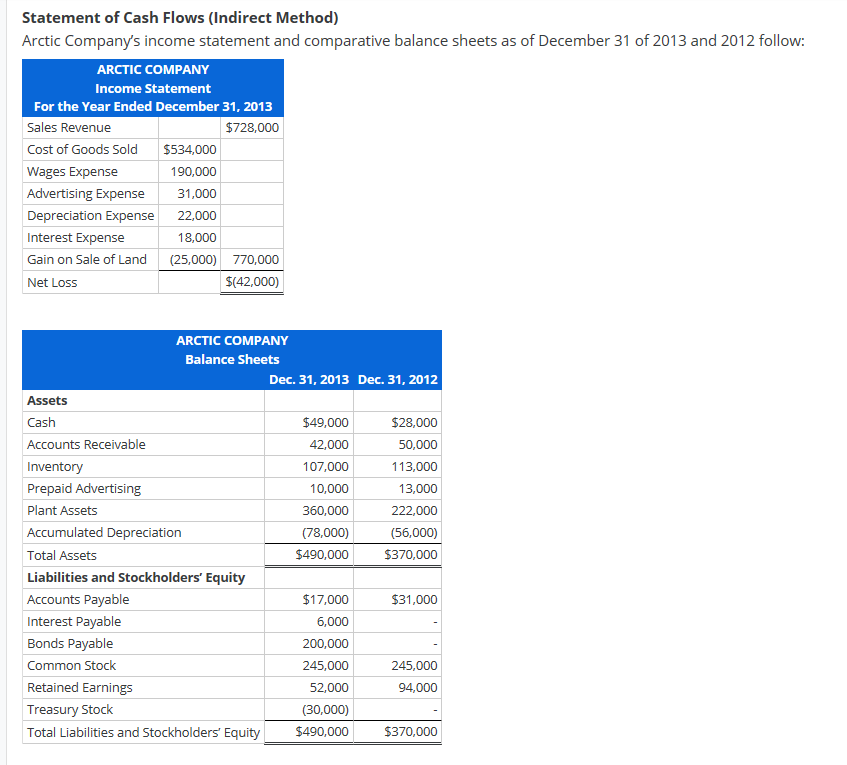

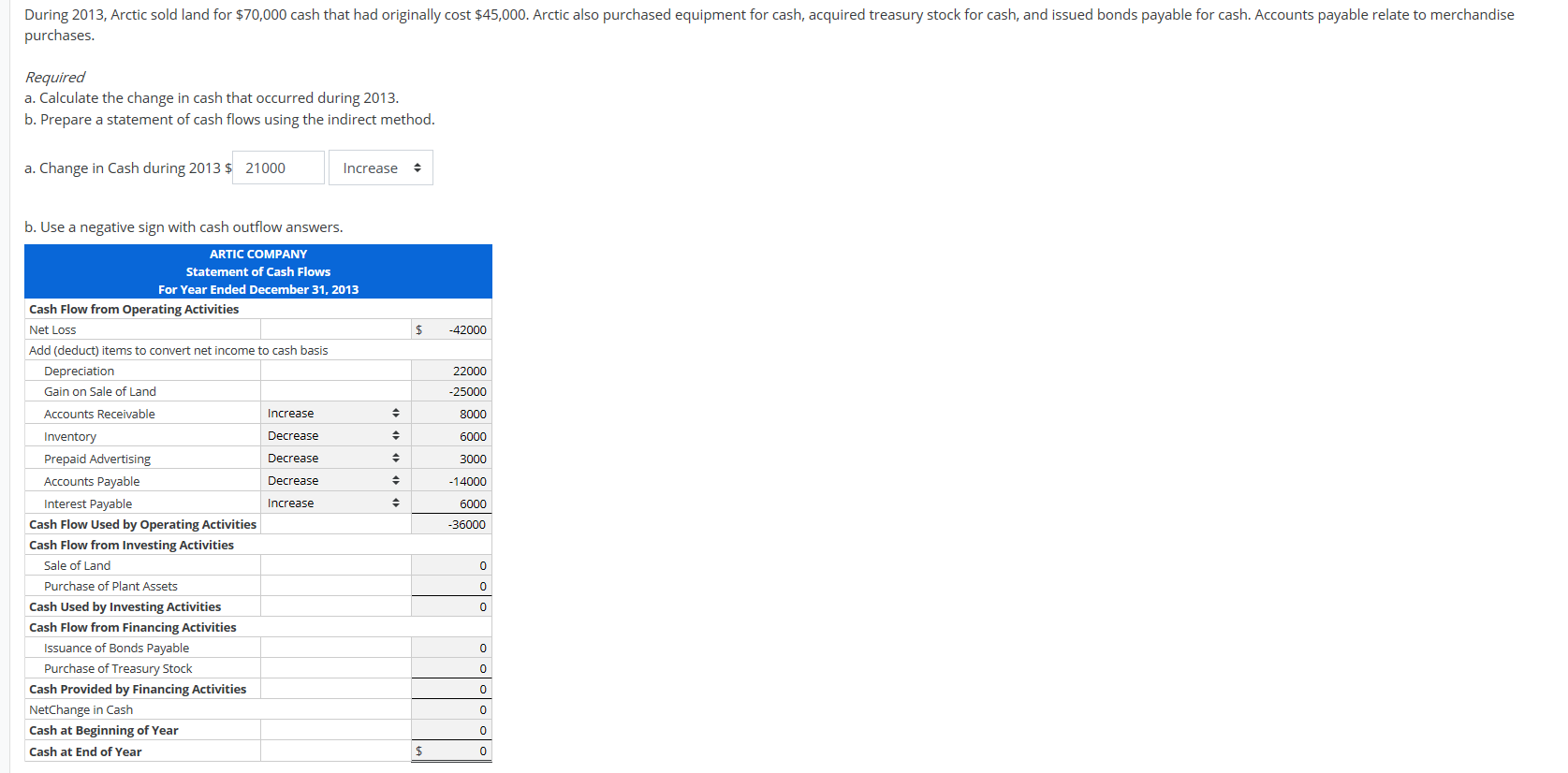

Statement of Cash Flows (Indirect Method) Arctic Company's income statement and comparative balance sheets as of December 31 of 2013 and 2012 follow: ARCTIC COMPANY Income Statement For the Year Ended December 31, 2013 Sales Revenue $728,000 Cost of Goods Sold $534,000 Wages Expense 190,000 Advertising Expense 31,000 Depreciation Expense 22,000 Interest Expense 18,000 Gain on Sale of Land (25,000) 770,000 Net Loss $(42,000) ARCTIC COMPANY Balance Sheets Dec. 31, 2013 Dec. 31, 2012 Assets Cash $49,000 $28,000 Accounts Receivable 42,000 50,000 Inventory 107,000 113,000 Prepaid Advertising 10,000 13,000 Plant Assets 360,000 222,000 Accumulated Depreciation (78,000) (56,000) Total Assets $490,000 $370,000 Liabilities and Stockholders' Equity Accounts Payable $17,000 $31,000 Interest Payable 6,000 Bonds Payable 200,000 Common Stock 245,000 245,000 Retained Earnings 52,000 94,000 Treasury Stock (30,000) Total Liabilities and Stockholders' Equity $490,000 $370,000 During 2013, Arctic sold land for $70,000 cash that had originally cost $45,000. Arctic also purchased equipment for cash, acquired treasury stock for cash, and issued bonds payable for cash. Accounts payable relate to merchandise purchases. Required a. Calculate the change in cash that occurred during 2013. b. Prepare a statement of cash flows using the indirect method. a. Change in Cash during 2013 $ 21000 Increase - b. Use a negative sign with cash outflow answers. -42000 22000 -25000 8000 6000 3000 ARTIC COMPANY Statement of Cash Flows For Year Ended December 31, 2013 Cash Flow from Operating Activities Net Loss Add (deduct) items to convert net income to cash basis Depreciation Gain on Sale of Land Accounts Receivable Increase Inventory Decrease Prepaid Advertising Decrease Accounts Payable Decrease Interest Payable Increase Cash Flow Used by Operating Activities Cash Flow from Investing Activities Sale of Land Purchase of Plant Assets Cash Used by Investing Activities Cash Flow from Financing Activities Issuance of Bonds Payable Purchase of Treasury Stock Cash Provided by Financing Activities NetChange in Cash Cash at Beginning of Year Cash at End of Year -14000 6000 -36000 oooo oo