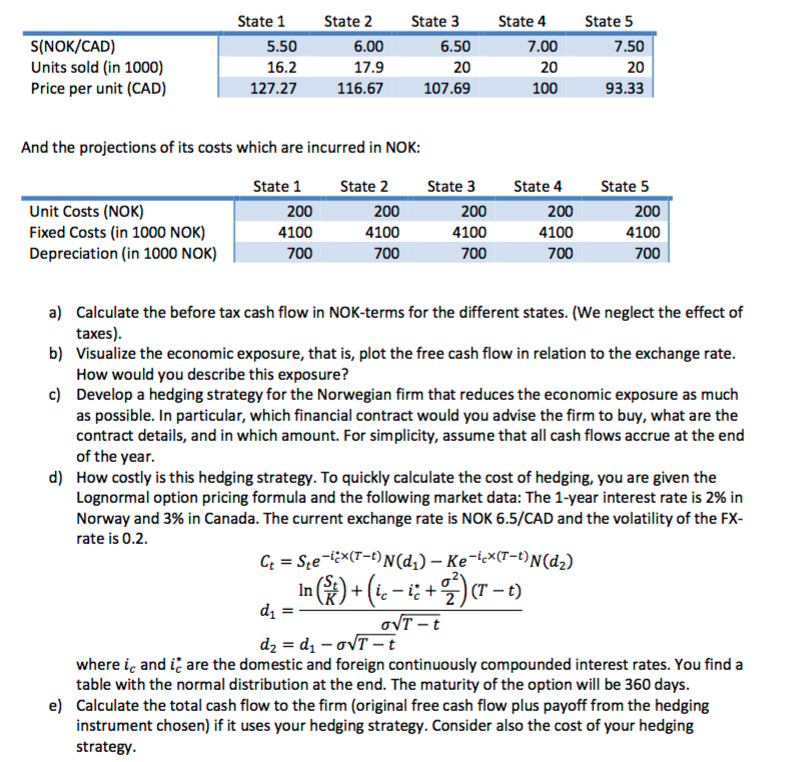

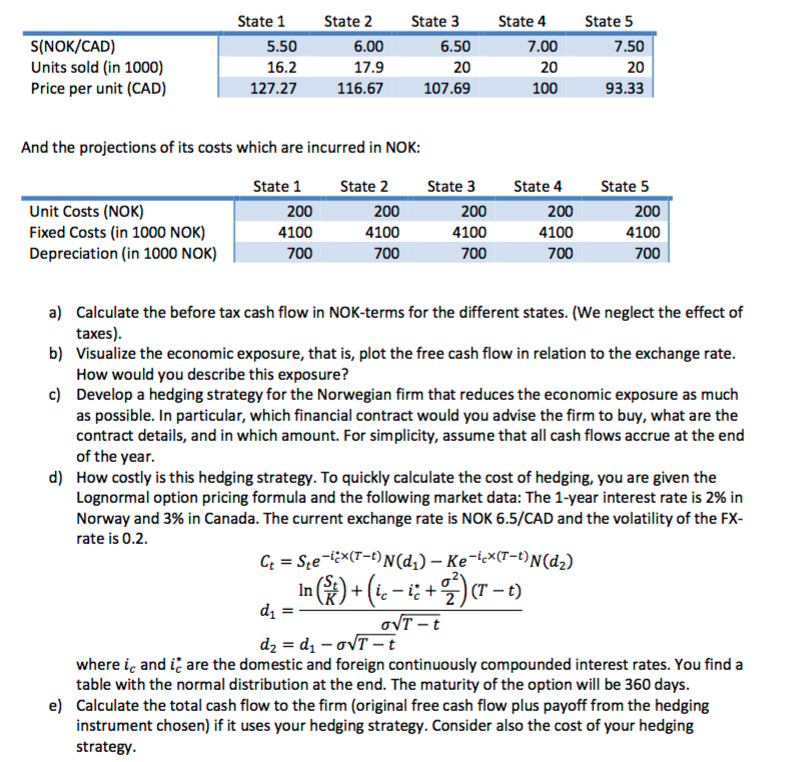

State State 2 State 3 State 4 State 5 S(NOK/CAD) Units sold (in 1000) Price per unit (CAD) 5.50 16.2 127.27 6.00 17.9 116.67 6.50 20 107.69 7.00 20 100 7.50 20 93.33 And the projections of its costs which are incurred in NOK: State 1 State 2 State 3 State 4 State 5 Unit Costs (NOK) Fixed Costs (in 1000 NOK) Depreciation (in 1000 NOK) 200 4100 700 200 4100 700 200 4100 700 200 4100 700 200 4100 700 a) b) c) Calculate the before tax cash flow in NOK-terms for the different states. (We neglect the effect of taxes) Visualize the economic exposure, that is, plot the free cash flow in relation to the exchange rate How would you describe this exposure? Develop a hedging strategy for the Norwegian firm that reduces the economic exposure as much as possible. In particular, which financial contract would you advise the firm to buy, what are the contract details, and in which amount. For simplicity, assume that all cash flows accrue at the end of the year How costly is this hedging strategy. To quickly calculate the cost of hedging, you are given the Lognormal option pricing formula and the following market data: The 1-year interest rate is 2% in Norway and 3% in Canada. The current exchange rate is NOK 6.5/CAD and the volatility of the FX- ate is 0.2 d) T-t whereic and ic are the domestic and foreign continuously compounded interest rates. You find a table with the normal distribution at the end. The maturity of the option will be 360 days Calculate the total cash flow to the firm (original free cash flow plus payoff from the hedging instrument chosen) if it uses your hedging strategy. Consider also the cost of your hedging strategy e) State State 2 State 3 State 4 State 5 S(NOK/CAD) Units sold (in 1000) Price per unit (CAD) 5.50 16.2 127.27 6.00 17.9 116.67 6.50 20 107.69 7.00 20 100 7.50 20 93.33 And the projections of its costs which are incurred in NOK: State 1 State 2 State 3 State 4 State 5 Unit Costs (NOK) Fixed Costs (in 1000 NOK) Depreciation (in 1000 NOK) 200 4100 700 200 4100 700 200 4100 700 200 4100 700 200 4100 700 a) b) c) Calculate the before tax cash flow in NOK-terms for the different states. (We neglect the effect of taxes) Visualize the economic exposure, that is, plot the free cash flow in relation to the exchange rate How would you describe this exposure? Develop a hedging strategy for the Norwegian firm that reduces the economic exposure as much as possible. In particular, which financial contract would you advise the firm to buy, what are the contract details, and in which amount. For simplicity, assume that all cash flows accrue at the end of the year How costly is this hedging strategy. To quickly calculate the cost of hedging, you are given the Lognormal option pricing formula and the following market data: The 1-year interest rate is 2% in Norway and 3% in Canada. The current exchange rate is NOK 6.5/CAD and the volatility of the FX- ate is 0.2 d) T-t whereic and ic are the domestic and foreign continuously compounded interest rates. You find a table with the normal distribution at the end. The maturity of the option will be 360 days Calculate the total cash flow to the firm (original free cash flow plus payoff from the hedging instrument chosen) if it uses your hedging strategy. Consider also the cost of your hedging strategy e)