Answered step by step

Verified Expert Solution

Question

1 Approved Answer

stata coding ***Construct the the regression variables inv cf as gro fs cr by stata**** if we have variables: at ppent ditt dic seq wkvalt

stata coding

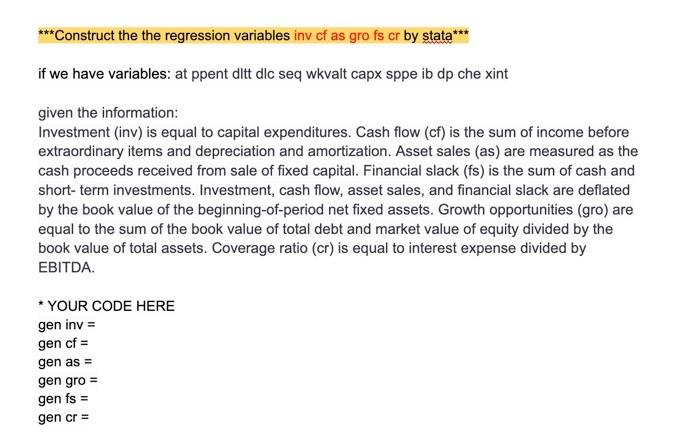

***Construct the the regression variables inv cf as gro fs cr by stata**** if we have variables: at ppent ditt dic seq wkvalt capx sppe ib dp che xint given the information: Investment (inv) is equal to capital expenditures. Cash flow (cf) is the sum of income before extraordinary items and depreciation and amortization. Asset sales (as) are measured as the cash proceeds received from sale of fixed capital. Financial slack (fs) is the sum of cash and short-term investments. Investment, cash flow, asset sales, and financial slack are deflated by the book value of the beginning-of-period net fixed assets. Growth opportunities (gro) are equal to the sum of the book value of total debt and market value of equity divided by the book value of total assets. Coverage ratio (cr) is equal to interest expense divided by EBITDA. * YOUR CODE HERE gen inv= gen cf = gen as = gen gro = gen fs = gen cr=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started