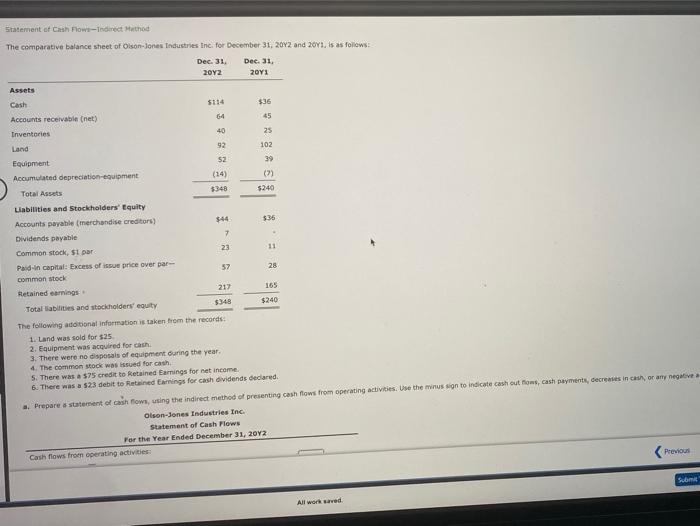

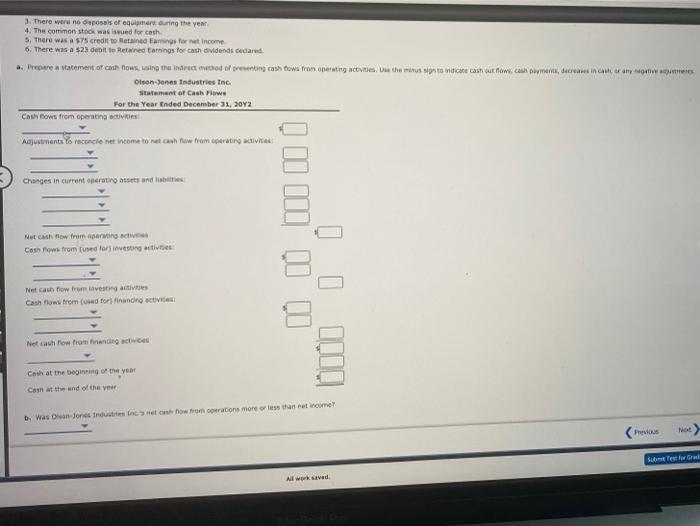

Statement of Cash Flow-indirect Method The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 2012 and 2041, is as follows: Dec. 31. Dec. 31, 2012 2011 ***** Assets Cash $114 $36 Accounts receivable (net) 64 45 Inventories 40 25 Land 92 102 Equipment 52 39 Accumulated depreciation equipment (14) (7) Total Assets $348 $240 Liabilities and Stockholders' Equity Accounts payable merchandise creditors) 3-64 $35 Dividends payable 7 Common stock, si par 23 11 Paid in capital: Excess of issue price over par- 57 28 common stock Retained earnings 212 165 Total abilities and stockholders' equity $240 The following additional information is taken from the records 1. Land was sold for $25 2. Equipment was acquired for cash 3. There were no disposals of equipment during the year 4. The common stock was issued for cash 5. There was a $75 credit to Retained Earnings for net income 6. There was a 523 debit to Retained Earnings for cash dividends declared. . Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the insign to indicate cash outons, cash payments, decreases in cash, or any negative Olson-Jones Industries Inc. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities Previous lala $348 som All work saved 3. There were no oposals of equipment during the year 4. The common stock was sued for cash S. There was a 575 credit to Ratings for income 6. There was a $23 de eRetained arnings for cash dividends dared a. Prepare a statement of cathows in the dream of cash flows from operating activities, thesis to maine cas our flow.cak Dame, and in carne Olson-Jones Industries Inc Statement of Cash Flow For the Year Ended December 31, 2012 Chanows from operating activities Atments Y reconcle et income one show from corteve Changes in current rating and be Do ul DI Net cash flow from pering Cash flows from used for investigative Net cash flow from investing Cash flow from (wed for financing Net cash flow to find i Cash at the beginning of the year Cash at the end of the year 1. Was On-Jones nostres instant from orations more or less than net income Previous Sme i Grad Al Wavad