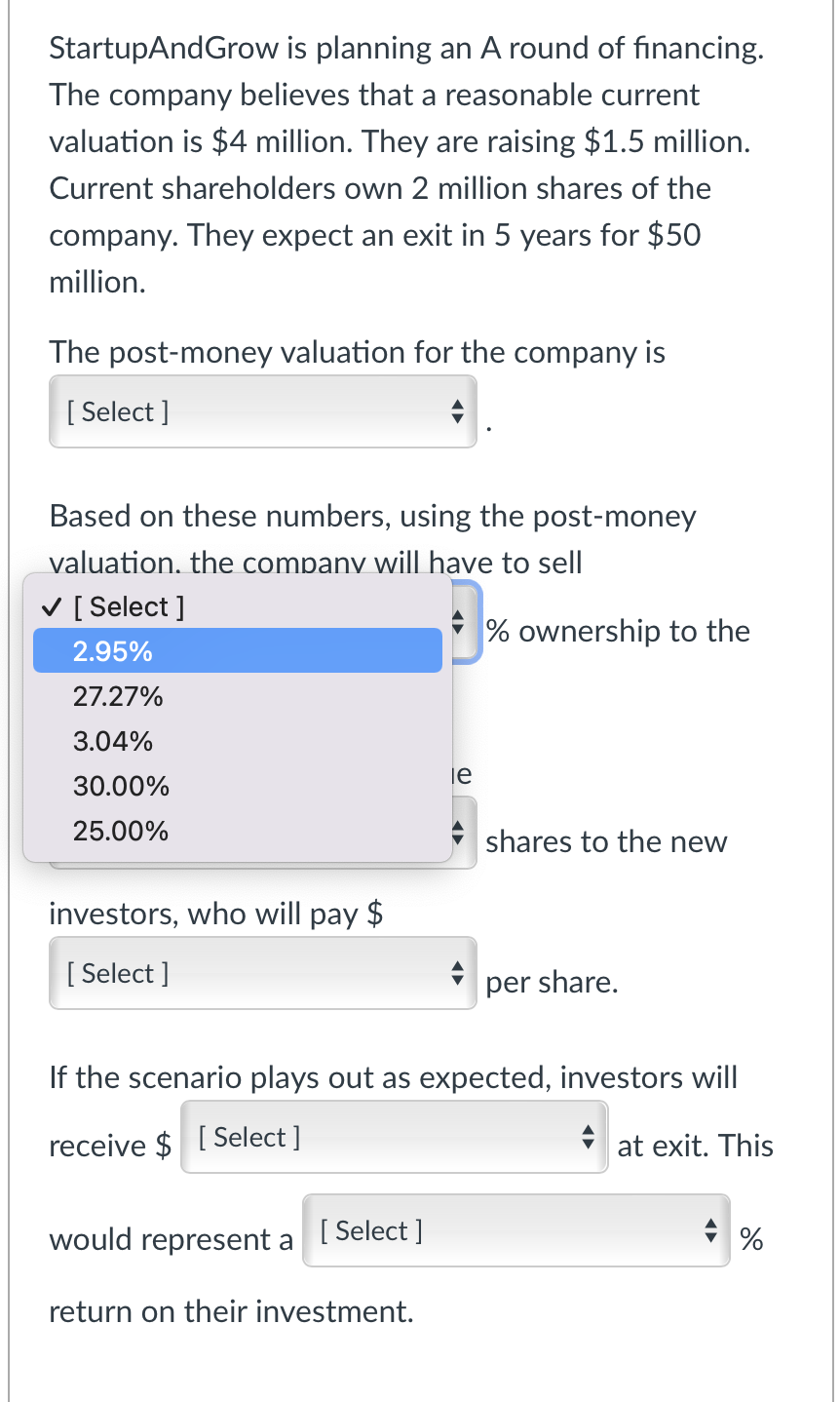

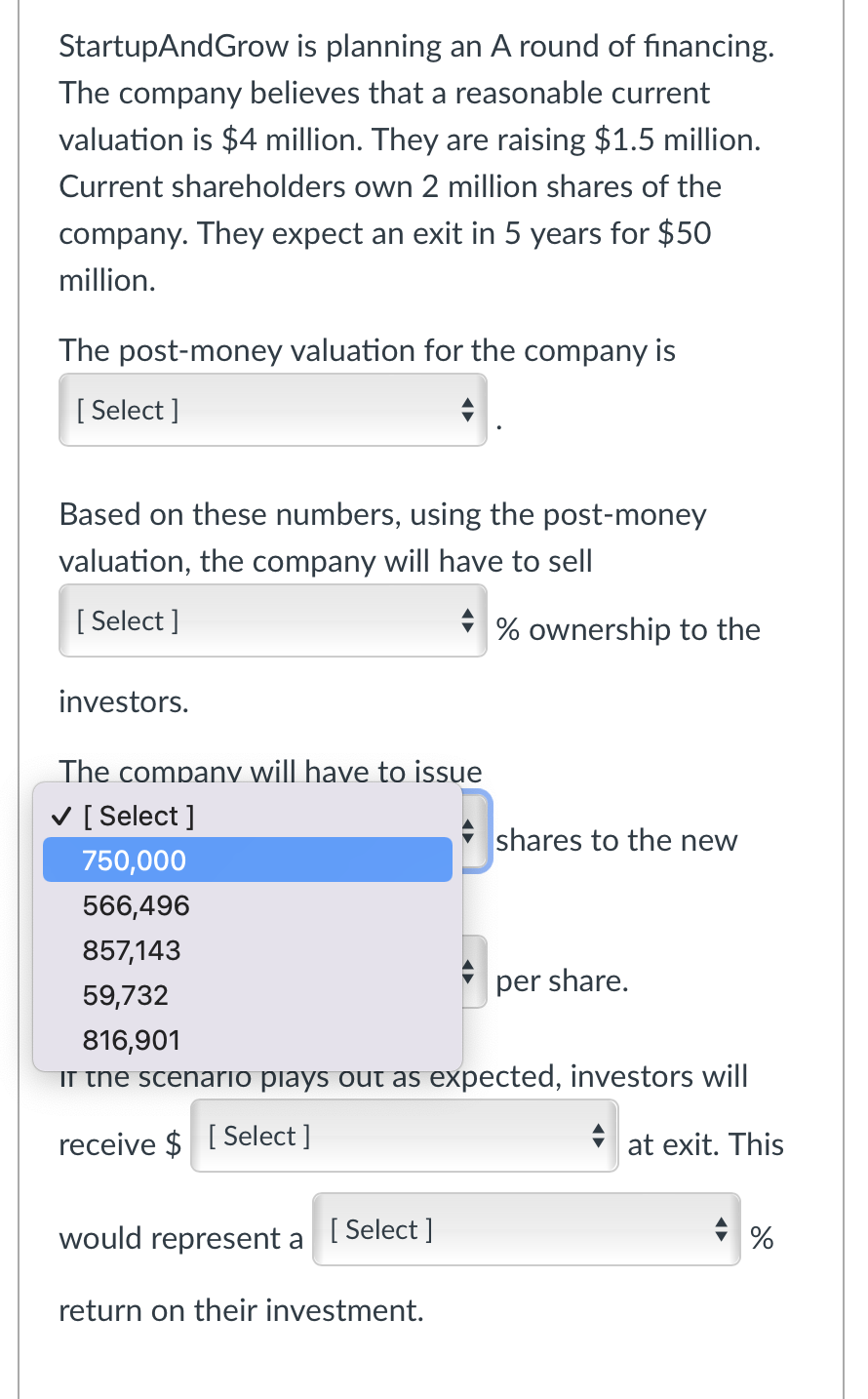

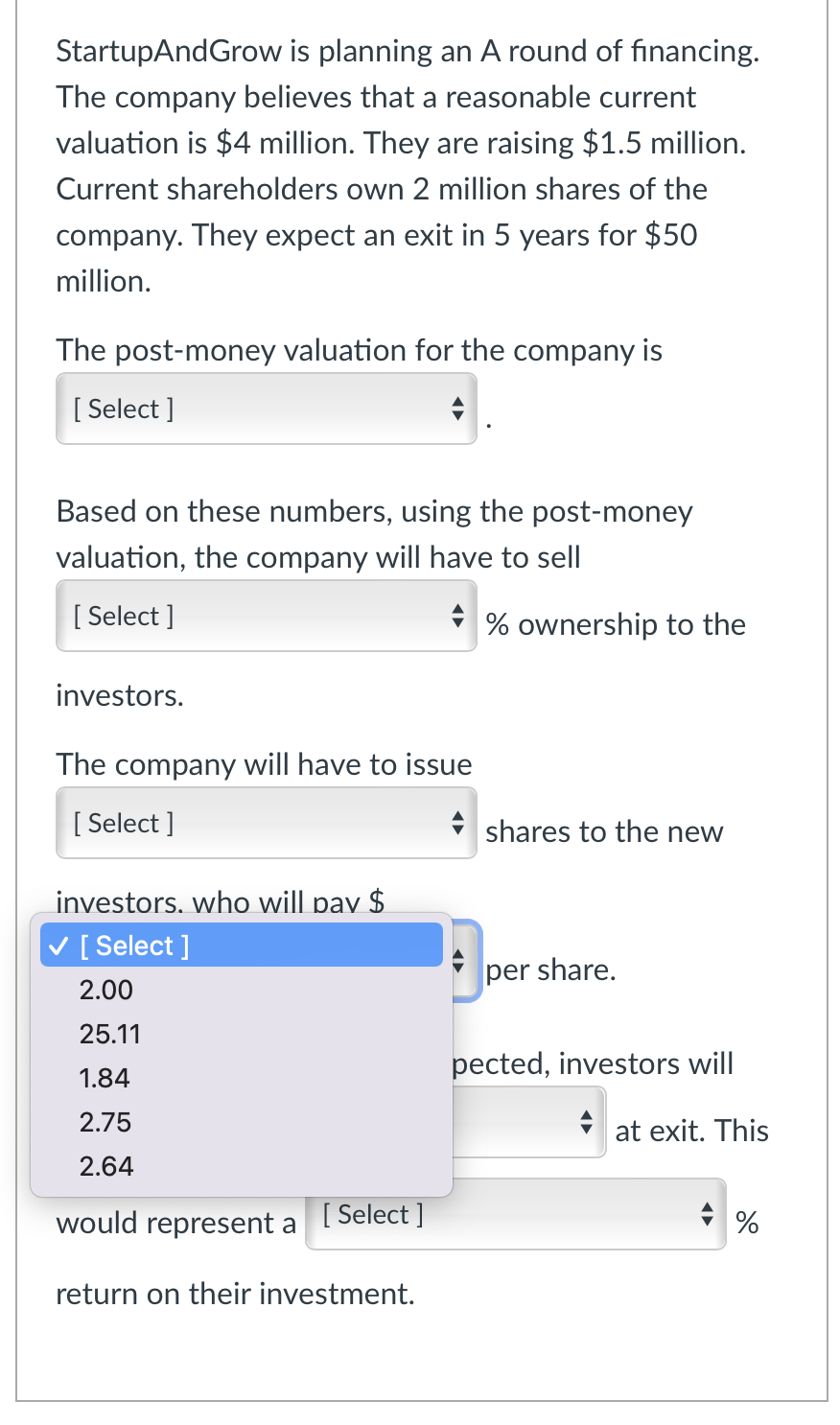

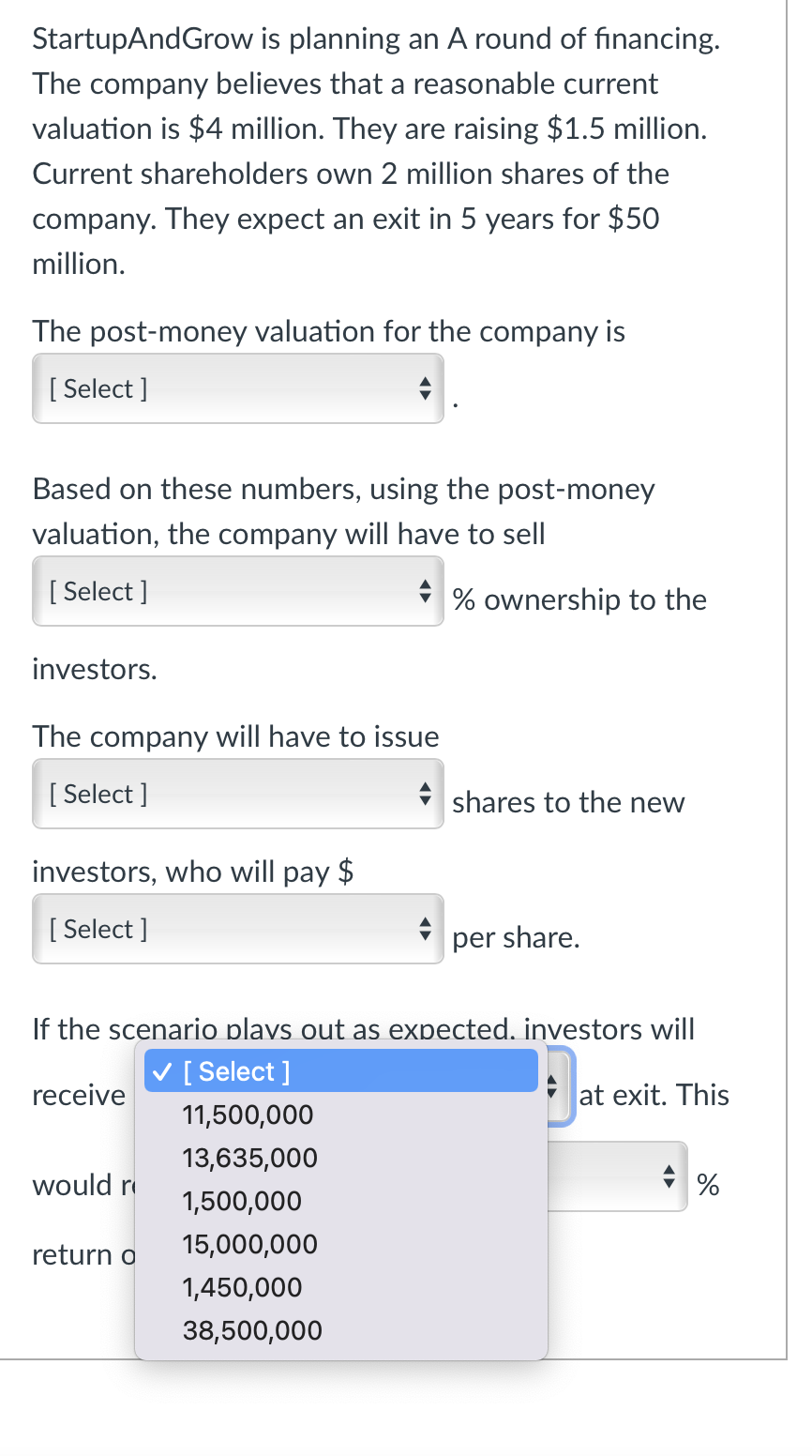

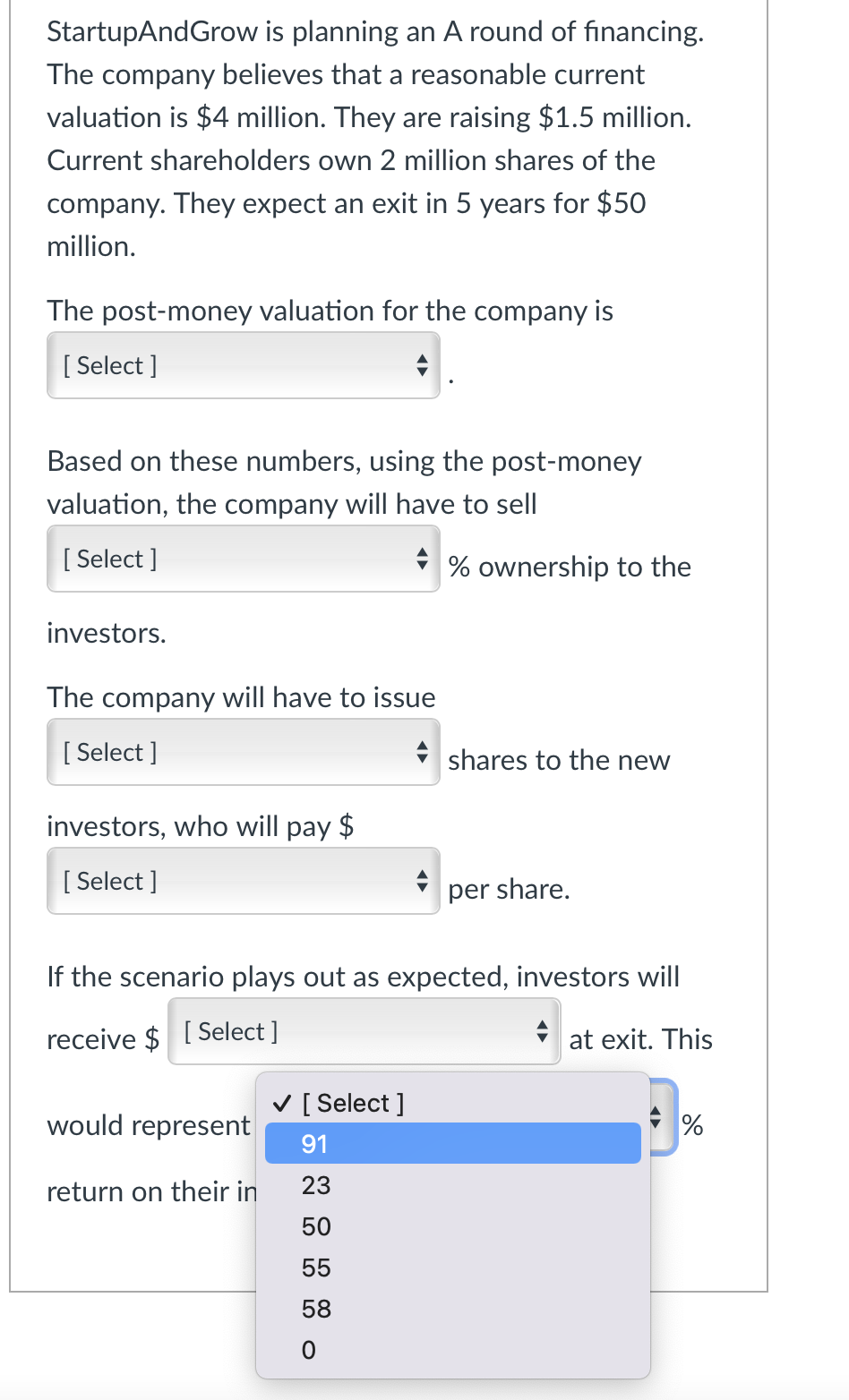

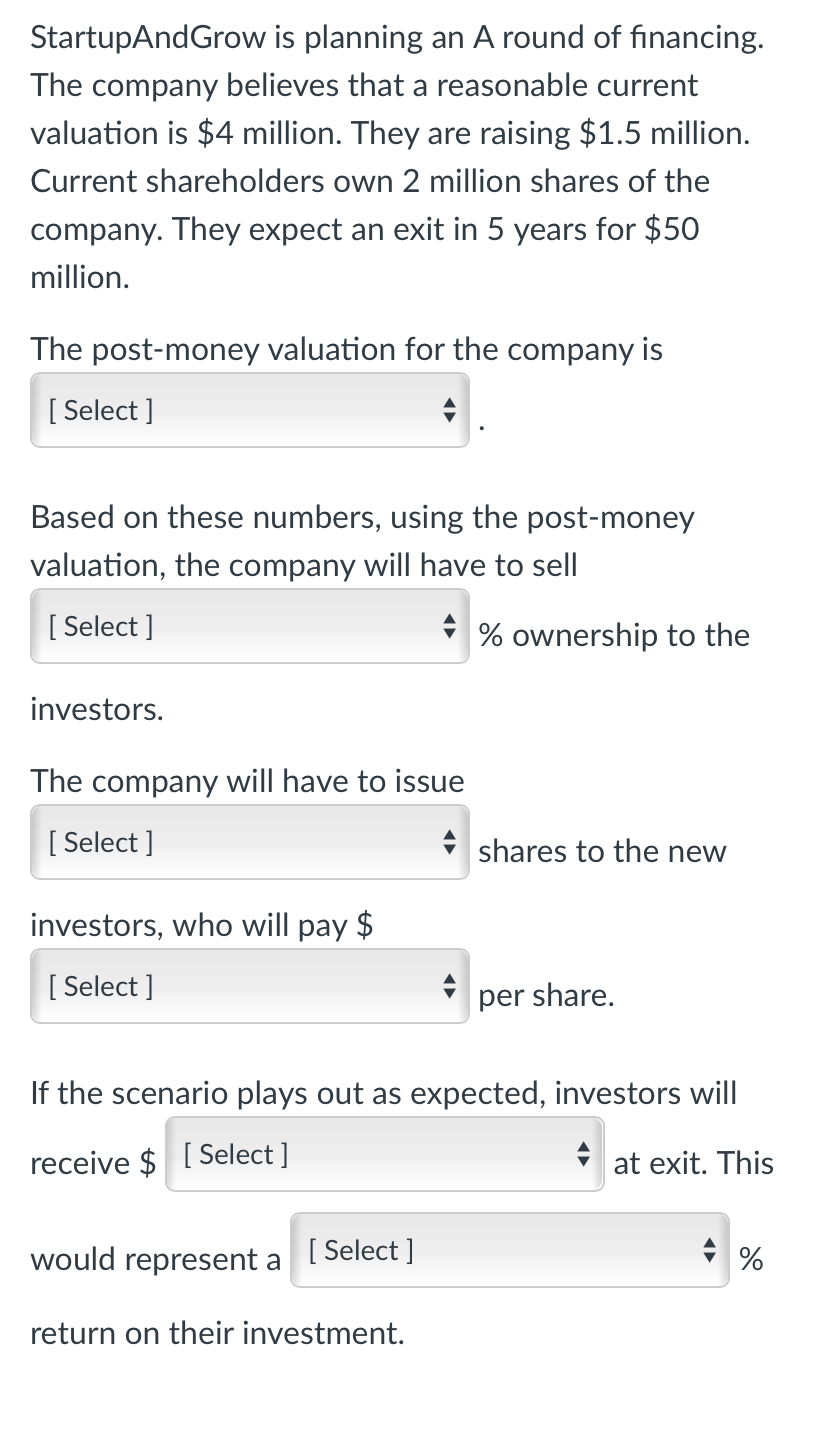

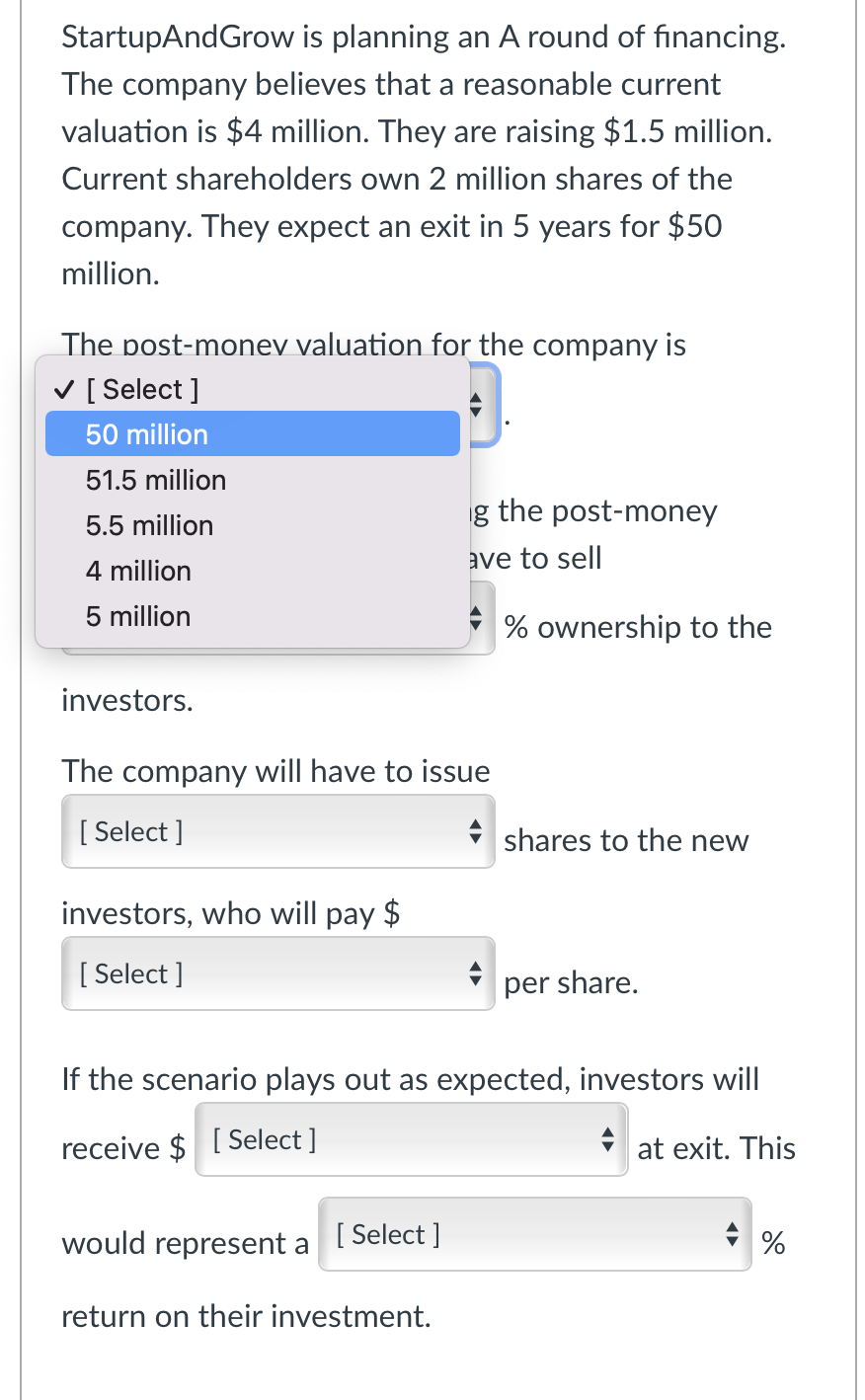

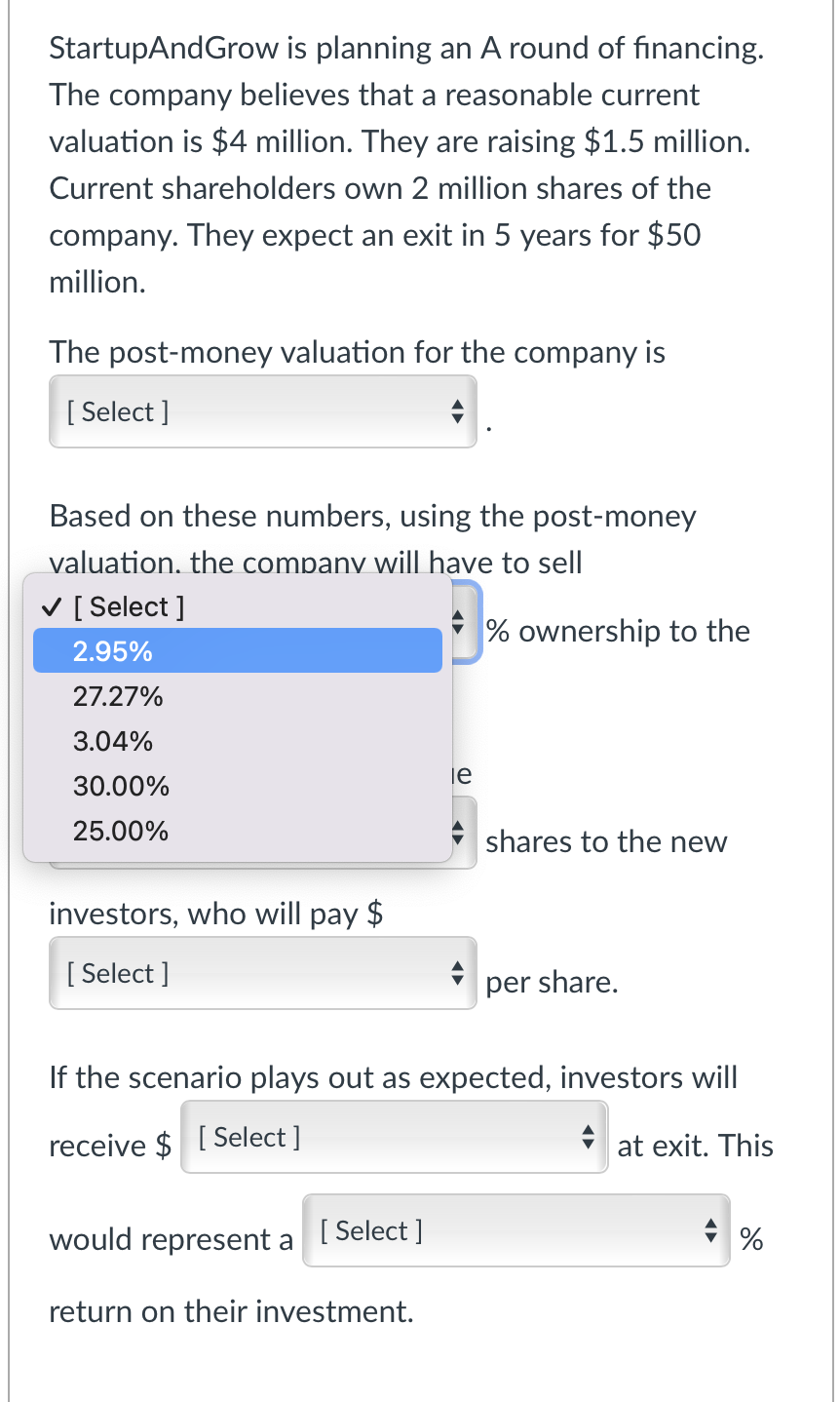

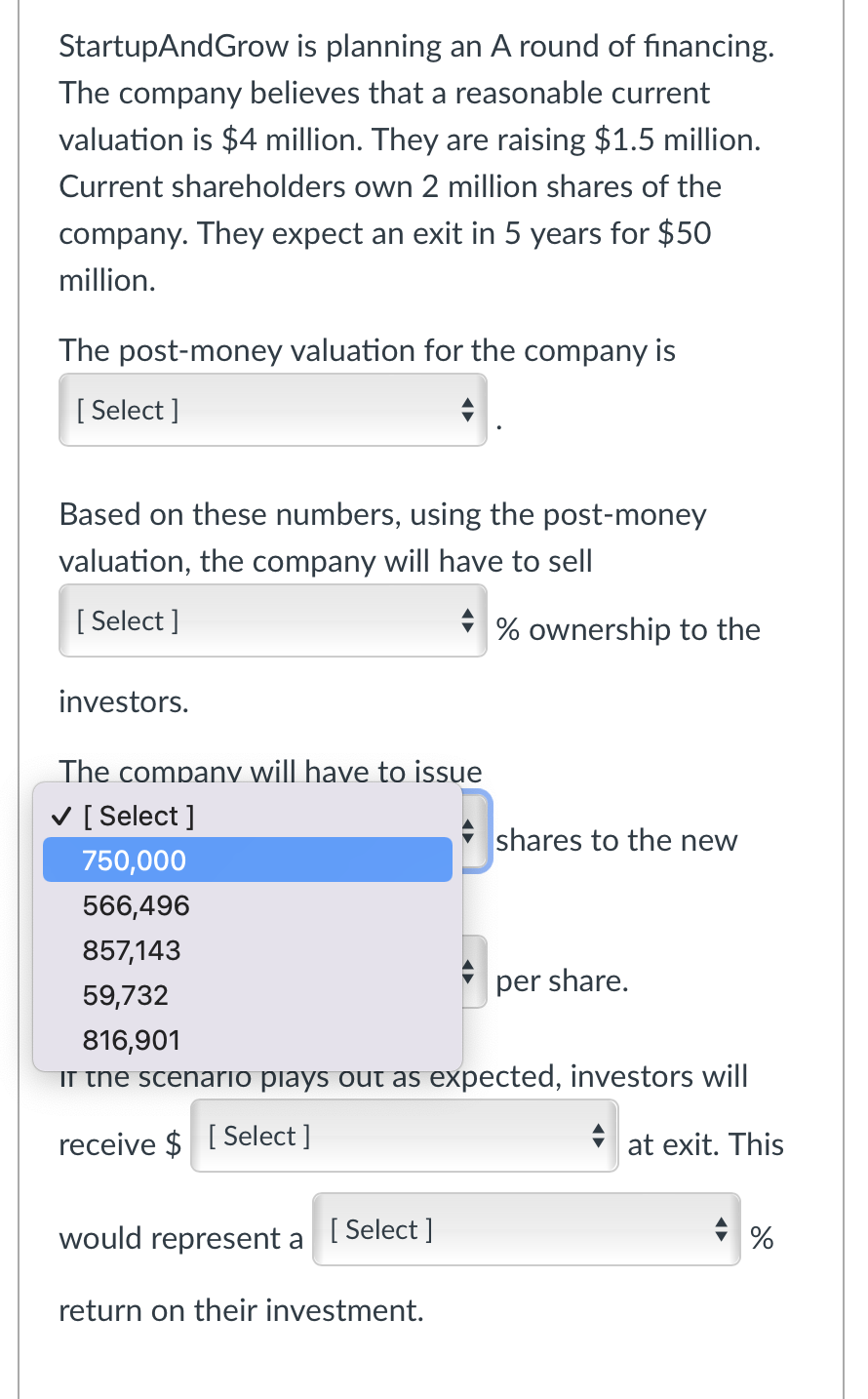

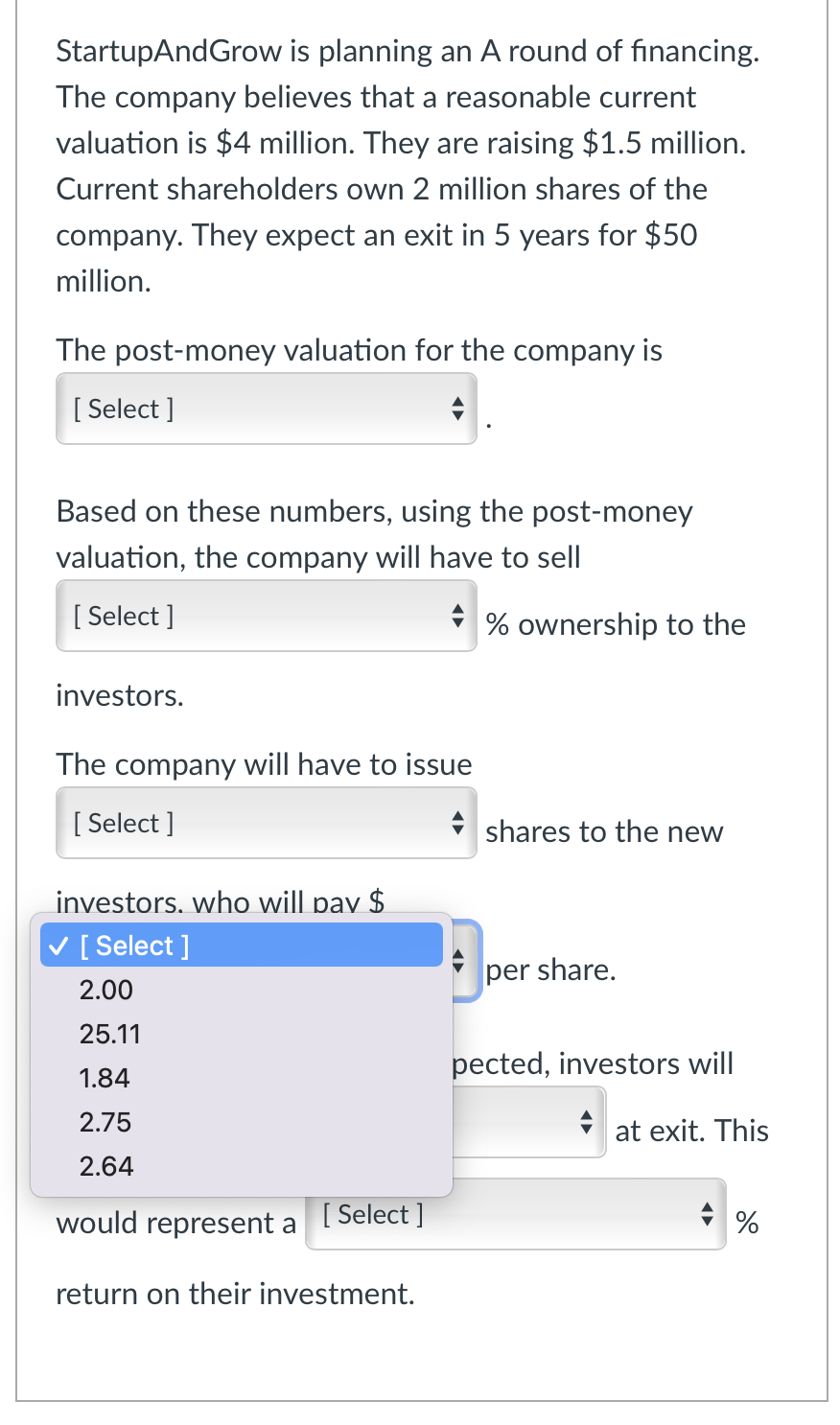

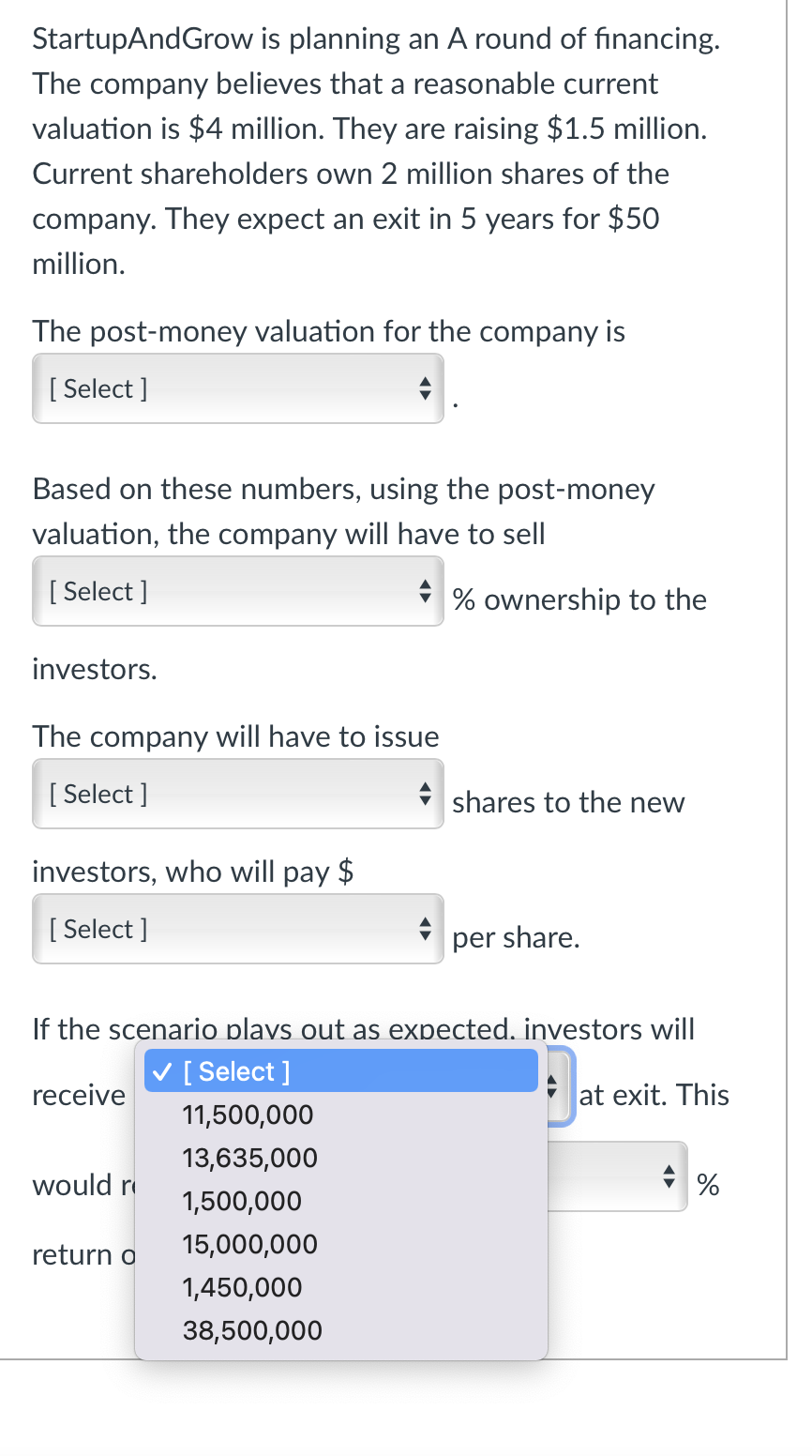

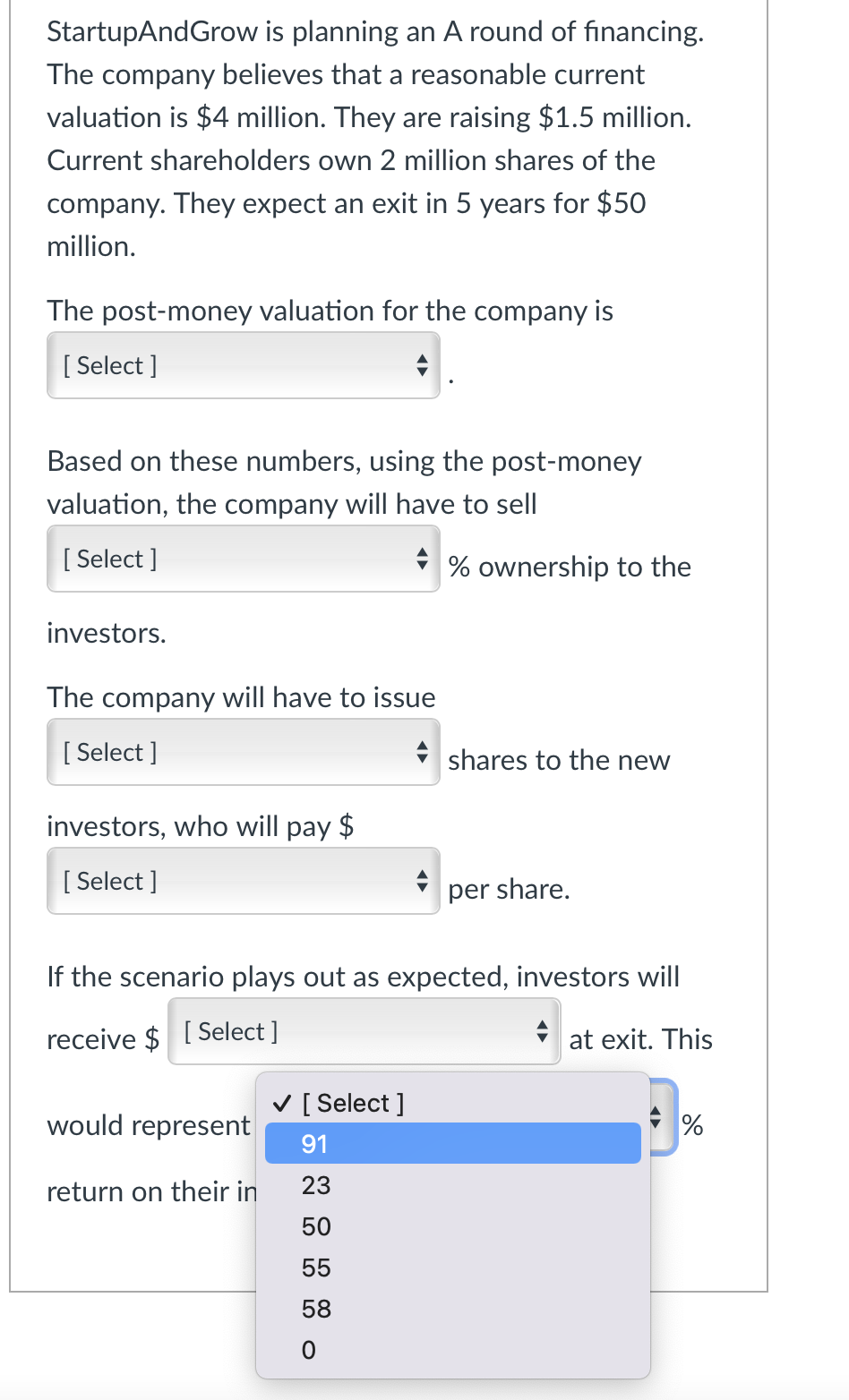

StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 million. The post-money valuation for the company is [ Select ] A Based on these numbers, using the post-money valuation, the company will have to sell [ Select] % ownership to the investors. The company will have to issue [ Select ] shares to the new investors, who will pay $ [ Select] per share. If the scenario plays out as expected, investors will receive $ [ Select ] A at exit. This would represent a [ Select] % return on their investment. StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 million. The post-money valuation for the company is [ Select] 50 million 51.5 million 5.5 million g the post-money 4 million ave to sell 5 million $ % ownership to the investors. The company will have to issue [ Select ] shares to the new investors, who will pay $ [ Select] per share. If the scenario plays out as expected, investors will receive $ [ Select ] A at exit. This would represent a [ Select ] % return on their investment. a StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 million. The post-money valuation for the company is [ Select] Based on these numbers, using the post-money valuation, the company will have to sell [Select ] % ownership to the 2.95% 27.27% 3.04% le 30.00% 25.00% shares to the new investors, who will pay $ [ Select ] per share. If the scenario plays out as expected, investors will receive $ [ Select ] at exit. This would represent a [ Select] % return on their investment. StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 5 million. The post-money valuation for the company is [ Select ] Based on these numbers, using the post-money valuation, the company will have to sell [ Select ] $ % ownership to the investors. The company will have to issue [ Select ] shares to the new 750,000 566,496 857,143 59,732 per share. 816,901 If the scenario piays out as expected, investors will receive $ [Select ] at exit. This would represent a [ Select ] % return on their investment. StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 million. The post-money valuation for the company is [ Select] Based on these numbers, using the post-money valuation, the company will have to sell [ Select ] % ownership to the investors. The company will have to issue [ Select] shares to the new investors, who will pay $ [ Select ] 2.00 25.11 per share. 1.84 pected, investors will 2.75 at exit. This 2.64 would represent a [ Select ] 9 % return on their investment. StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 million. The post-money valuation for the company is [ Select ] Based on these numbers, using the post-money valuation, the company will have to sell [ Select ] * % ownership to the investors. The company will have to issue [ Select] shares to the new investors, who will pay $ [ Select] per share. If the scenario plays out as expected, investors will [Select] receive at exit. This 11,500,000 13,635,000 would r ^ % 1,500,000 return o 15,000,000 1,450,000 38,500,000 StartupAndGrow is planning an A round of financing. The company believes that a reasonable current valuation is $4 million. They are raising $1.5 million. Current shareholders own 2 million shares of the company. They expect an exit in 5 years for $50 million. The post-money valuation for the company is [ Select ] Based on these numbers, using the post-money valuation, the company will have to sell [ Select ] $ % ownership to the investors. The company will have to issue [ Select] A shares to the new investors, who will pay $ [ Select] per share. If the scenario plays out as expected, investors will receive $ [Select] at exit. This [ Select ] would represent % 91 return on their in 23 50 55 58 o