Answered step by step

Verified Expert Solution

Question

1 Approved Answer

statement of cash flow from balance sheet and income statement! help! I cannot for the life of me get the calculations to add up. total

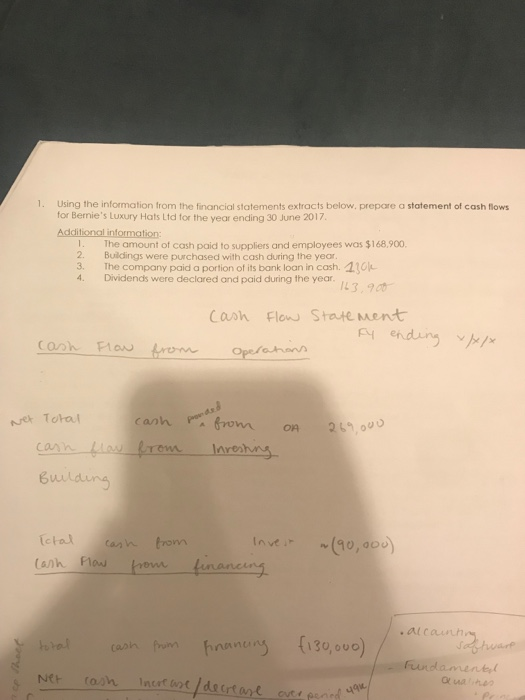

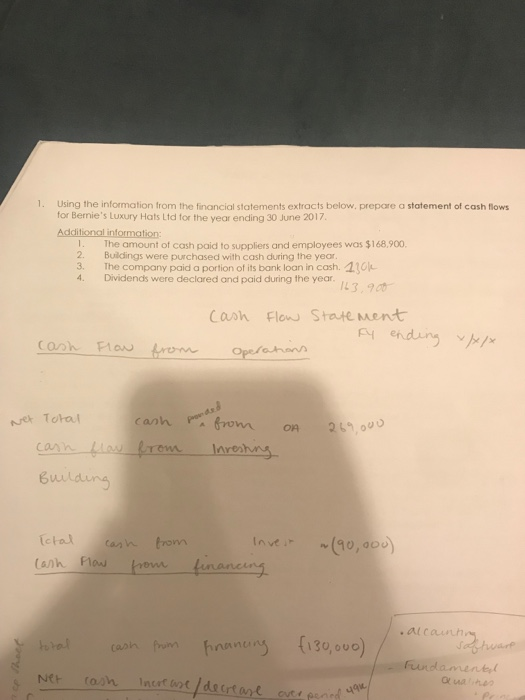

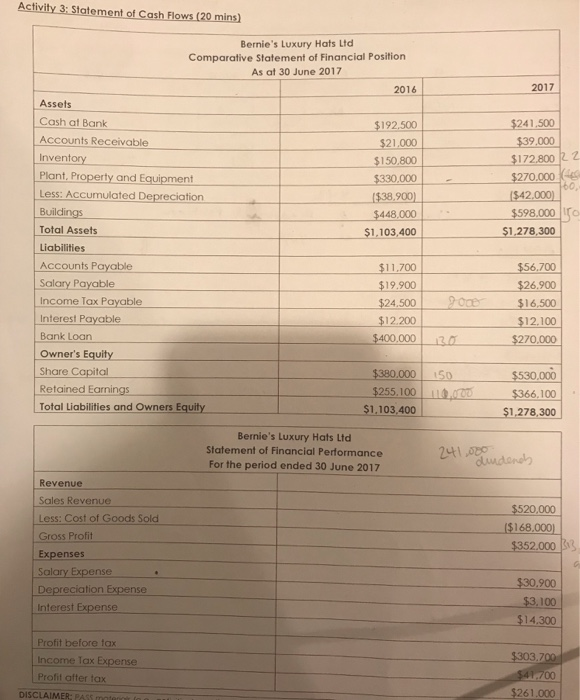

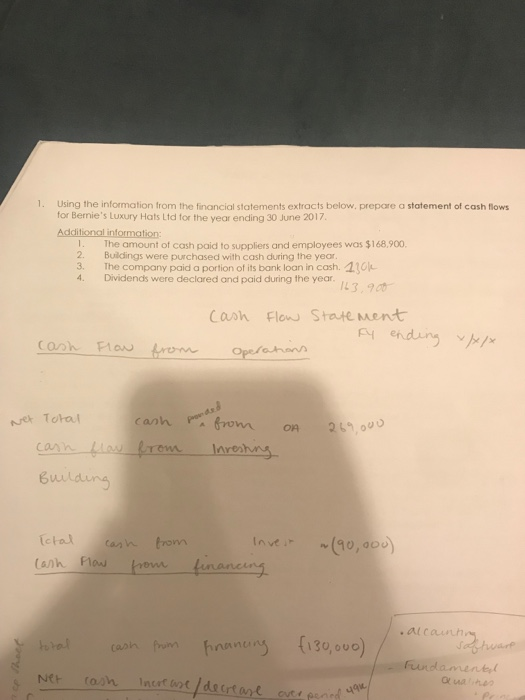

statement of cash flow from balance sheet and income statement! help!I cannot for the life of me get the calculations to add up. total for OA should be: 269,000 total for investing activities should be: (90,000) total for financing activities should be: (130,000) net total: 49,000

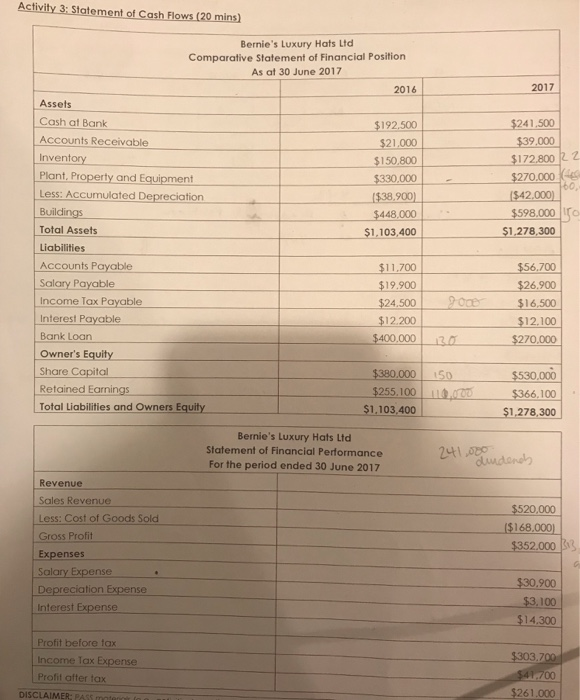

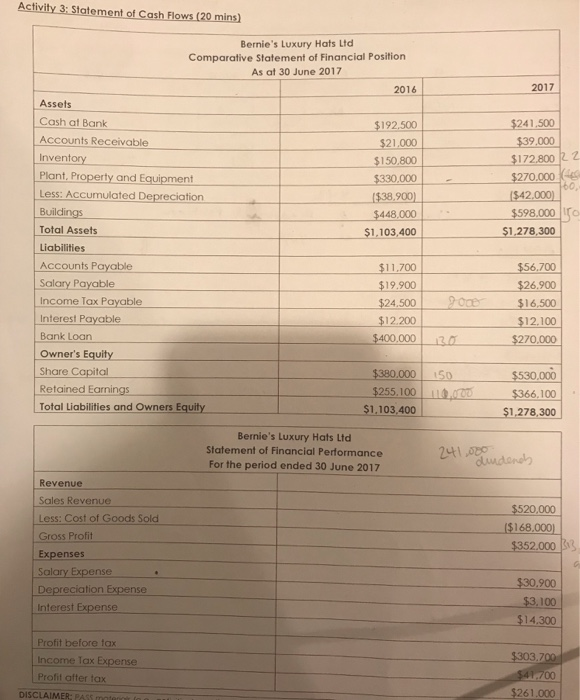

Activity 3: Statement of Cash Flows (20 mins) Bernie's Luxury Hats Ltd Comparative Statement of Financial Position As at 30 June 2017 2017 2016 Assets Cash at Bank $241,500 $192,500 Accounts Receivable $39,000 $21,000 Inventory $172.800 2 2 $150,800 $270,000 G 160, ($42.000) Plant, Property and Equipment $330,000 Less: Accumulated Depreciation ($38,900) Buildings $598.000c $448,000 Total Assets $1,278,300 $1,103,400 Liabilities Accounts Payable $56,700 $11,700 Salary Payable $19.900 $26.900 Income Tax Payable $24,500 $16.500 Interest Payable $12.200 $12,100 Bank Loan $400,000 30 $270,000 Owner's Equity Share Capital $380,000 150 $530,000 Retained Earnings $255.100 1.D $366,100 Total Liabilities and Owners Equity $1,103,400 $1,278,300 Bernie's Luxury Hats Ltd 241 000 dudend Statement of Financial Performance For the period ended 30 June 2017 Revenue Sales Revenue $520,000 Less: Cost of Goods Sold ($168,000 Gross Profit $352.000 Expenses Salary Expense $30,900 Depreciation Expense $3,100 Interest Expense $14,300 Profit before tax $303,700 Income Tax Expense $41 700 Profit after tax $261,000 DISCLAIMER: PASS mo 1. Using the information from the financial statements extracts below, prepare a statement of cash flows for Bernie's LUXury Hats Ltd for the year ending 30 June 2017 Additional information 1. The amount of cash paid to suppliers and employees was $168,900. Buildings were purchased with cash during the year The company paid a portion of its bank loan in cash. 110 Dividends were declared and paid during the year. 2. 3. 4. IL3.900 Cash Flow State Ment Anding /x Cosh Flau from Operahans Podsd 6rom Net Toha canh 269 o00 OA cann Liay rom Inreahng Euilaing Inver (90,0ou Tctal trom Canh rom linancung (anh Plaw anng alca huare Fundamentl f130,000) pnancng cash frann Incat wnt /decrtane NeH toh

Activity 3: Statement of Cash Flows (20 mins) Bernie's Luxury Hats Ltd Comparative Statement of Financial Position As at 30 June 2017 2017 2016 Assets Cash at Bank $241,500 $192,500 Accounts Receivable $39,000 $21,000 Inventory $172.800 2 2 $150,800 $270,000 G 160, ($42.000) Plant, Property and Equipment $330,000 Less: Accumulated Depreciation ($38,900) Buildings $598.000c $448,000 Total Assets $1,278,300 $1,103,400 Liabilities Accounts Payable $56,700 $11,700 Salary Payable $19.900 $26.900 Income Tax Payable $24,500 $16.500 Interest Payable $12.200 $12,100 Bank Loan $400,000 30 $270,000 Owner's Equity Share Capital $380,000 150 $530,000 Retained Earnings $255.100 1.D $366,100 Total Liabilities and Owners Equity $1,103,400 $1,278,300 Bernie's Luxury Hats Ltd 241 000 dudend Statement of Financial Performance For the period ended 30 June 2017 Revenue Sales Revenue $520,000 Less: Cost of Goods Sold ($168,000 Gross Profit $352.000 Expenses Salary Expense $30,900 Depreciation Expense $3,100 Interest Expense $14,300 Profit before tax $303,700 Income Tax Expense $41 700 Profit after tax $261,000 DISCLAIMER: PASS mo 1. Using the information from the financial statements extracts below, prepare a statement of cash flows for Bernie's LUXury Hats Ltd for the year ending 30 June 2017 Additional information 1. The amount of cash paid to suppliers and employees was $168,900. Buildings were purchased with cash during the year The company paid a portion of its bank loan in cash. 110 Dividends were declared and paid during the year. 2. 3. 4. IL3.900 Cash Flow State Ment Anding /x Cosh Flau from Operahans Podsd 6rom Net Toha canh 269 o00 OA cann Liay rom Inreahng Euilaing Inver (90,0ou Tctal trom Canh rom linancung (anh Plaw anng alca huare Fundamentl f130,000) pnancng cash frann Incat wnt /decrtane NeH toh

I cannot for the life of me get the calculations to add up.

total for OA should be: 269,000

total for investing activities should be: (90,000)

total for financing activities should be: (130,000)

net total: 49,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started