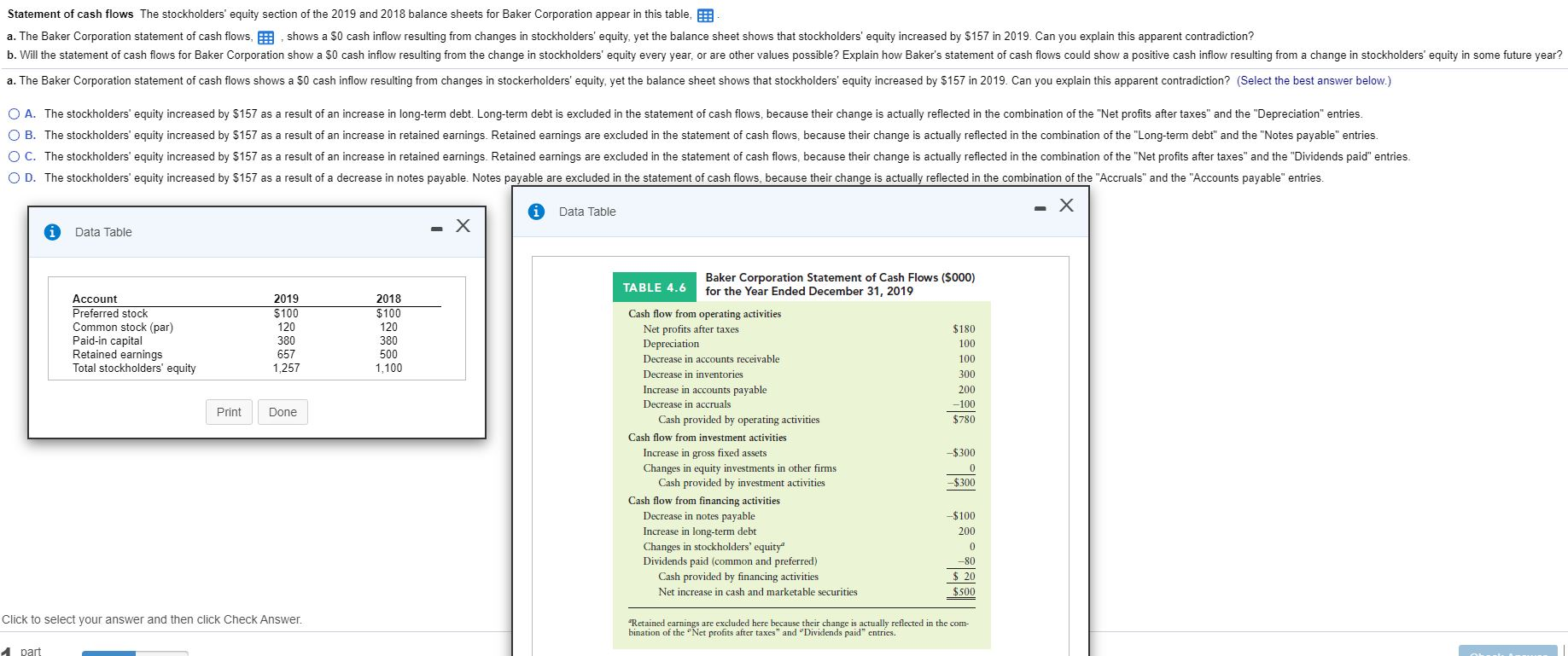

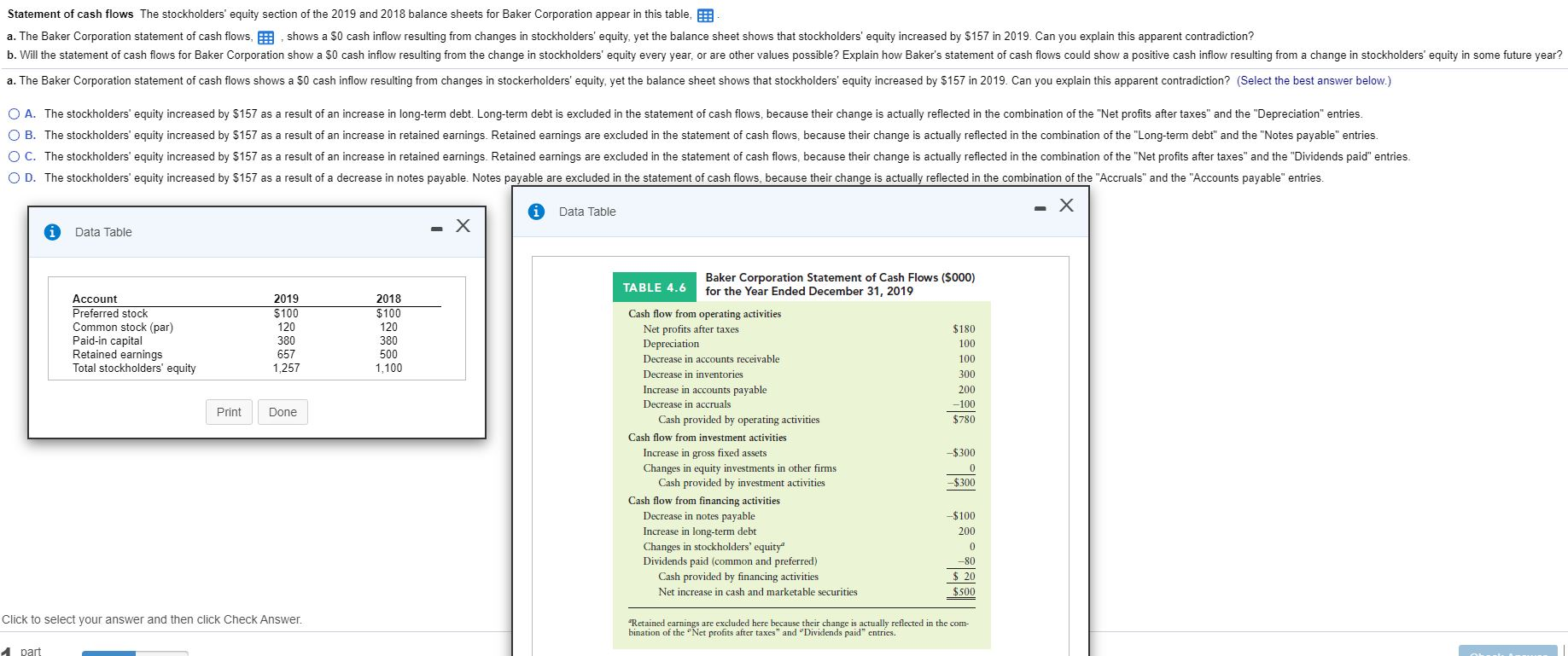

Statement of cash flows The stockholders' equity section of the 2019 and 2018 balance sheets for Baker Corporation appear in this table, a. The Baker Corporation statement of cash flows, shows a $0 cash inflow resulting from changes in stockholders' equity, yet the balance sheet shows that stockholders' equity increased by $157 in 2019. Can you explain this apparent contradiction? b. Will the statement of cash flows for Baker Corporation show a $0 cash inflow resulting from the change in stockholders' equity every year, or are other values possible? Explain how Baker's statement of cash flows could show a positive cash inflow resulting from a change in stockholders' equity in some future year? a. The Baker Corporation statement of cash flows shows a $0 cash inflow resulting from changes in stockerholders' equity, yet the balance sheet shows that stockholders' equity increased by $157 in 2019. Can you explain this apparent contradiction? (Select the best answer below.) O A. The stockholders' equity increased by $157 as a result of an increase in long-term debt. Long-term debt is excluded in the statement of cash flows, because their change is actually reflected in the combination of the "Net profits after taxes" and the "Depreciation" entries. OB. The stockholders' equity increased by $157 as a result of an increase in retained earnings. Retained earnings are excluded in the statement of cash flows, because their change is actually reflected in the combination of the "Long-term debt" and the "Notes payable" entries. O C. The stockholders' equity increased by $157 as a result of an increase in retained earnings. Retained earnings are excluded in the statement of cash flows, because their change is actually reflected in the combination of the "Net profits after taxes" and the "Dividends paid" entries. OD. The stockholders' equity increased by $157 as a result of a decrease in notes payable. Notes payable are excluded in the statement of cash flows, because their change is actually reflected in the combination of the "Accruals" and the "Accounts payable" entries. A Data Table - X Data Table - X TABLE 4.6 Baker Corporation Statement of Cash Flows (5000) for the Year Ended December 31, 2019 Account Preferred stock Common stock (par) Paid-in capital Retained earnings Total stockholders' equity 2019 $100 120 380 2018 $100 120 380 500 1,100 657 $180 100 100 300 200 1,257 100 Print Done $780 Cash flow from operating activities Net profits after taxes Depreciation Decrease in accounts receivable Decrease in inventories Increase in accounts payable Decrease in accruals Cash provided by operating activities Cash flow from investment activities Increase in gross fixed assets Changes in equity investments in other firms Cash provided by investment activities Cash flow from financing activities Decrease in notes payable Increase in long-term debt Changes in stockholders' equity Dividends paid (common and preferred) Cash provided by financing activities Net increase in cash and marketable securities $300 -$300 -$100 200 -80 S500 Click to select your answer and then click Check Answer. "Retained earnings are excluded here because their change is actually reflected in the com- bination of the "Net profits after taxes" and "Dividends paid" entries. 4 part