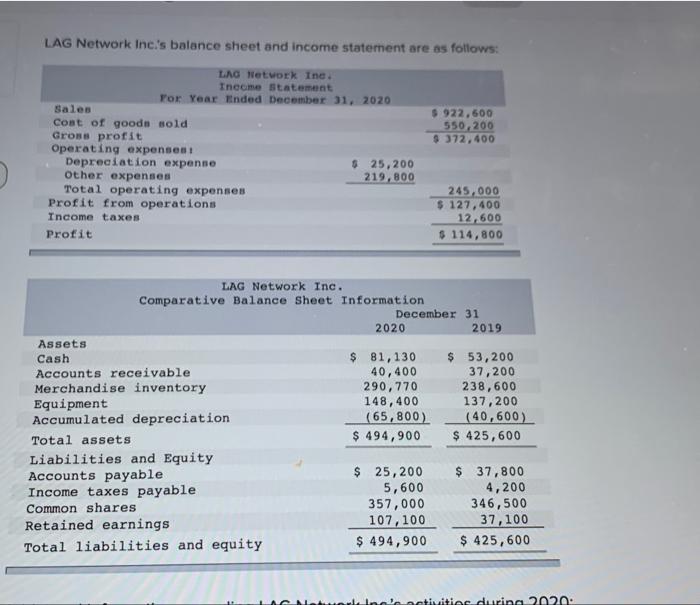

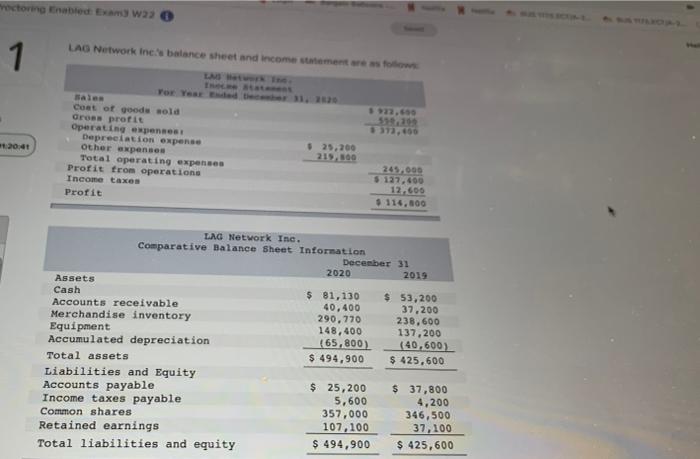

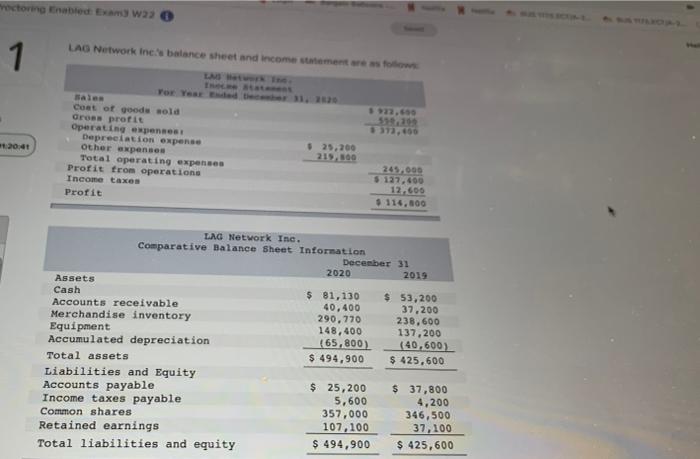

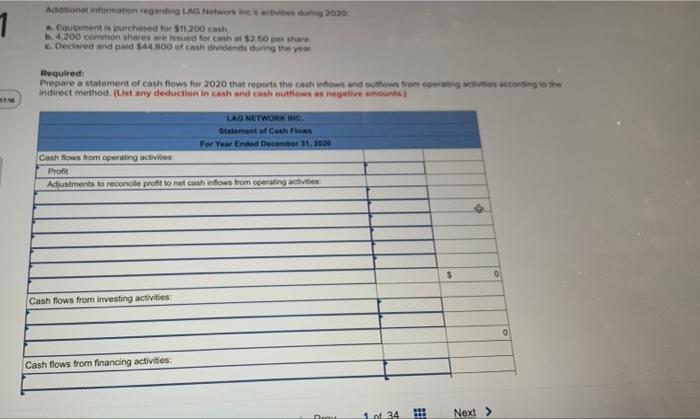

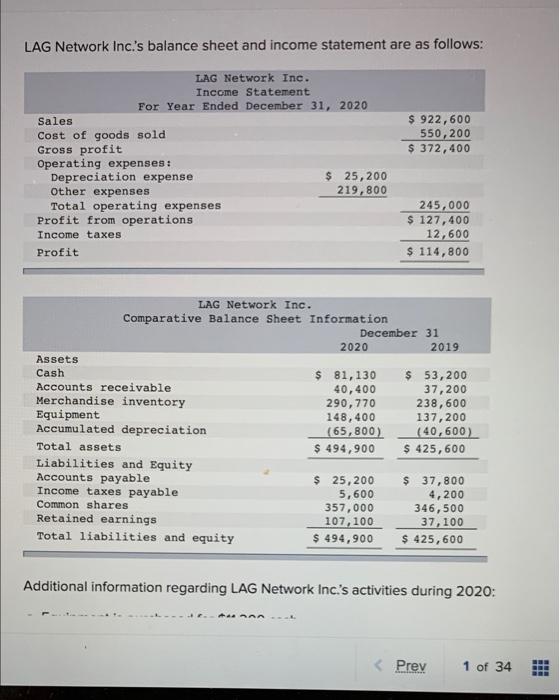

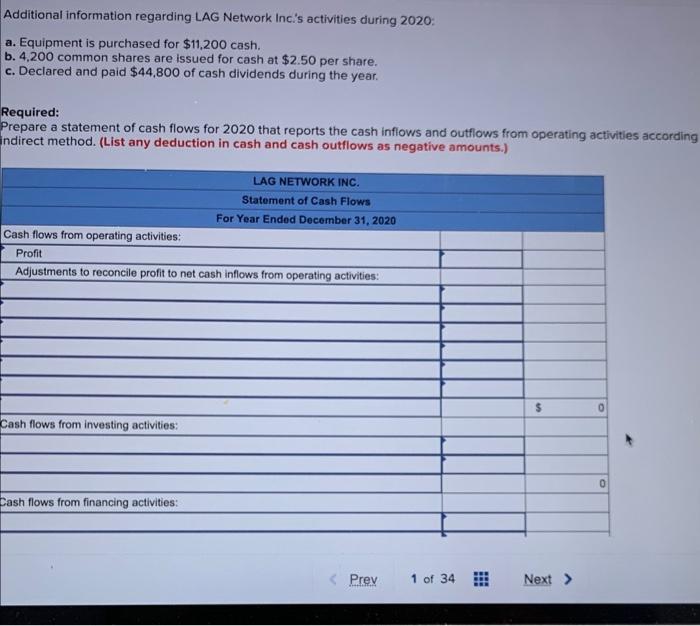

LAG Network Inc.'s balance sheet and income statement are as follows: $922.500 550,200 $ 372,400 LAO Network Inc. Income Statement For Year Ended December 31, 2020 Sales Cont of goods sold Gross profit Operating expenses Depreciation expense $ 25,200 Other expenses 219,800 Total operating expenses Profit from operations Income taxes Profit 245.000 $ 127,400 12,600 $ 114,800 LAG Network Inc. Comparative Balance Sheet Information December 31 2020 2019 Assets Cash $ 81,130 $ 53,200 Accounts receivable 40,400 37,200 Merchandise inventory 290,770 238,600 Equipment 148,400 137,200 Accumulated depreciation (65,800) (40,600) Total assets $ 494,900 $ 425,600 Liabilities and Equity Accounts payable $ 25, 200 $ 37,800 Income taxes payable 5,600 4,200 Common shares 357,000 346,500 Retained earnings 107, 100 37,100 Total liabilities and equity $ 494,900 $ 425,600 Intel Inol activities during 2020 actoring Enabled am W22 LAG Network Inc. balance sheet and income tahamentos 1 Yo Yes 3.60 20:41 Cost of goods sold Gross profit Operating expenses Depreciation expense other expenses Total operating expenses Profit from operations Income taxes Profit 219.500 245.000 $ 127.400 12.606 $ 114.00 LAG Network Ine. Comparative Balance Sheet Information December 31 2020 2019 Assets Cash $ 81,130 $ 53,200 Accounts receivable 40,400 37,200 Merchandise inventory 290,770 238,600 Equipment 148,400 137,200 Accumulated depreciation (65.800) (40.600) Total assets $ 494,900 $ 425,600 Liabilities and Equity Accounts payable $ 25,200 $ 37,800 Income taxes payable 5,600 4,200 Common shares 357,000 346,500 Retained earnings 107, 100 37.100 Total liabilities and equity $ 494,900 $ 425,600 Additional information ording LAG Netties during 2030 - Equipment is purchased for $1.200 cash b. 4.200 common shares are sued for at $2.50 per har Declared and paid $44.800 of cash vidends during the yeat Required: Prepare a statement of cash flows for 2020 that reports the cash in and out how to get to Indirect method. (List any deduction in cash and cash outflows as negativement LAG NETWORX WC Statement of Cash Flows For Year Ended December 31, 2010 Cash flows from operating activities Profit Adjustments to reconcile profit to net cash flows from operating activities $ 0 Cash flows from investing activities: Cash flows from financing activities 1 of 34 BE D. Next > LAG Network Inc.'s balance sheet and income statement are as follows: $ 922,600 550, 200 $ 372,400 LAG Network Inc. Income Statement For Year Ended December 31, 2020 Sales Cost of goods sold Gross profit Operating expenses: Depreciation expense $ 25,200 Other expenses 219,800 Total operating expenses Profit from operations Income taxes Profit 245,000 $ 127,400 12,600 $ 114,800 LAG Network Inc. Comparative Balance Sheet Information December 31 2020 2019 Assets Cash $ 81,130 $ 53,200 Accounts receivable 40,400 37,200 Merchandise inventory 290, 770 238,600 Equipment 148, 400 137,200 Accumulated depreciation (65,800) (40,600) Total assets $ 494,900 $ 425,600 Liabilities and Equity Accounts payable $ 25,200 $ 37,800 Income taxes payable 5,600 4,200 Common shares 357,000 346,500 Retained earnings 107, 100 37,100 Total liabilities and equity $ 494,900 $ 425,600 Additional information regarding LAG Network Inc.'s activities during 2020: