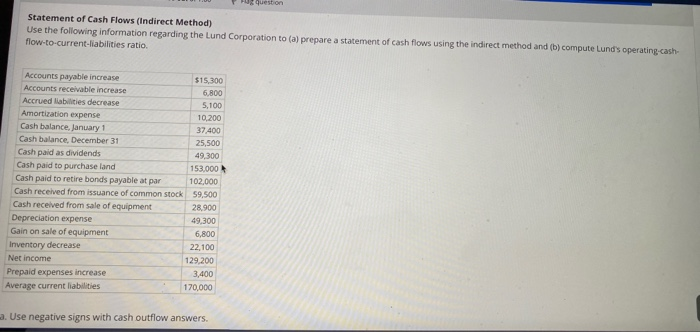

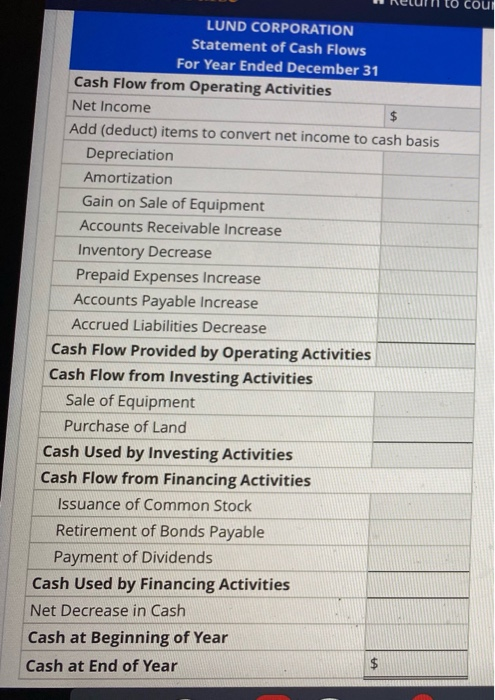

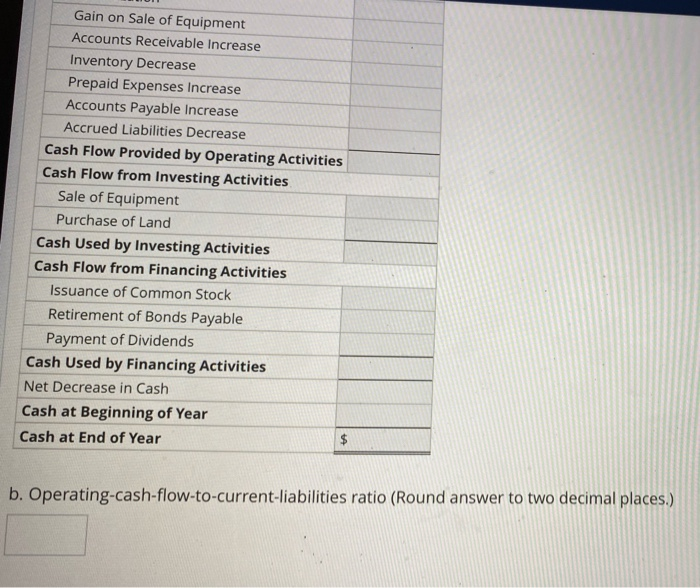

Statement of Cash Flows (Indirect Method) Use the following information regarding the Lund Corporation to (a) prepare a statement of cash flows using the indirect method and (b) compute Lund's operating-cash- flow-to-current liabilities ratio. Accounts payable increase Accounts receivable increase Accrued liabilities decrease Amortization expense Cash balance, January 1 Cash balance December 31 Cash paid as dividends Cash paid to purchase land Cash paid to retire bonds payable at par Cash received from issuance of common stock Cash received from sale of equipment Depreciation expense Gain on sale of equipment Inventory decrease Net income Prepaid expenses increase Average current liabilities $15.300 6.800 5,100 10.200 37.400 25.500 49,300 153,000 102.000 59,500 28.900 49,300 6.800 22,100 129.200 3,400 170,000 Use negative signs with cash outflow answers Relum to cour LUND CORPORATION Statement of Cash Flows For Year Ended December 31 Cash Flow from Operating Activities Net Income Add (deduct) items to convert net income to cash basis Depreciation Amortization Gain on Sale of Equipment Accounts Receivable Increase Inventory Decrease Prepaid Expenses Increase Accounts Payable Increase Accrued Liabilities Decrease Cash Flow Provided by Operating Activities Cash Flow from Investing Activities Sale of Equipment Purchase of Land Cash Used by Investing Activities Cash Flow from Financing Activities Issuance of Common Stock Retirement of Bonds Payable Payment of Dividends Cash Used by Financing Activities Net Decrease in Cash Cash at Beginning of Year Cash at End of Year Gain on Sale of Equipment Accounts Receivable Increase Inventory Decrease Prepaid Expenses Increase Accounts Payable Increase Accrued Liabilities Decrease Cash Flow Provided by Operating Activities Cash Flow from Investing Activities Sale of Equipment Purchase of Land Cash Used by Investing Activities Cash Flow from Financing Activities Issuance of Common Stock Retirement of Bonds Payable Payment of Dividends Cash Used by Financing Activities Net Decrease in Cash Cash at Beginning of Year Cash at End of Year b. Operating-cash-flow-to-current-liabilities ratio (Round answer to two decimal places.)