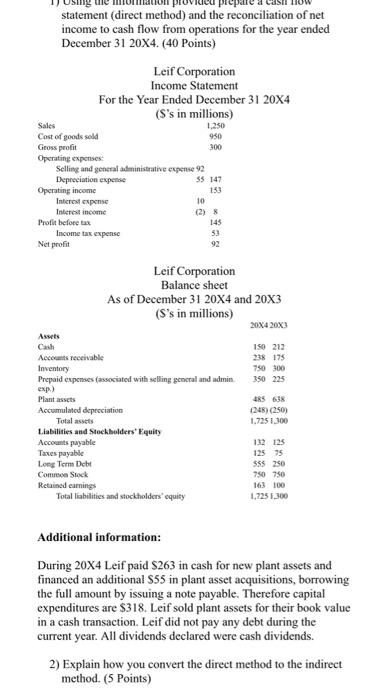

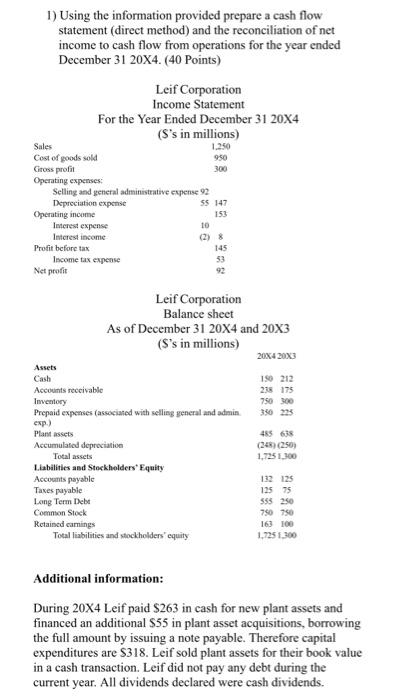

statement (direct method) and the reconciliation of net income to cash flow from operations for the year ended December 31 20X4. (40 Points) Leif Corporation Income Statement For the Year Ended December 31 20X4 (S's in millions) Sales 1.250 Cost of goods sold 950 Gross profit 300 Operating expenses Selling and general administrative expense 92 Depreciation expense 55 147 Operating income 151 Interest expense 10 Interest income Profit before tax 145 Income tax expense 53 Net profit 92 Leif Corporation Balance sheet As of December 31 20x4 and 20X3 (S's in millions) 20x420x3 Assets 150 212 238 175 750 300 350 225 4R$ 638 (248) (250) 1.725 1.300 Accounts receivable Inventory Prepaid expenses (associated with selling general and admin. exp) Plant assets Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Taxes payable Long Term Debt Common Stock Retained earnings Total liabilities and stockholders' equity 132 125 125 75 555 250 750 750 163 100 1.725 1,300 Additional information: During 20X4 Leif paid S263 in cash for new plant assets and financed an additional S55 in plant asset acquisitions, borrowing the full amount by issuing a note payable. Therefore capital expenditures are $318. Leif sold plant assets for their book value in a cash transaction. Leif did not pay any debt during the current year. All dividends declared were cash dividends. 2) Explain how you convert the direct method to the indirect method. (5 Points) 1) Using the information provided prepare a cash flow statement (direct method) and the reconciliation of net income to cash flow from operations for the year ended December 31 20X4. (40 Points) Leif Corporation Income Statement For the Year Ended December 31 20X4 (S's in millions) Sales Cost of goods sold 950 Gross profil 300 Operating expenses Selling and general administrative expense 92 Depreciation expense 55 147 Operating income 153 Interest expense 10 Interest income Profit before tax 145 Income tax expense 53 Net profit Leif Corporation Balance sheet As of December 31 20X4 and 20X3 (S's in millions) 20x420X3 Assets Cash 190 212 Accounts receivable 238 175 Inventory 750 300 Prepaid expenses associated with selling general and admin. 350 225 exp) Plant assets 455 638 Accumulated depreciation (24 (250) Total assets 1,7251.300 Liabilities and Stockholders' Equity Accounts payable 132125 Taxes payable 125 75 Long Term Debt 555 250 Common Stock 750 750 Retained camings 163 100 Total liabilities and stockholders equity 1.725 1.300 Additional information: During 20X4 Leif paid $263 in cash for new plant assets and financed an additional S55 in plant asset acquisitions, borrowing the full amount by issuing a note payable. Therefore capital expenditures are $318. Leif sold plant assets for their book value in a cash transaction. Leif did not pay any debt during the current year. All dividends declared were cash dividends