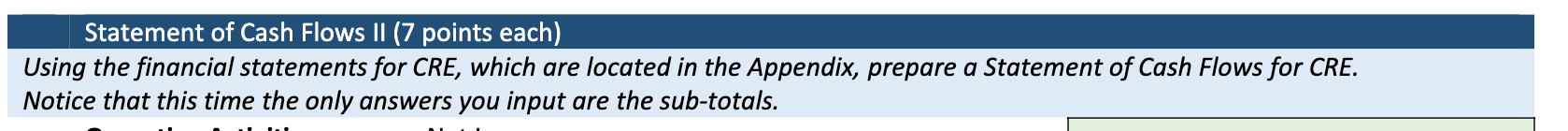

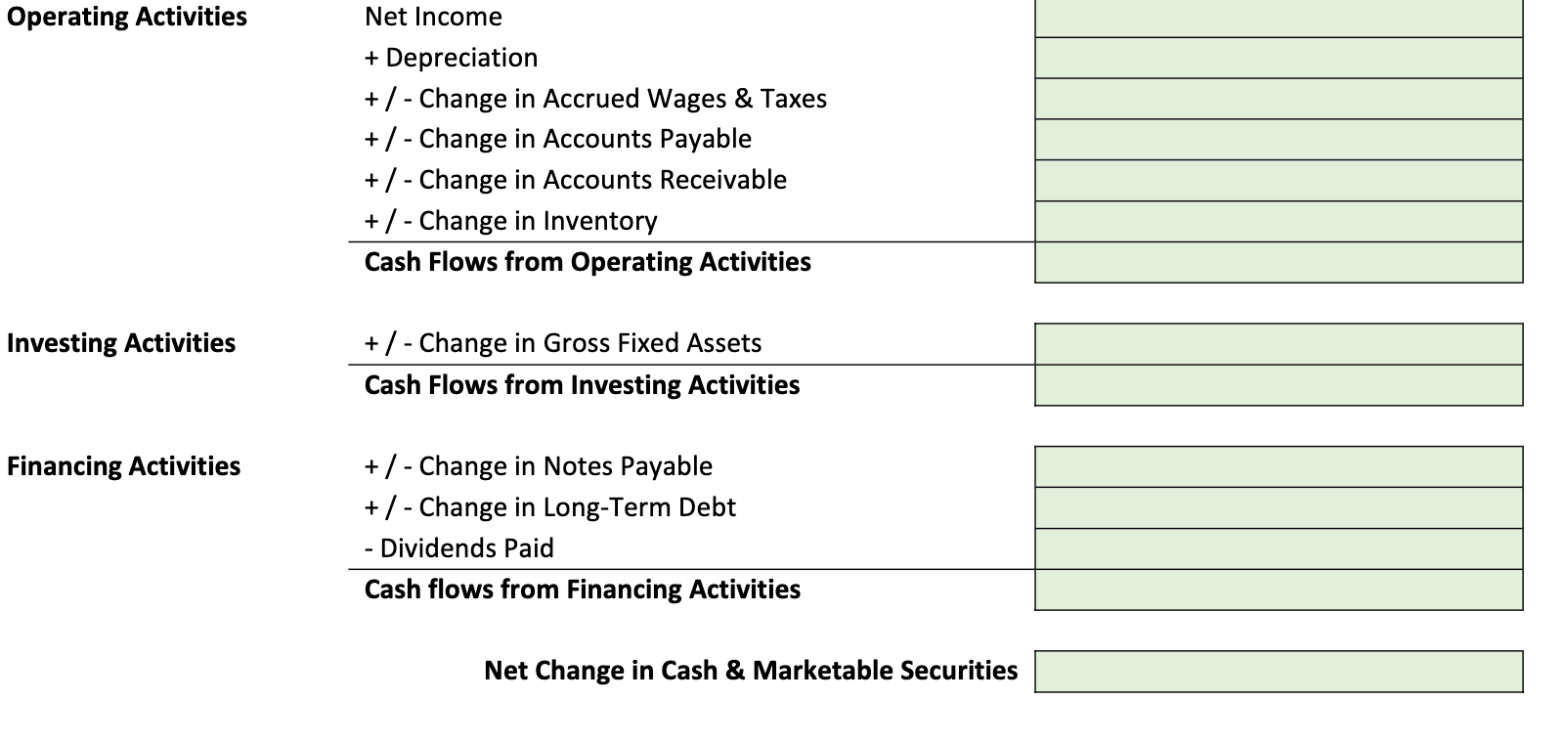

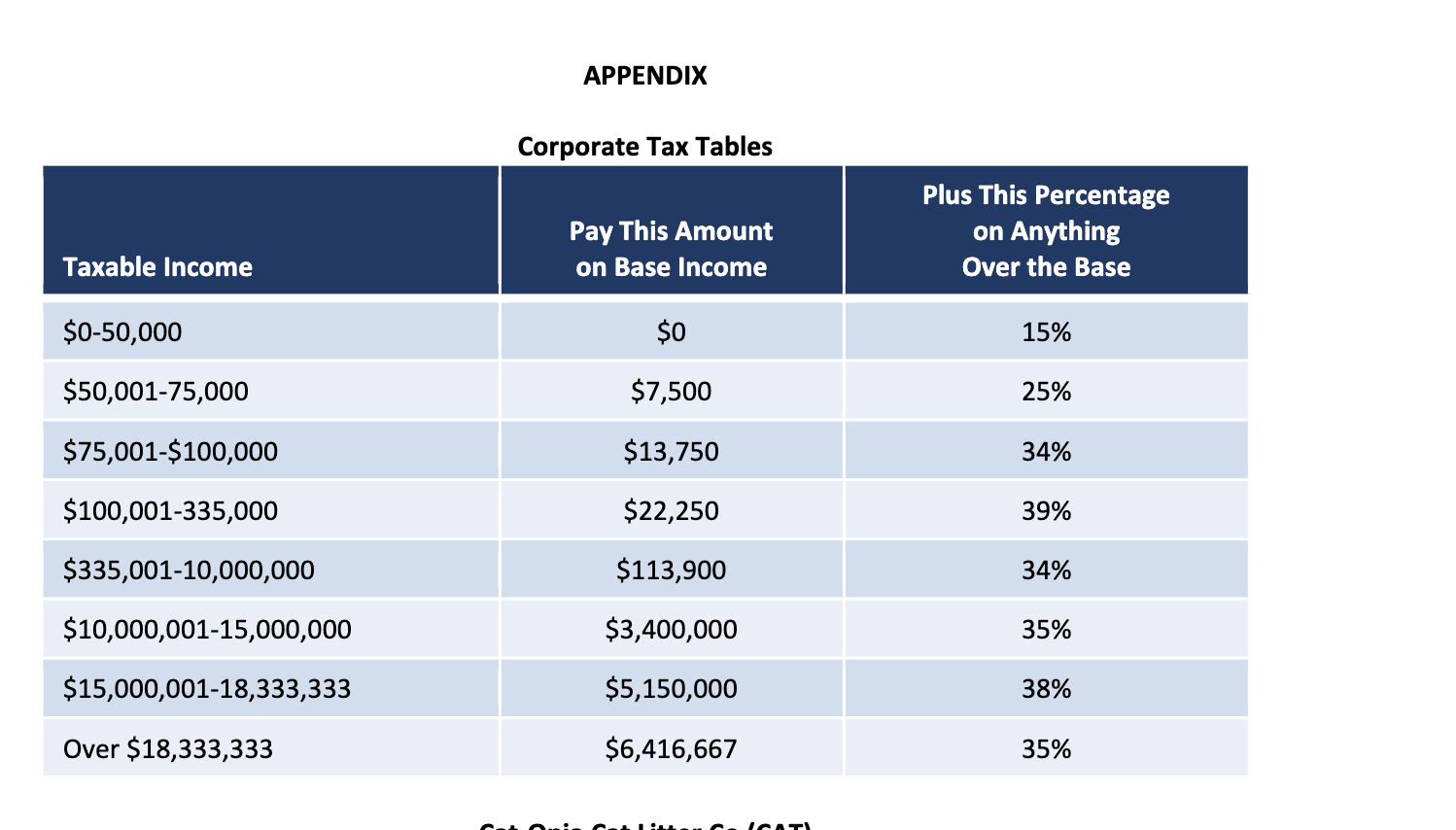

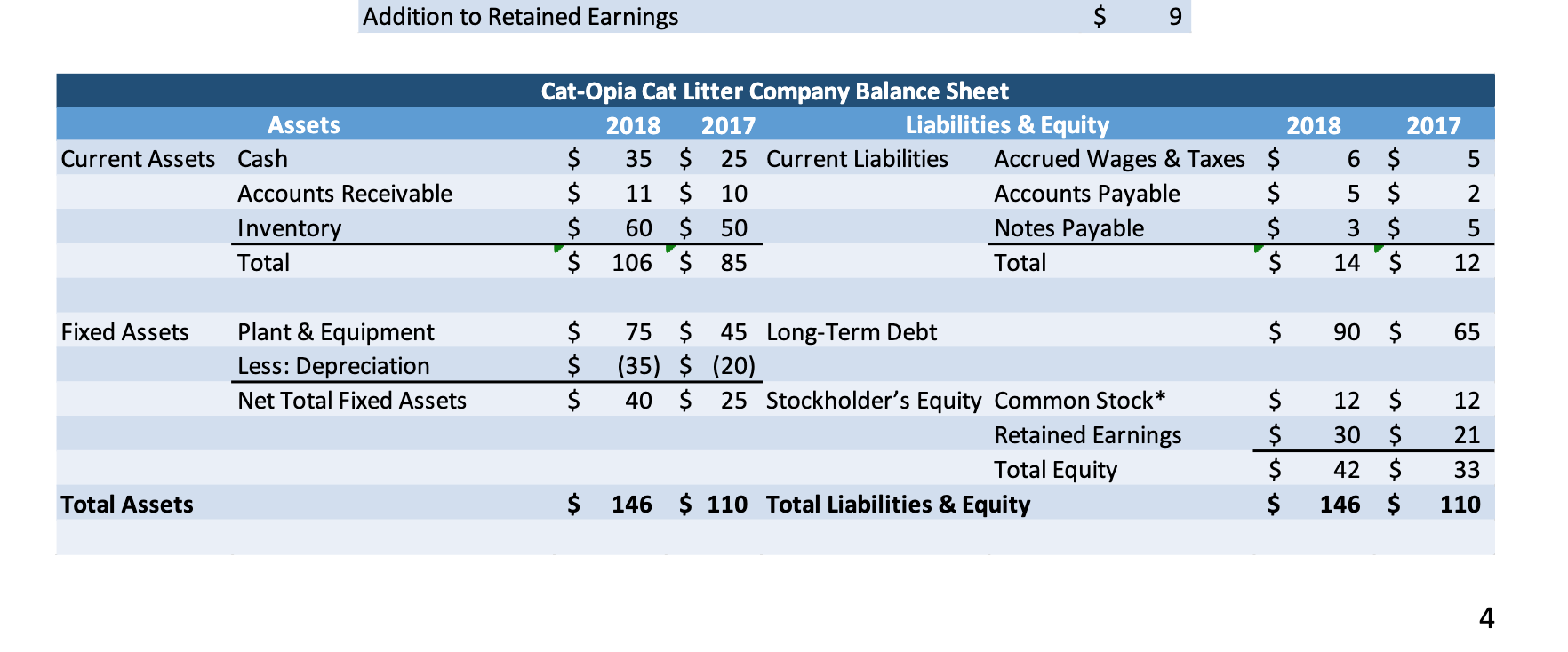

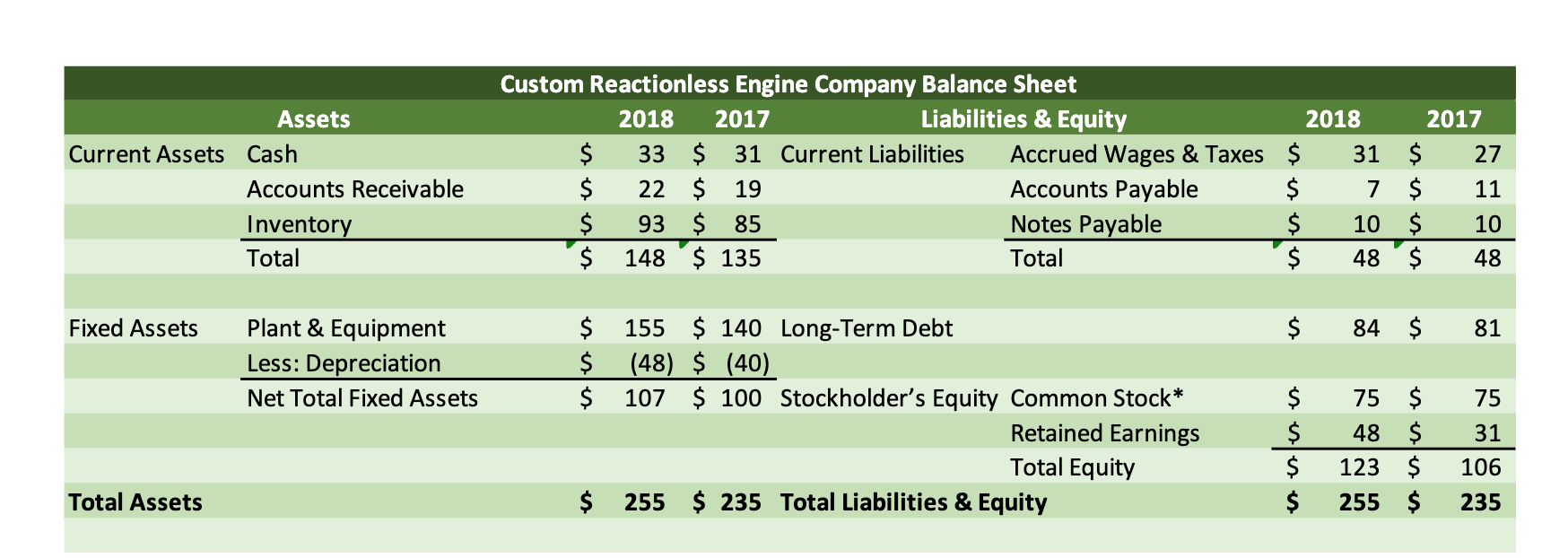

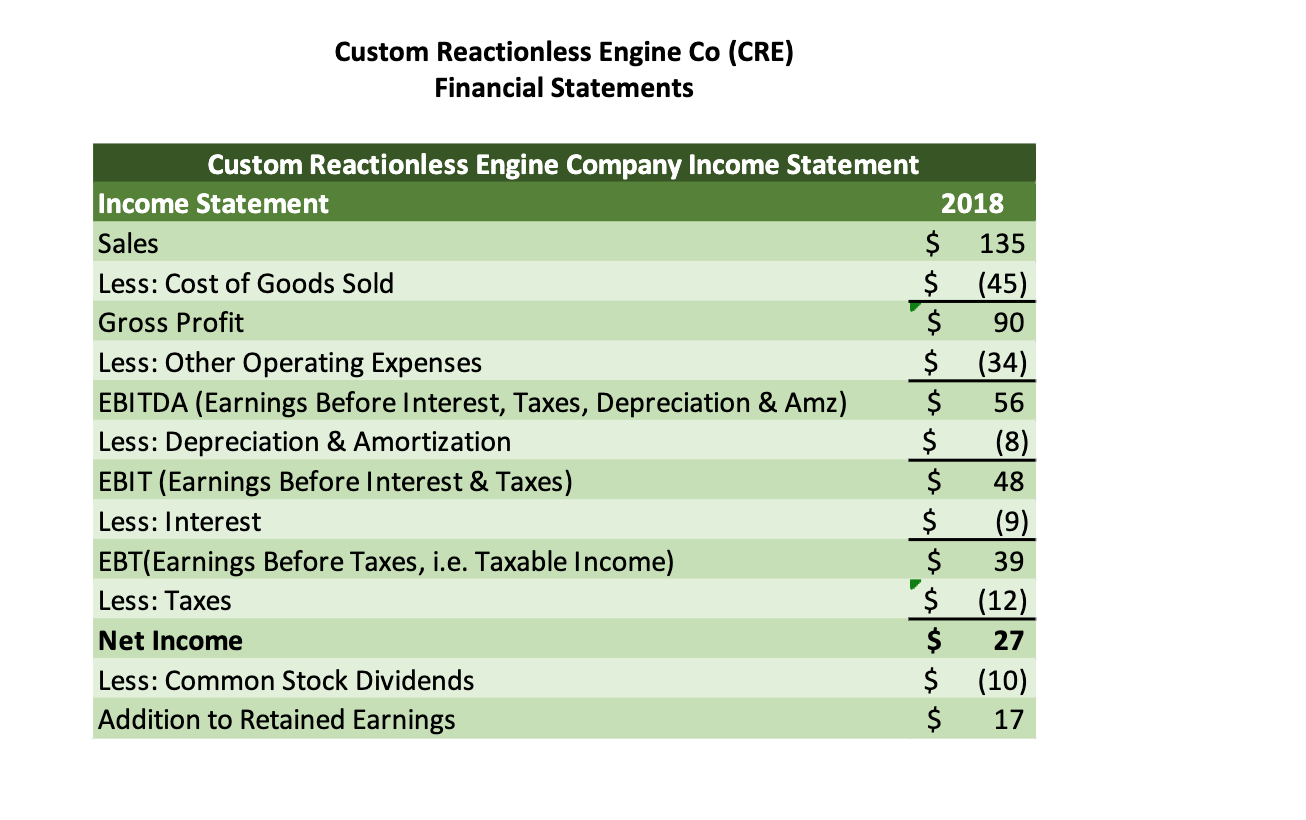

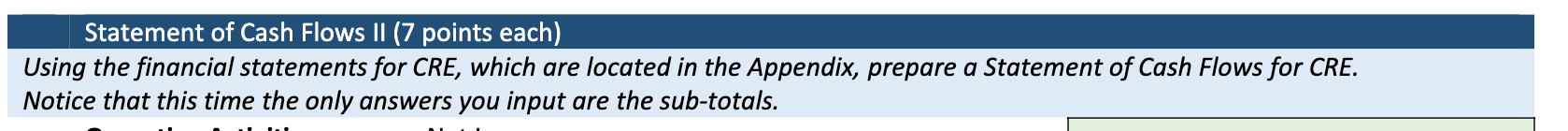

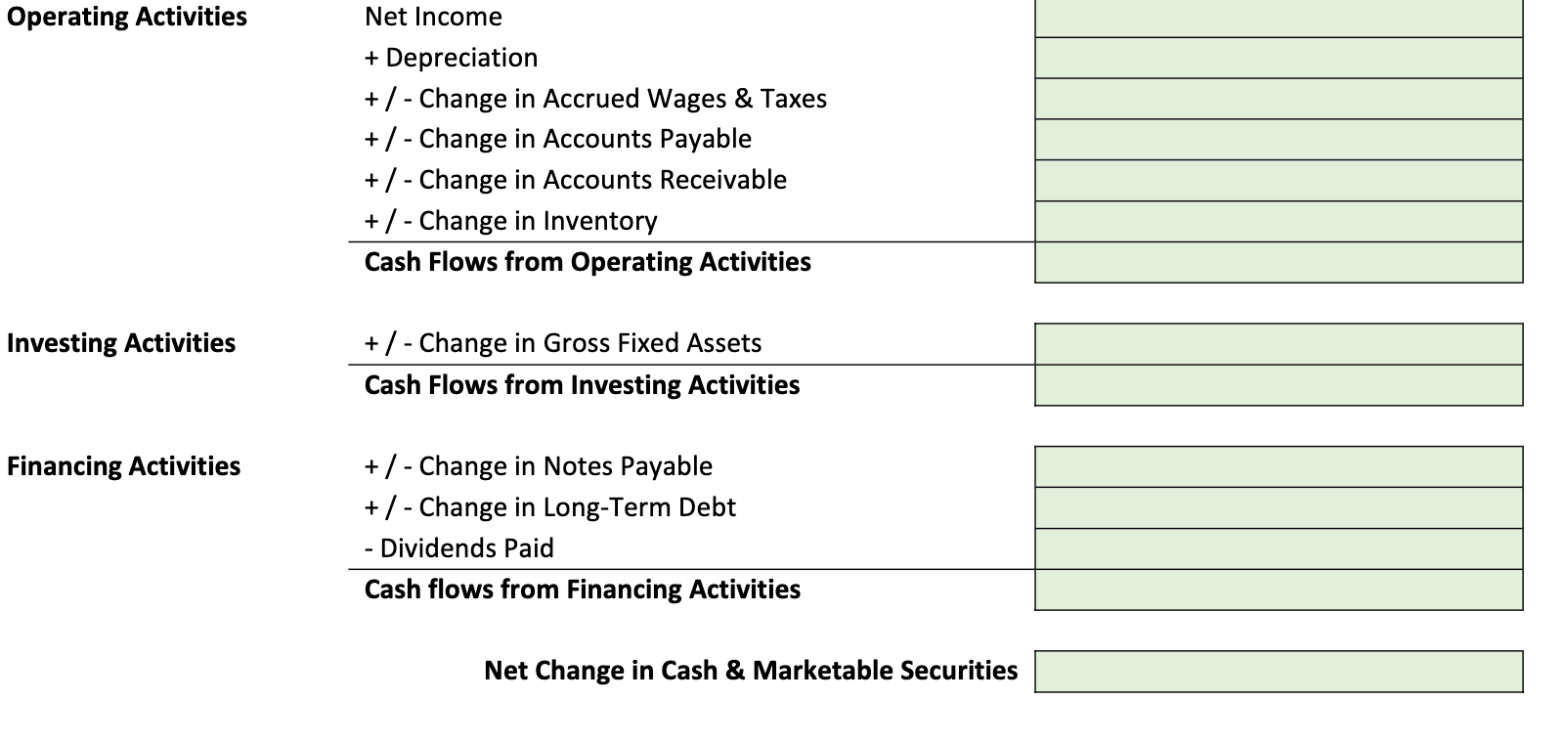

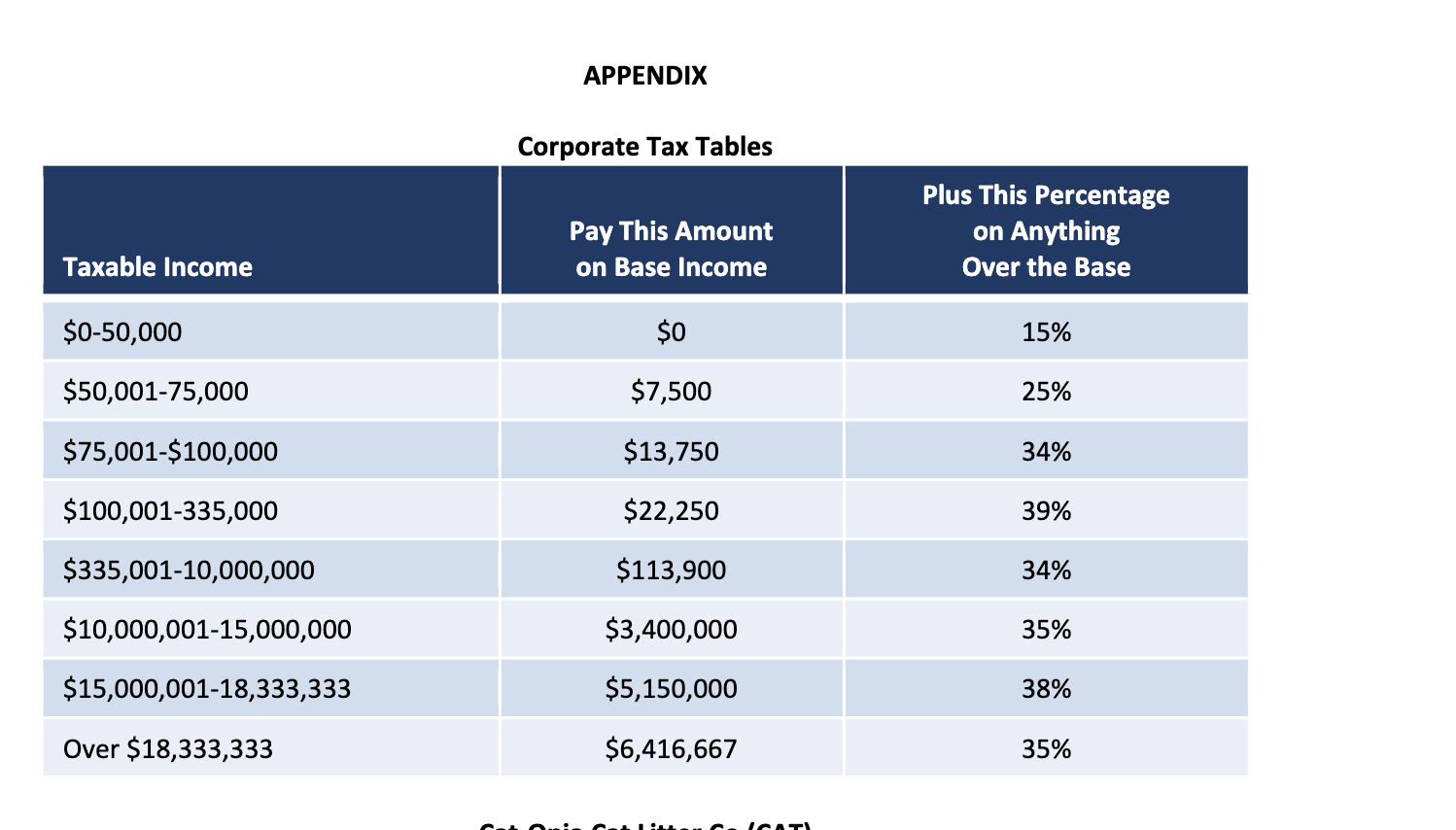

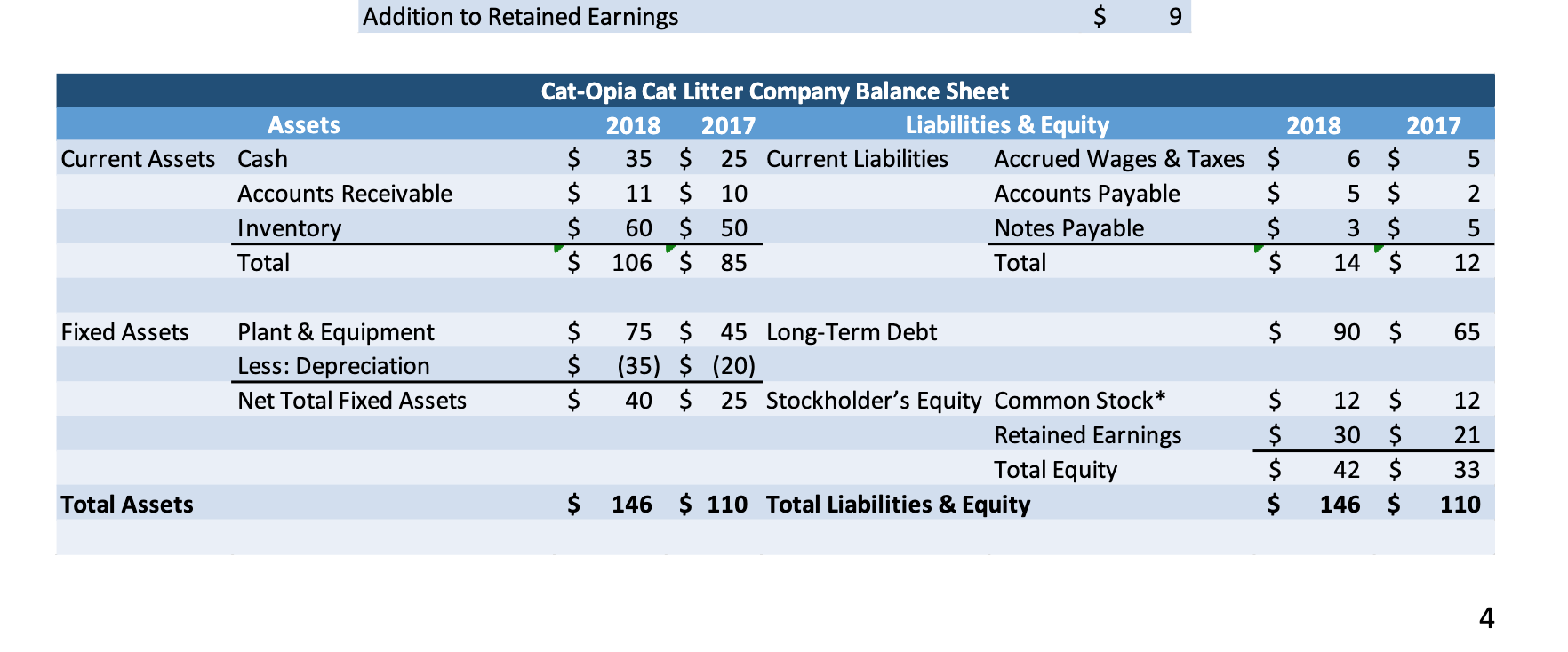

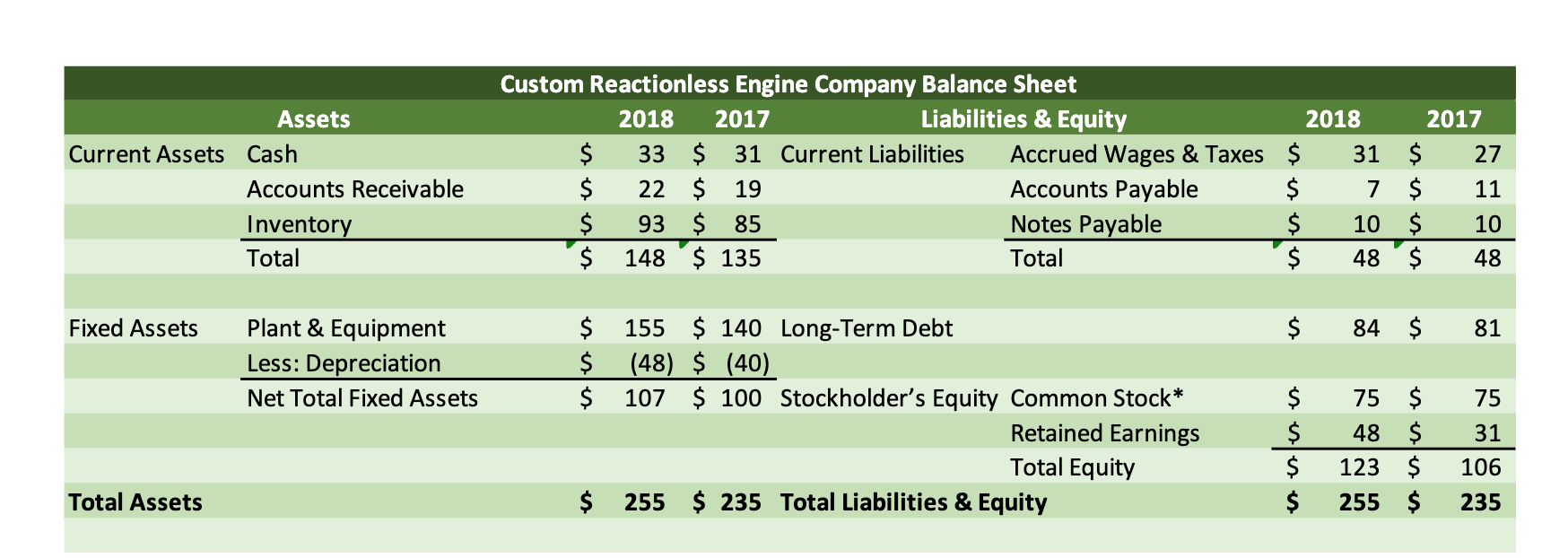

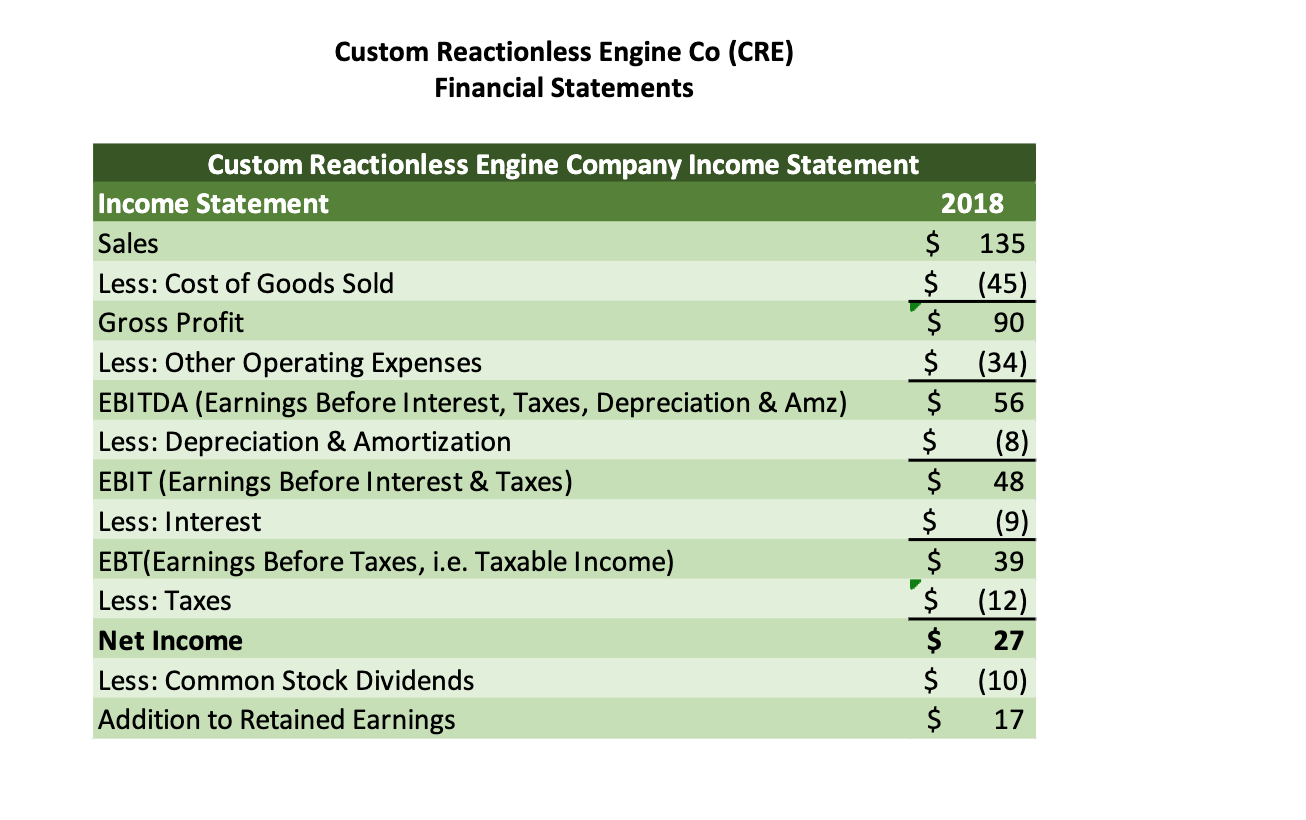

Statement of Cash Flows II (7 points each) Using the financial statements for CRE, which are located in the Appendix, prepare a Statement of Cash Flows for CRE. Notice that this time the only answers you input are the sub-totals. Operating Activities Net Income + Depreciation +/- Change in Accrued Wages & Taxes +/- Change in Accounts Payable + / - Change in Accounts Receivable + / - Change in Inventory Cash Flows from Operating Activities Investing Activities + / - Change in Gross Fixed Assets Cash Flows from Investing Activities Financing Activities +/- Change in Notes Payable +/- Change in Long-Term Debt - Dividends Paid Cash flows from Financing Activities Net Change in Cash & Marketable Securities APPENDIX Corporate Tax Tables Pay This Amount on Base Income Plus This Percentage on Anything Over the Base Taxable Income $0-50,000 $0 15% $50,001-75,000 $7,500 25% $75,001-$100,000 $13,750 34% $100,001-335,000 $22,250 39% $335,001-10,000,000 $113,900 34% $10,000,001-15,000,000 $3,400,000 35% $15,000,001-18,333,333 $5,150,000 38% Over $18,333,333 $6,416,667 35% CICATI Cat-Opia Cat Litter Co (CAT) Financial Statements (25) Cat-Opia Cat Litter Company Income Statement Income Statement Sales Less: Cost of Goods Sold Gross Profit Less: Other Operating Expenses EBITDA (Earnings Before Interest, Taxes, Depreciation & Amz) Less: Depreciation & Amortization EBIT (Earnings Before Interest & Taxes) Less: Interest EBT(Earnings Before Taxes, i.e. Taxable Income) Less: Taxes Net Income Less: Common Stock Dividends Addition to Retained Earnings 2018 $ 100 $ $ $ (15) $ $ (15) $ $ (25) $ : :0 $ $ $ Addition to Retained Earnings $ 9 Assets Current Assets Cash Accounts Receivable Inventory Total Cat-Opia Cat Litter Company Balance Sheet 2018 2017 Liabilities & Equity 2018 2017 $ 35 $ 25 Current Liabilities Accrued Wages & Taxes $ 6 $ 5 $ 11 $ 10 Accounts Payable $ 5 $ 2 $ 60 $ 50 Notes Payable $ 3 $ 5 $ 106 $ 85 Total $ 14 $ 12 Fixed Assets 90 $ 65 Plant & Equipment Less: Depreciation Net Total Fixed Assets $ $ $ 12 75 $ 45 Long-Term Debt (35) $ (20) 40 $ 25 Stockholder's Equity Common Stock* Retained Earnings Total Equity 146 $ 110 Total Liabilities & Equity 21 $ $ $ $ 12 $ 30 $ 42 $ 146 $ 33 Total Assets $ 110 4 Assets Current Assets Cash Accounts Receivable Inventory Total Custom Reactionless Engine Company Balance Sheet 2018 2017 Liabilities & Equity 2018 2017 $ 33 $ 31 Current Liabilities Accrued Wages & Taxes $ 31 $ 27 $ 22 $ 19 Accounts Payable $ 7 $ 11 $ 93 $ 85 Notes Payable $ 10 $ 10 $ 148 $ 135 Total $ 48 $ 48 Fixed Assets $ 84 $ 81 Plant & Equipment Less: Depreciation Net Total Fixed Assets 75 $ 155 $ 140 Long-Term Debt $ (48) $ (40) $ 107 $ 100 Stockholder's Equity Common Stock* Retained Earnings Total Equity $ 255 $ 235 Total Liabilities & Equity $ $ $ $ 75 $ 48 $ 123 $ 255 $ 31 106 Total Assets 235 Custom Reactionless Engine Co (CRE) Financial Statements Custom Reactionless Engine Company Income Statement Income Statement 2018 Sales $ 135 Less: Cost of Goods Sold $ (45) Gross Profit $ 90 Less: Other Operating Expenses $ (34) EBITDA (Earnings Before Interest, Taxes, Depreciation & Amz) $ 56 Less: Depreciation & Amortization $ (8) EBIT (Earnings Before Interest & Taxes) $ 48 Less: Interest $ (9) EBT(Earnings Before Taxes, i.e. Taxable Income) $ 39 Less: Taxes $ (12) Net Income $ 27 Less: Common Stock Dividends $ (10) Addition to Retained Earnings $ 17