Answered step by step

Verified Expert Solution

Question

1 Approved Answer

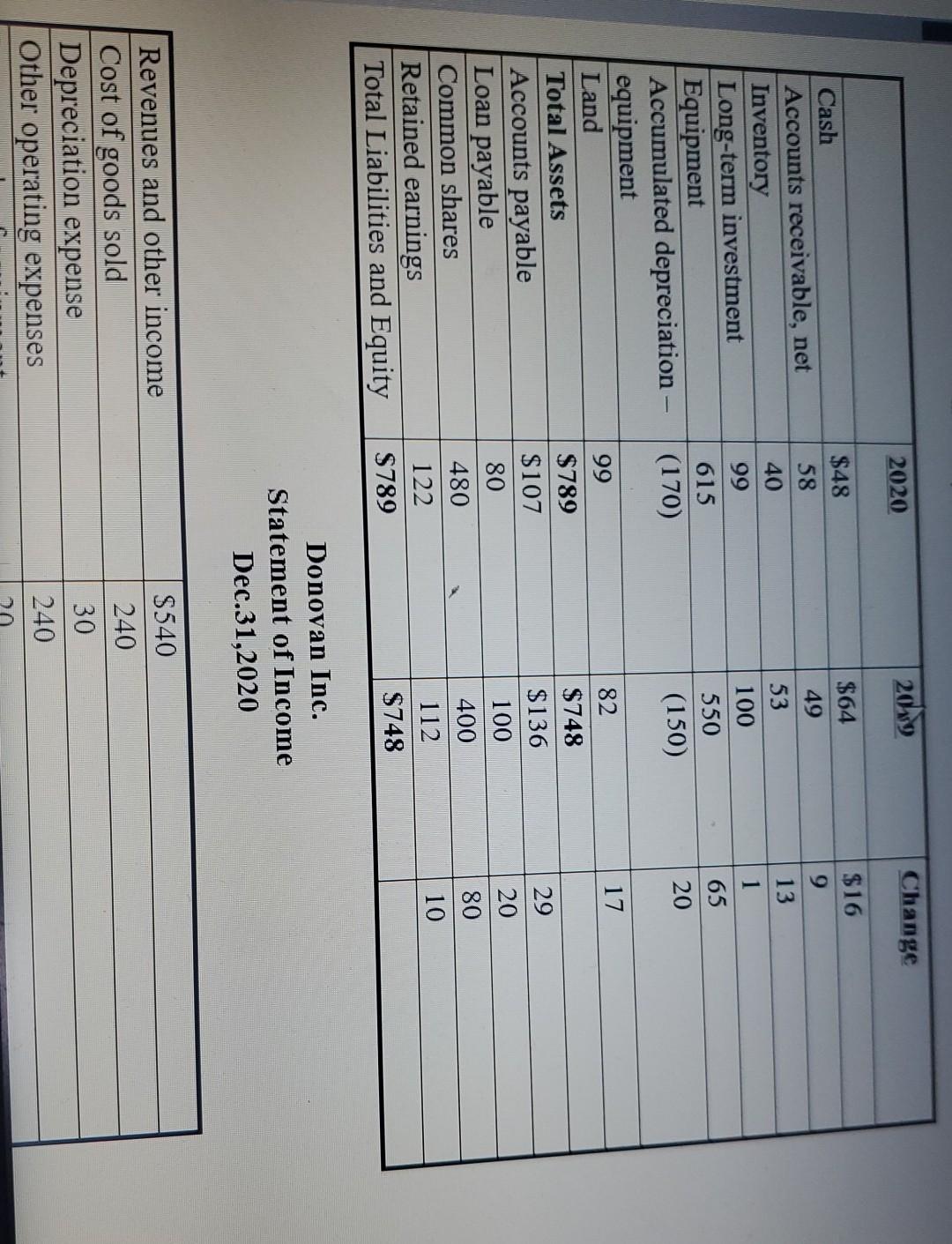

statement of cash flow 2020 209 Change $48 58 $16 9 13 40 99 $64 49 53 100 550 (150) 1 615 (170) 65 20

statement of cash flow

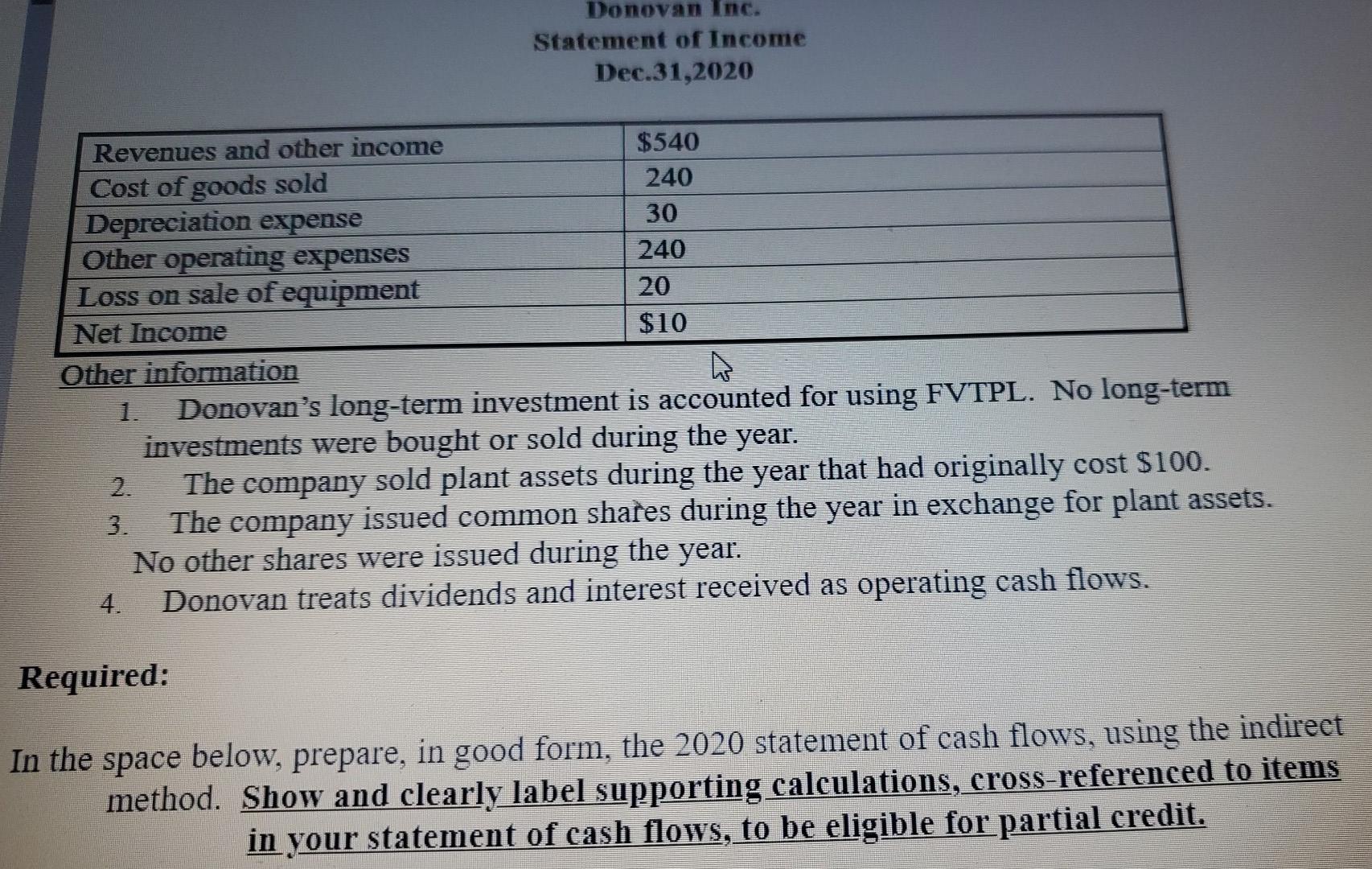

2020 209 Change $48 58 $16 9 13 40 99 $64 49 53 100 550 (150) 1 615 (170) 65 20 17 Cash Accounts receivable, net Inventory Long-term investment Equipment Accumulated depreciation equipment Land Total Assets Accounts payable Loan payable Common shares Retained earnings Total Liabilities and Equity 29 99 $789 $107 80 480 122 $789 82 $748 $136 100 400 112 $748 20 80 10 Donovan Inc. Statement of Income Dec.31,2020 Revenues and other income Cost of goods sold Depreciation expense Other operating expenses S540 240 30 240 Donovan Inc. Statement of Income Dec.31,2020 Revenues and other income $540 Cost of goods sold 240 Depreciation expense 30 Other operating expenses 240 Loss on sale of equipment 20 Net Income $10 Other information 1. Donovan's long-term investment is accounted for using FVTPL. No long-term investments were bought or sold during the year. 2. The company sold plant assets during the year that had originally cost $100. 3. The company issued common shares during the year in exchange for plant assets. No other shares were issued during the year. 4. Donovan treats dividends and interest received as operating cash flows. Required: In the space below, prepare, in good form, the 2020 statement of cash flows, using the indirect method. Show and clearly label supporting calculations, cross-referenced to items in your statement of cash flows, to be eligible for partial creditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started