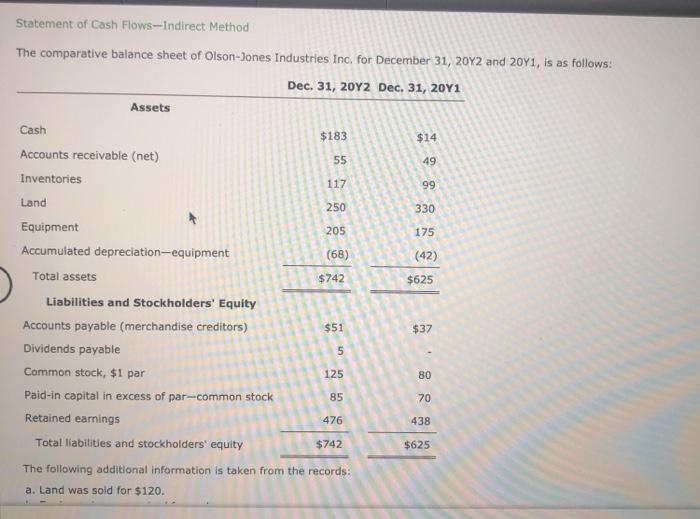

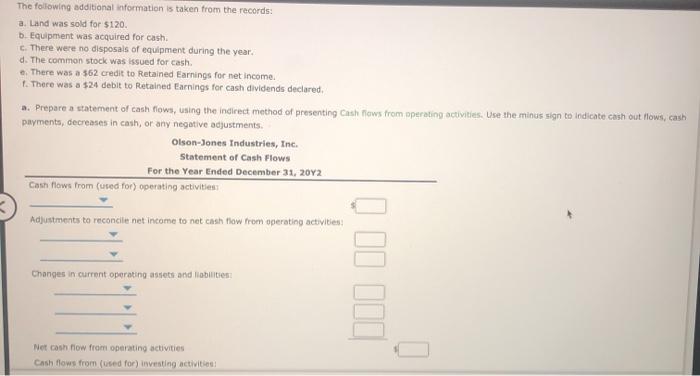

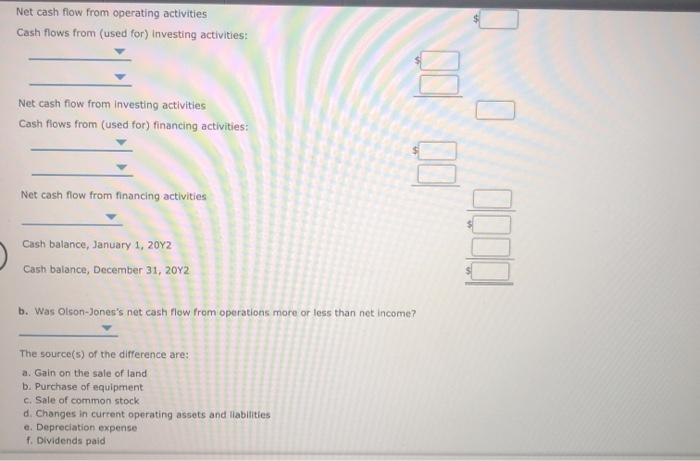

Statement of Cash Flows-Indirect Method The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 2041, is as follows: Dec 31, 2012 Dec. 31, 2011 Assets Cash $183 $14 55 49 117 99 250 330 205 175 (68) (42) $742 $625 Accounts receivable (net) Inventories Land Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Dividends payable Common stock, $1 par Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $51 $37 5 125 80 85 70 476 438 $742 $625 The following additional information is taken from the records: a. Land was sold for $120. The following additional information is taken from the records: a. Land was sold for $120. b. Equipment was acquired for cash c. There were no disposals of equipment during the year. d. The common stock was issued for cash. a. There was a $62 credit to Retained Earnings for net income 1. There was a $24 debit to retained Earnings for cash dividends declared. m. Prepare a statement of cash flows, using the Indirect method of presenting Cash Flows from operating activities. Use the minus sign to indicate cash out hows, cash payments, decreases in cath, or any negative adjustments. Olson-Jones Industries, Inc. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from (used for) operating activities Adjustments to reconcile net income to net cash flow from operating activities Changes in current operating assets and liabilities Net cash flow from operating activities Cash flows from used for investing activities o Net cash flow from operating activities Cash flows from (used for) Investing activities: Net cash flow from investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash balance, January 1, 2012 Cash balance, December 31, 2012 b. Was Olson-Jones's net cash flow from operations more or less than net income? The source(s) of the difference are: a. Gain on the sale of land b. Purchase of equipment c. Sale of common stock d. Changes in current operating assets and liabilities e. Depreciation expense 1. Dividends paid