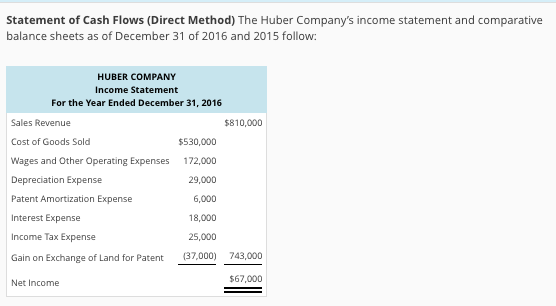

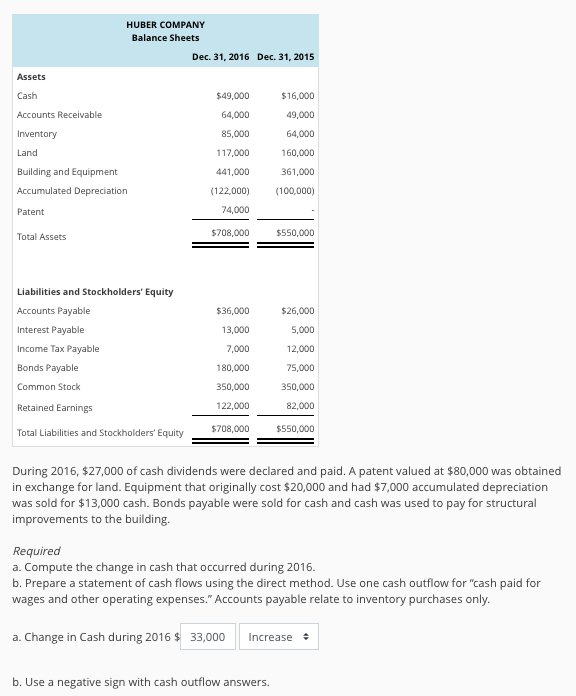

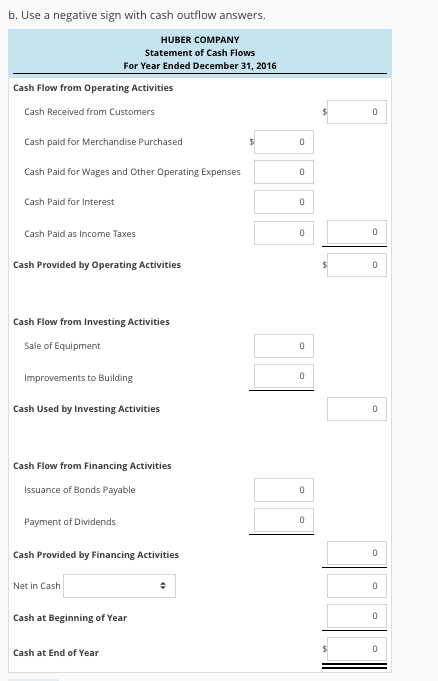

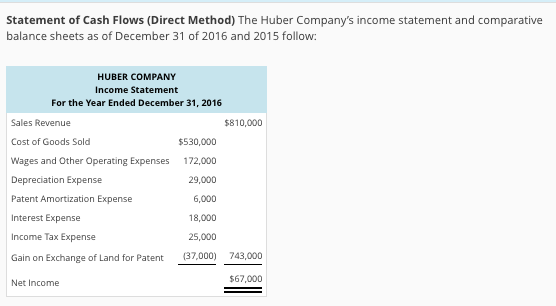

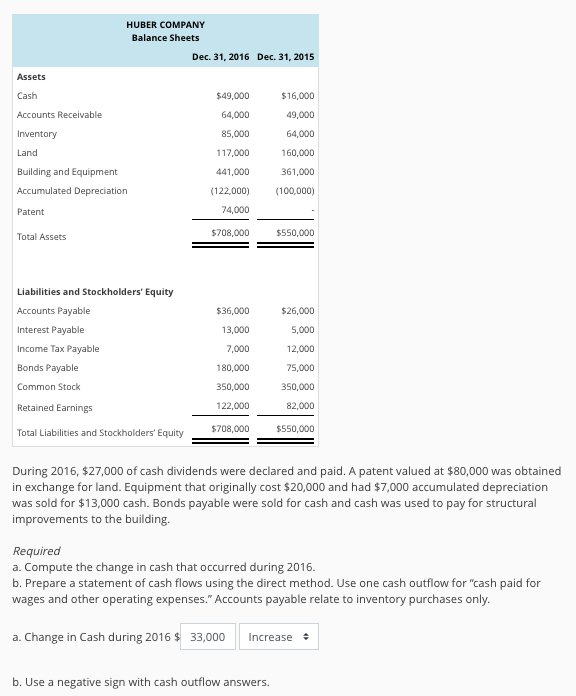

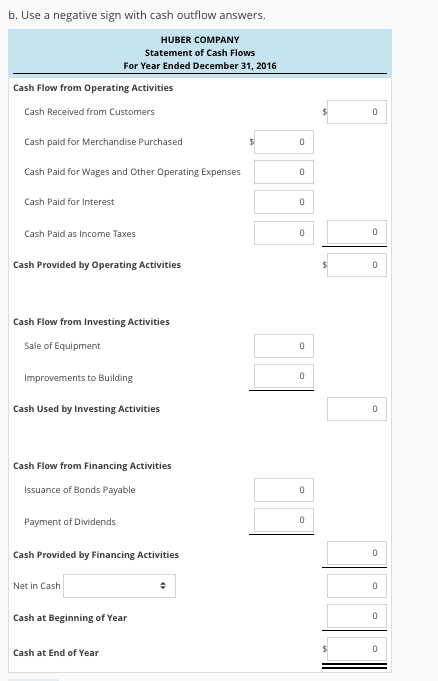

Statement of Cash Flows (Direct Method) The Huber Company's income statement and comparative balance sheets as of December 31 of 2016 and 2015 follow: HUBER COMPANY Income Statement For the Year Ended December 31, 2016 Sales Revenue Cost of Goods Sold Wages and Other Operating Expenses Depreciation Expense Patent Amortization Expense Interest Expense Income Tax Expense $810,000 $530,000 172,000 29,000 6,000 18,000 25,000 Gain on Exchange of Land for Patent ,000 743,000 $67,000 Net Income HUBER COMPANY Balance Sheets Dec. 31, 2016 Dec. 31, 2015 Assets Cash Accounts Receivable Inventory Land Building and Equipment Accumulated Depreciation Patent $16,000 49,000 64,000 160,000 361,000 122,000) 100,000) $49,000 64,000 85,000 117,000 441,000 74,000 $708,000 $550,000 Total Assets Liabilities and Stockholders' Equity Accounts Payable Interest Payable Income Tax Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Stockholders Equity $36,000 13,000 7,000 180,000 350,000 122,000 $708,000 $26,000 5,000 12,000 75,000 350,000 82,000 $550,000 During 2016, $27,000 of cash dividends were declared and paid. A patent valued at $80,000 was obtained in exchange for land. Equipment that originally cost $20,000 and had $7,000 accumulated depreciation was sold for $13,000 cash. Bonds payable were sold for cash and cash was used to pay for structural improvements to the building Required a. Compute the change in cash that occurred during 2016 b. Prepare a statement of cash flows using the direct method. Use one cash outflow for "cash paid for wages and other operating expenses." Accounts payable relate to inventory purchases only. a. Change in Cash during 2016 $ 33,000 increase b. Use a negative sign with cash outflow answers. b. Use a negative sign with cash outflow answers. HUBER COMPANY Statement of Cash Flows For Year Ended December 31, 2016 Cash Flow from Operating Activities Cash Received from Customers Cash paid for Merchandise Purchased Cash Paid fo r Wages and Other Operating Expenses Cash Paid for Interest Cash Paid as Income Taxes Cash Provided by Operating Activities Cash Flow from Investing Activities Sale of Equipment Improvements to Building Cash Used by Investing Activities Cash Flow from Financing Activities Issuance of Bonds Payable Payment of Dividends Cash Provided by Financing Activities Net in Cash Cash at Beginning of Year Cash at End of Year