Question: Statement of Cash Flows, Direct Method. Using the information from E6-7, compute net cash flow from operating activities for Tulsa Corporation under the direct

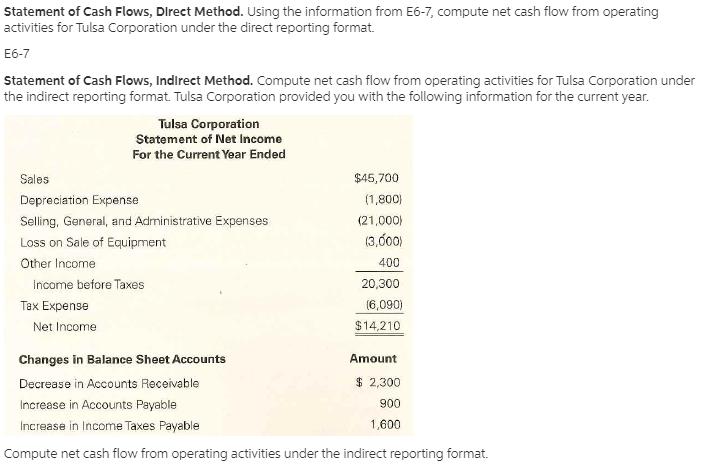

Statement of Cash Flows, Direct Method. Using the information from E6-7, compute net cash flow from operating activities for Tulsa Corporation under the direct reporting format. E6-7 Statement of Cash Flows, Indirect Method. Compute net cash flow from operating activities for Tulsa Corporation under the indirect reporting format. Tulsa Corporation provided you with the following information for the current year. Tulsa Corporation Statement of Net Income For the Current Year Ended Sales $45,700 Depreciation Expense (1,800) Selling, General, and Administrative Expenses (21,000) Loss on Sale of Equipment 3.00 Other Income 400 income before Taxes 20,300 Tax Expense (6,090) Net Income $14,210 Changes in Balance Sheet Accounts Amount Decrease in Accounts Receivable $ 2,300 Increase in Accounts Payable 900 Increase in Income Taxes Payable 1,600 Compute net cash flow from operating activities under the indirect reporting format.

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Net Cash Flow from Operating Activities using Direct Format 45700 2300 900 21000 4... View full answer

Get step-by-step solutions from verified subject matter experts