Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Statement of Cash Flows The comparative statements of financial position of Mikos Inc. as at December 31, 2017 and 2018, and its statement of earnings

Statement of Cash Flows

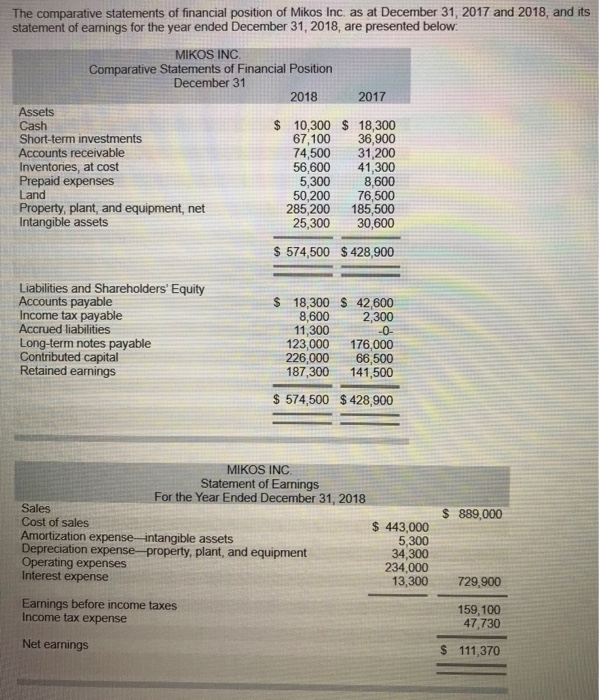

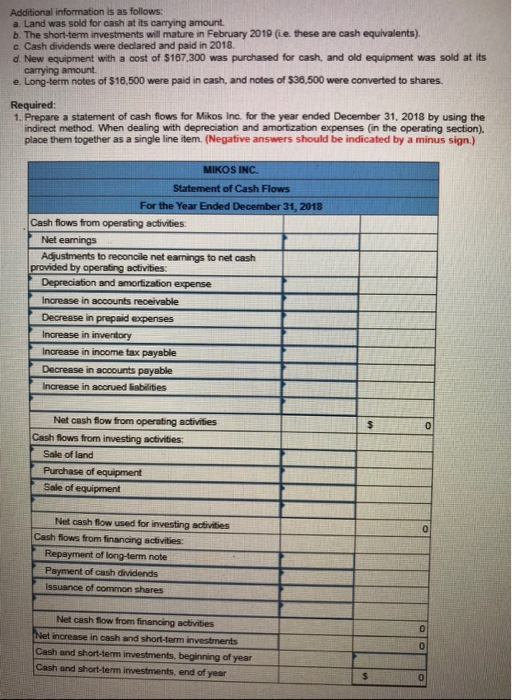

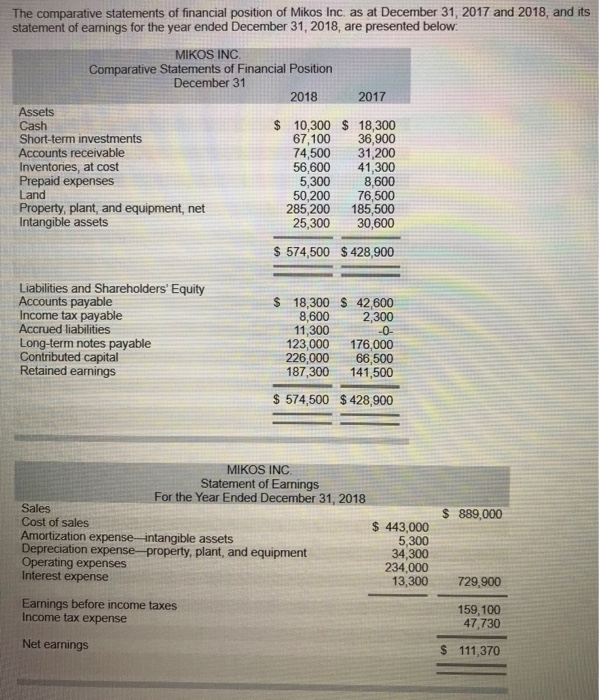

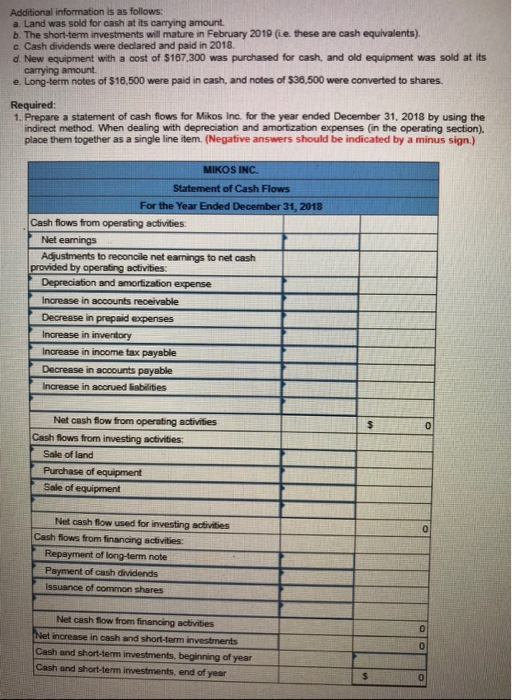

The comparative statements of financial position of Mikos Inc. as at December 31, 2017 and 2018, and its statement of earnings for the year ended December 31, 2018, are presented below! MIKOS INC Comparative Statements of Financial Position December 31 2018 2017 Assets Cash $ 10,300 $ 18,300 Short-term investments 67,100 36,900 Accounts receivable 74,500 31,200 Inventories, at cost 56,600 41,300 Prepaid expenses 5,300 8,600 Land 50,200 76,500 Property, plant, and equipment, net 285,200 185,500 Intangible assets 25,300 30,600 $ 574,500 $ 428,900 $ Liabilities and Shareholders' Equity Accounts payable Income tax payable Accrued liabilities Long-term notes payable Contributed capital Retained earnings 18,300 $ 42,600 8,600 2,300 11,300 -0- 123,000 176,000 226,000 66,500 187,300 141,500 $ 574,500 $ 428,900 MIKOS INC Statement of Earnings For the Year Ended December 31, 2018 Sales Cost of sales Amortization expense intangible assets Depreciation expense property, plant, and equipment Operating expenses Interest expense $ 889,000 $ 443,000 5,300 34,300 234,000 13,300 729,900 Earnings before income taxes Income tax expense 159,100 47,730 Net earnings $ 111,370 Additional information is as follows: a Land was sold for cash at its carrying amount b. The short-term investments will mature in February 2019 (ie these are cash equivalents). Cash dividends were declared and paid in 2018 d. New equipment with a cost of $107.300 was purchased for cash and old equipment was sold at its carrying amount e. Long-term notes of $16,500 were paid in cash, and notes of $36,500 were converted to shares. Required: 1. Prepare a statement of cash flows for Mikos Inc. for the year ended December 31, 2018 by using the indirect method. When dealing with depreciation and amortization expenses in the operating section). place them together as a single line item. (Negative answers should be indicated by a minus sign.) MIKOS INC Statement of Cash Flows For the Year Ended December 31, 2018 Cash flows from operating activities Net earnings Adjustments to reconcile net earings to net cash provided by operating activities Depreciation and amortization expense Increase in accounts receivable Decrease in prepaid expenses Increase in inventory Increase in income tax payable Decrease in accounts payable Increase in accrued liabilities Net cash flow from operating activities Cash flows from investing activities: Sale of land Purchase of equipment Sale of equipment Net cash flow used for investing activities Cash flows from financing activities: Repayment of long-term note Payment of cash dividends Issuance of common shares Net cash flow from financing activities Net increase in cash and short-term investments Cash and short-term investments, beginning of year Cash and short-term investments, end of year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started