Statement of cash flow

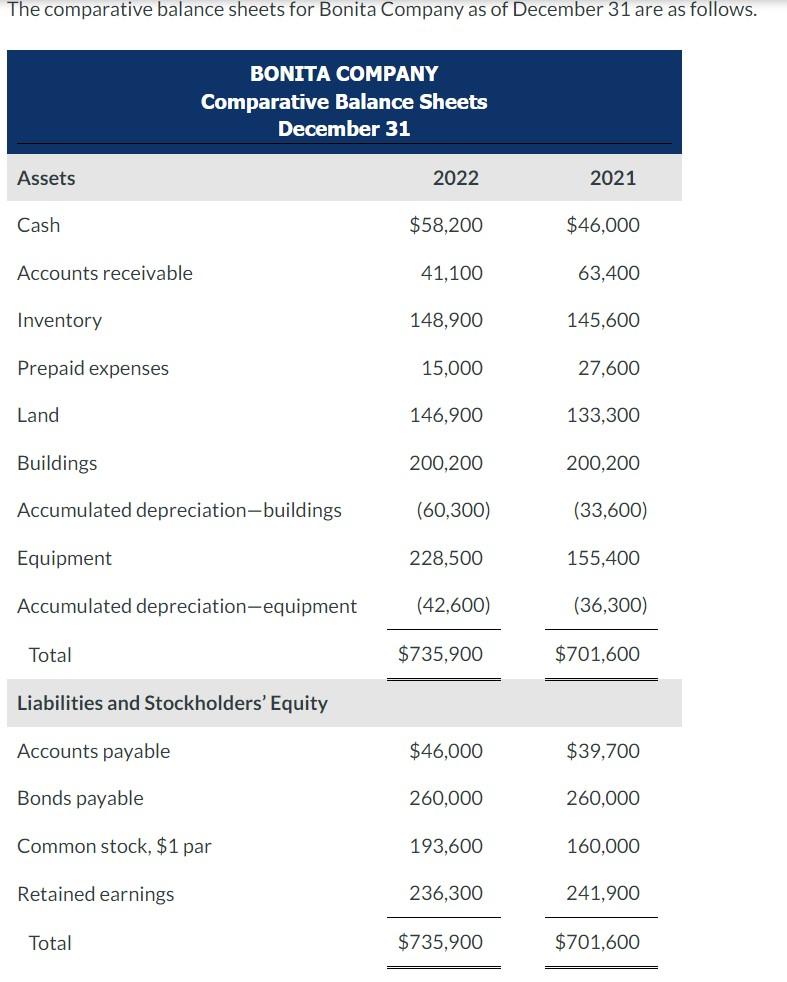

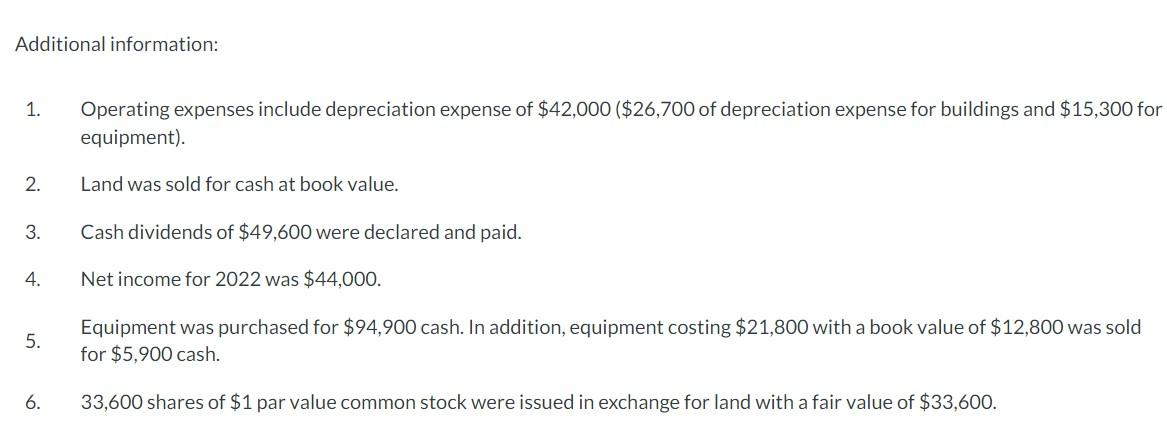

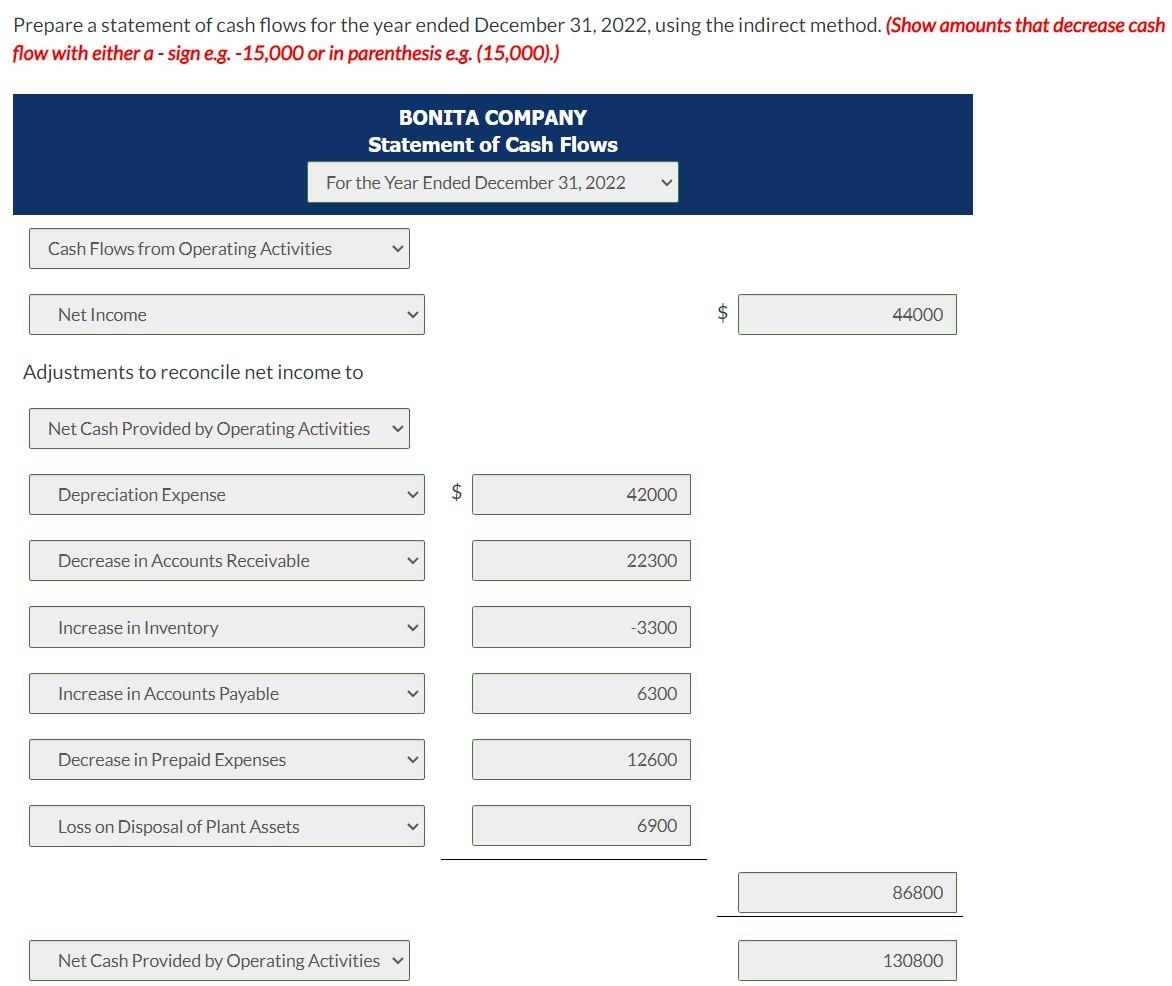

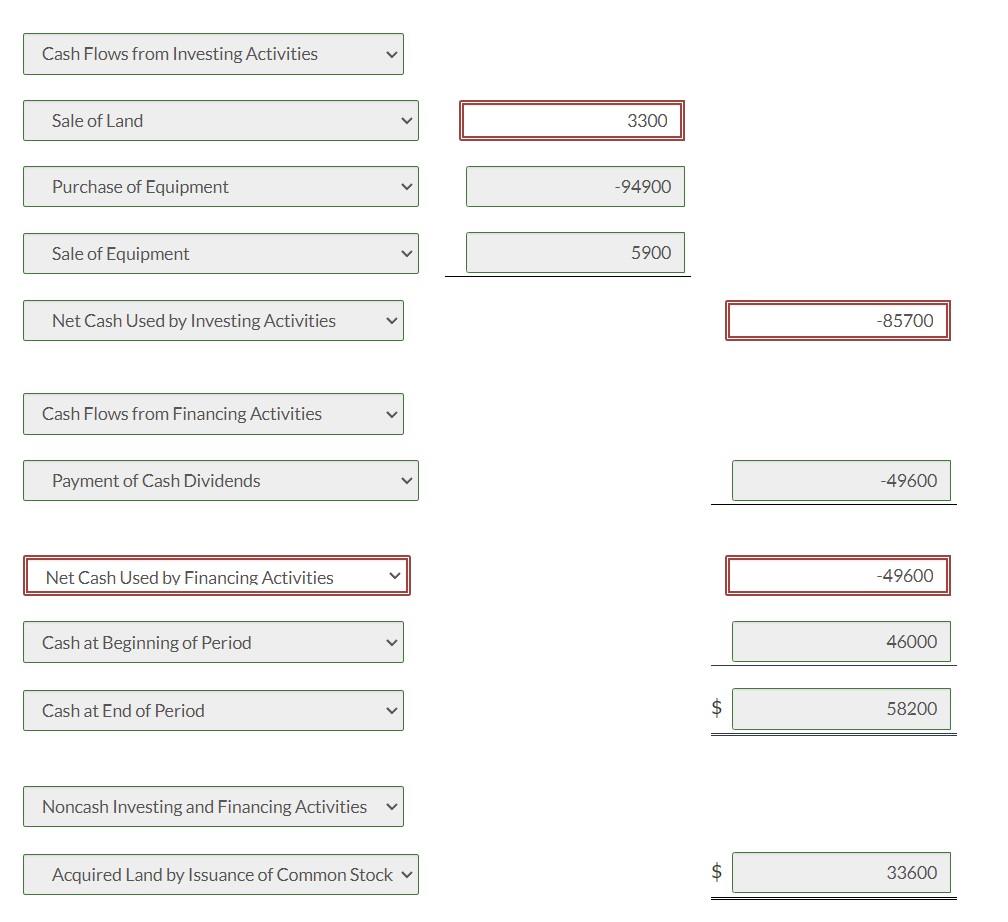

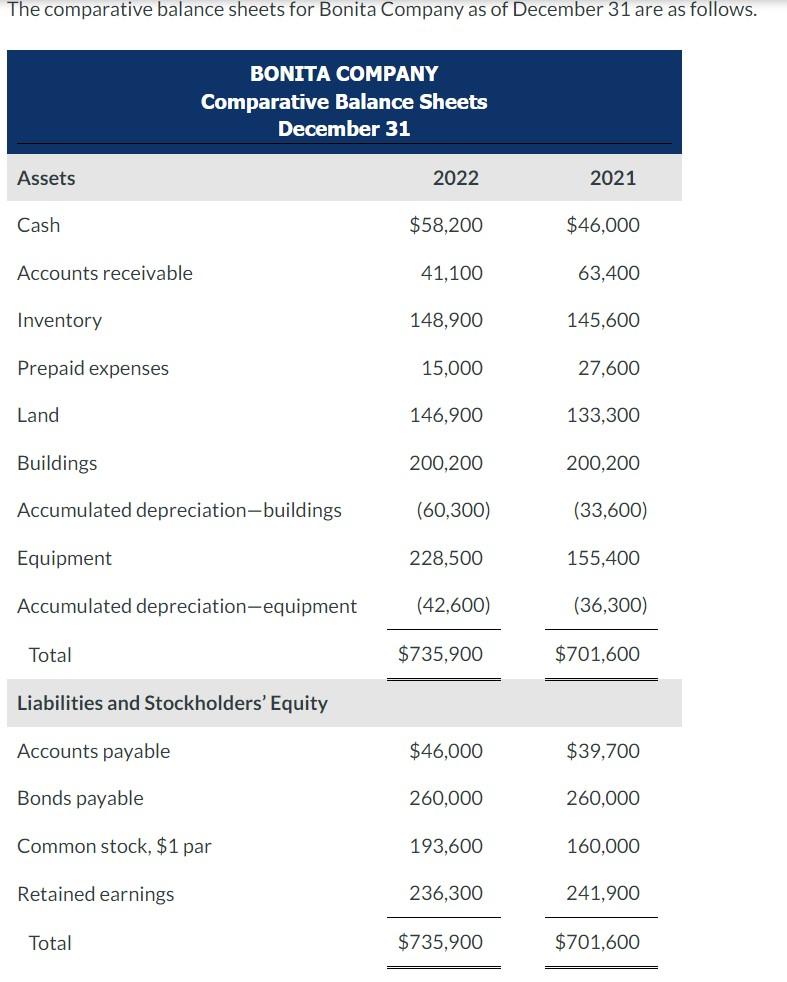

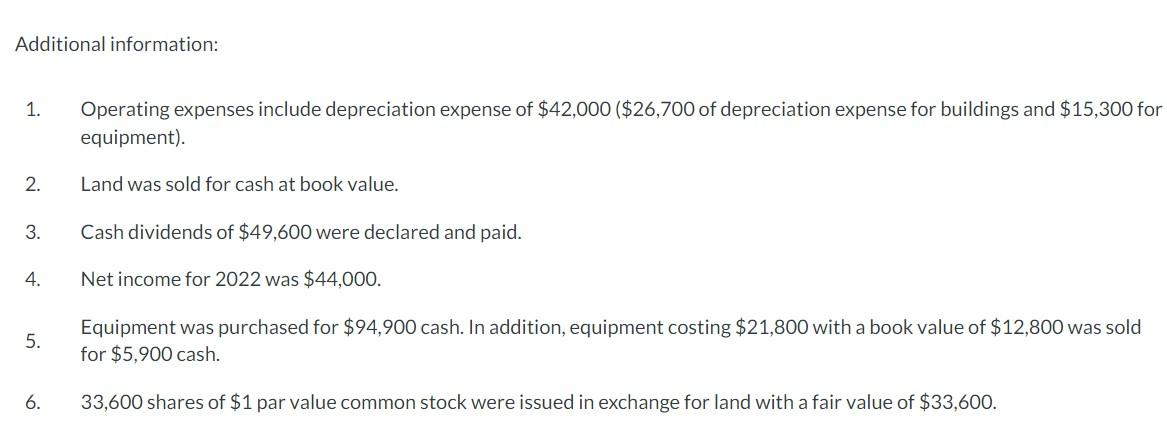

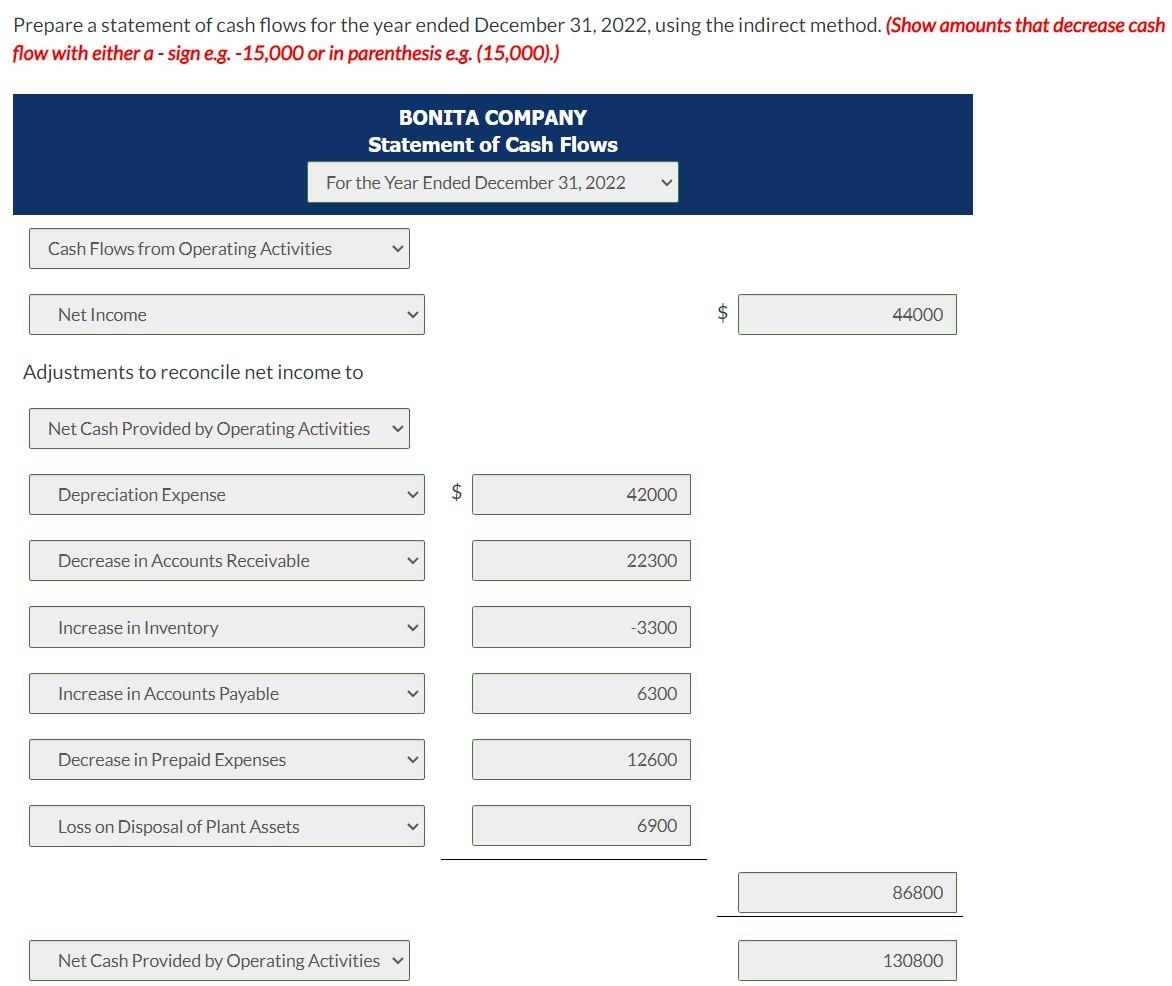

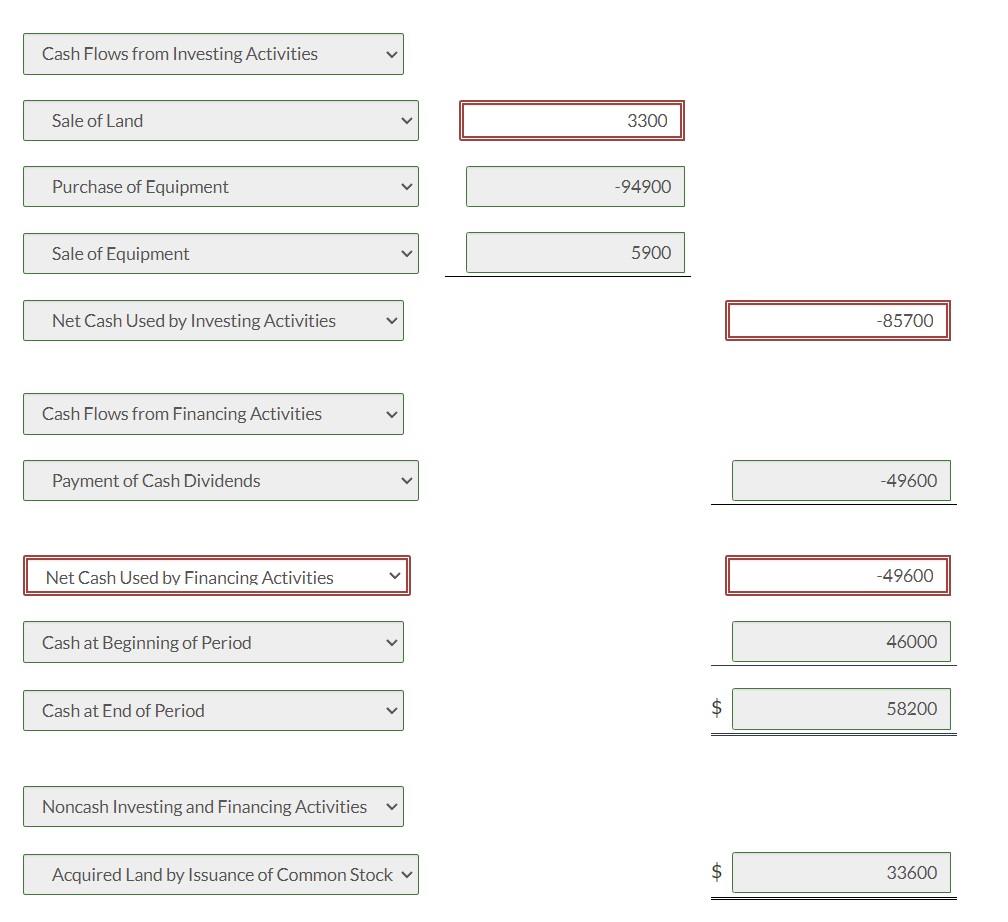

The comparative balance sheets for Bonita Company as of December 31 are as follows. BONITA COMPANY Comparative Balance Sheets December 31 Assets 2022 2021 Cash $58,200 $46,000 Accounts receivable 41,100 63,400 Inventory 148,900 145,600 Prepaid expenses 15,000 27,600 Land 146,900 133,300 Buildings 200,200 200,200 Accumulated depreciation-buildings (60,300) (33,600) Equipment 228,500 155,400 Accumulated depreciation equipment (42,600) (36,300) Total $735,900 $701,600 Liabilities and Stockholders' Equity Accounts payable $46,000 $39,700 Bonds payable 260,000 260,000 Common stock, $1 par 193,600 160,000 Retained earnings 236,300 241,900 Total $735,900 $701,600 Additional information: 1. Operating expenses include depreciation expense of $42,000 ($26,700 of depreciation expense for buildings and $15,300 for equipment). 2. Land was sold for cash at book value. 3. Cash dividends of $49,600 were declared and paid. 4. Net income for 2022 was $44,000. 5. Equipment was purchased for $94,900 cash. In addition, equipment costing $21,800 with a book value of $12,800 was sold for $5,900 cash. 6. 33,600 shares of $1 par value common stock were issued in exchange for land with a fair value of $33,600. Prepare a statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) BONITA COMPANY Statement of Cash Flows For the Year Ended December 31, 2022 V Cash Flows from Operating Activities Net Income $ 44000 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense 42000 Decrease in Accounts Receivable V 22300 Increase in Inventory -3300 Increase in Accounts Payable 6300 Decrease in Prepaid Expenses 12600 Loss on Disposal of Plant Assets 6900 86800 Net Cash Provided by Operating Activities 130800 Cash Flows from Investing Activities Sale of Land 3300 Purchase of Equipment -94900 Sale of Equipment 5900 Net Cash Used by Investing Activities -85700 Cash Flows from Financing Activities Payment of Cash Dividends -49600 Net Cash Used by Financing Activities V -49600 Cash at Beginning of Period 46000 Cash at End of Period $ 58200 Noncash Investing and Financing Activities Acquired Land by Issuance of Common Stock $ 33600