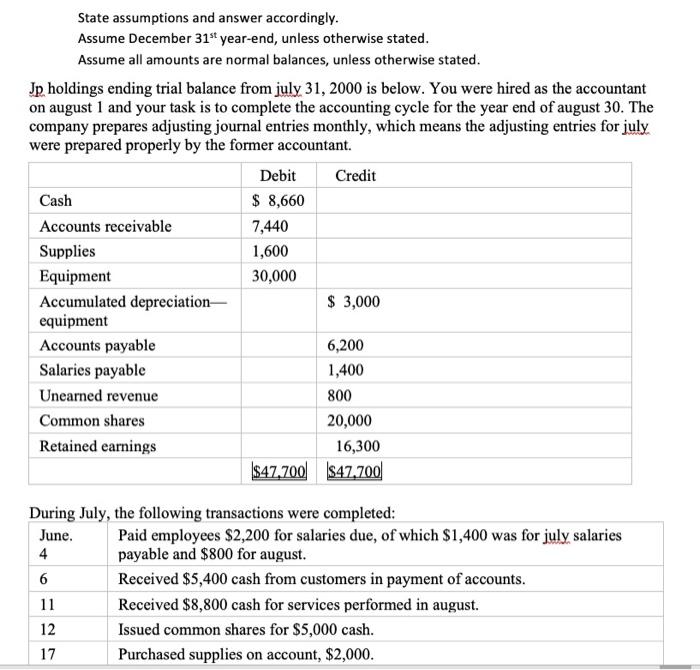

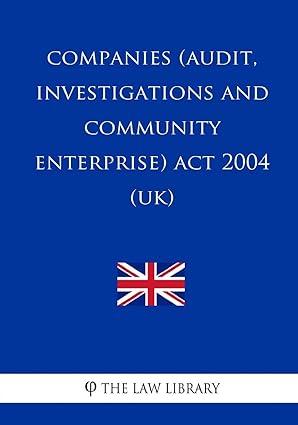

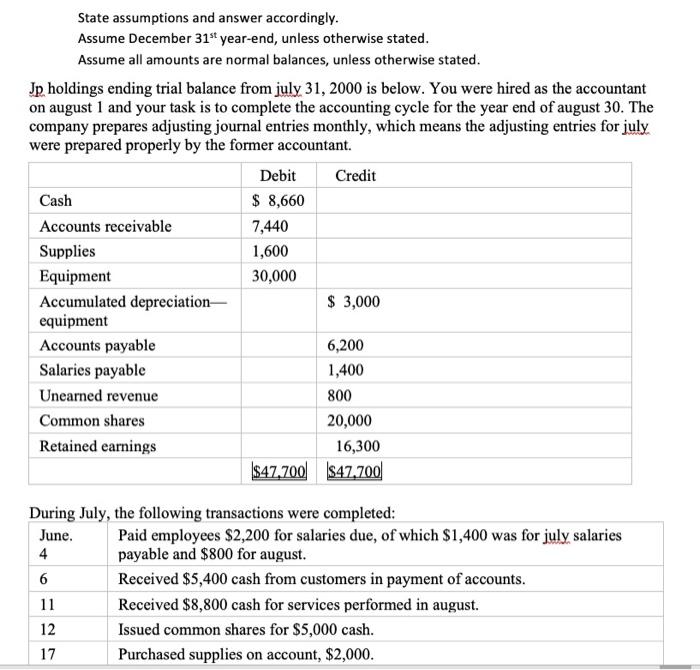

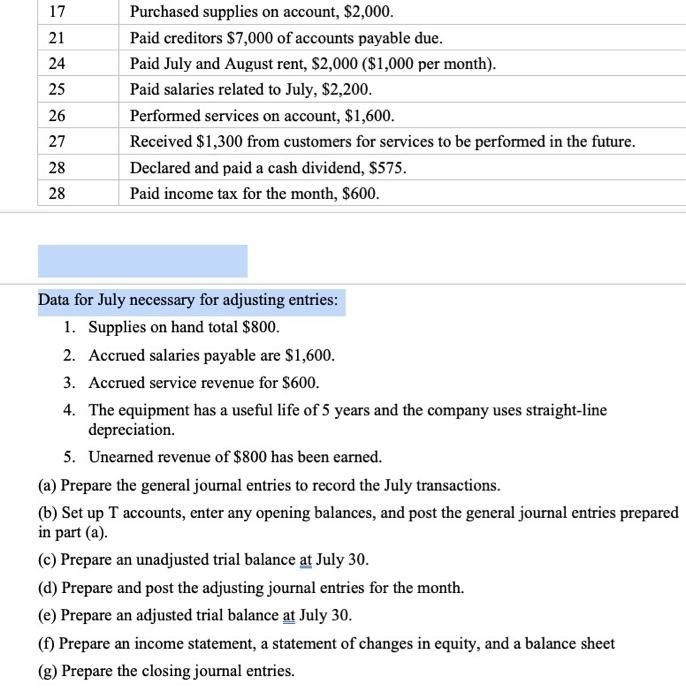

State assumptions and answer accordingly. Assume December 31st year-end, unless otherwise stated. Assume all amounts are normal balances, unless otherwise stated. Jp holdings ending trial balance from july 31, 2000 is below. You were hired as the accountant on august 1 and your task is to complete the accounting cycle for the year end of august 30. The company prepares adjusting journal entries monthly, which means the adjusting entries for july were prepared properly by the former accountant. Debit Credit Cash $ 8,660 Accounts receivable 7,440 Supplies 1,600 Equipment 30,000 Accumulated depreciation $ 3,000 equipment Accounts payable 6,200 Salaries payable 1,400 Unearned revenue 800 Common shares 20,000 Retained earnings 16,300 $47,700S47,700 During July, the following transactions were completed: June. Paid employees $2,200 for salaries due, of which $1,400 was for july salaries 4 payable and $800 for august. 6 Received $5,400 cash from customers in payment of accounts. 11 Received $8,800 cash for services performed in august. 12 Issued common shares for $5,000 cash. 17 Purchased supplies on account, $2,000. 17 21 24 25 Purchased supplies on account, $2,000. Paid creditors $7,000 of accounts payable due. Paid July and August rent, $2,000 ($1,000 per month). Paid salaries related to July, $2,200. Performed services on account, $1,600. Received $1,300 from customers for services to be performed in the future. Declared and paid a cash dividend, $575. Paid income tax for the month, $600. 26 27 28 28 Data for July necessary for adjusting entries: 1. Supplies on hand total $800. 2. Accrued salaries payable are $1,600. 3. Accrued service revenue for $600. 4. The equipment has a useful life of 5 years and the company uses straight-line depreciation. 5. Unearned revenue of $800 has been earned. (a) Prepare the general journal entries to record the July transactions. (b) Set up T accounts, enter any opening balances, and post the general journal entries prepared in part (a). (c) Prepare an unadjusted trial balance at July 30. (d) Prepare and post the adjusting journal entries for the month. (e) Prepare an adjusted trial balance at July 30. (1) Prepare an income statement, a statement of changes in equity, and a balance sheet (g) Prepare the closing journal entries