Question

Statement of Cash FlowsIndirect Method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31,

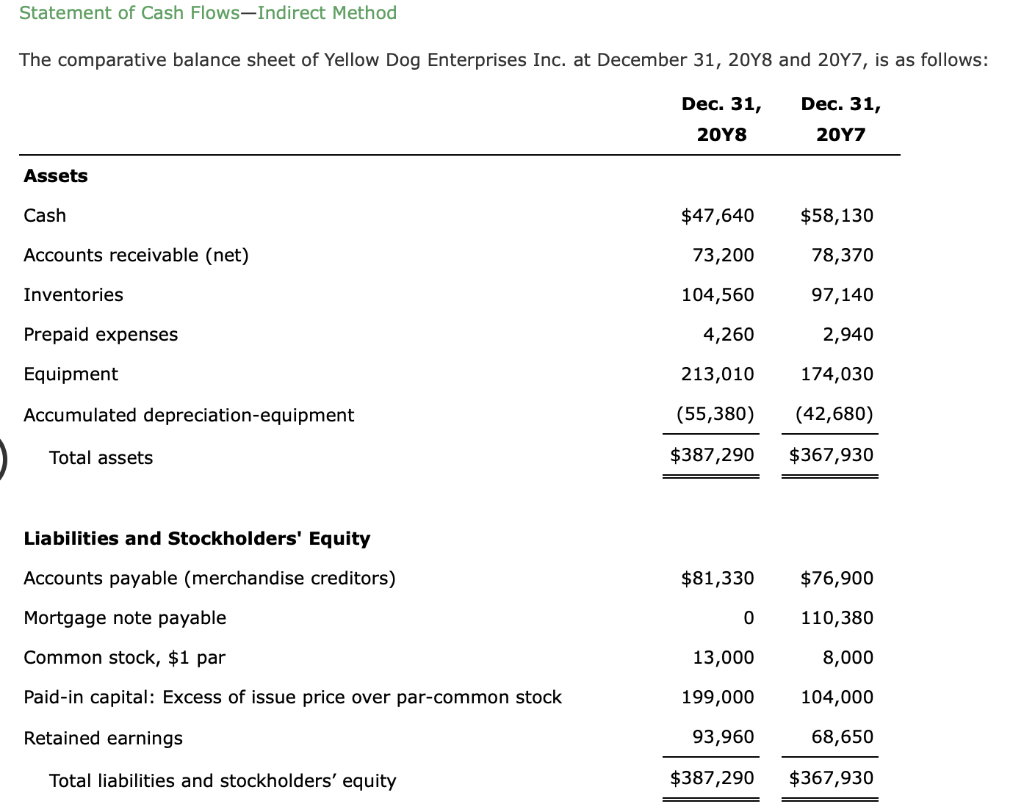

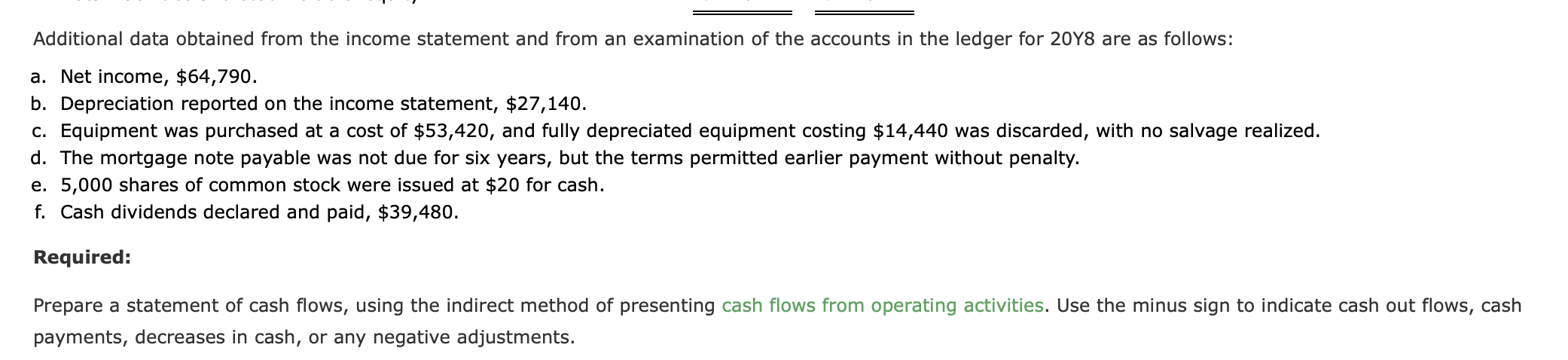

Statement of Cash FlowsIndirect Method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31, 20Y8 Dec. 31, 20Y7 Assets Cash $47,640 $58,130 Accounts receivable (net) 73,200 78,370 Inventories 104,560 97,140 Prepaid expenses 4,260 2,940 Equipment 213,010 174,030 Accumulated depreciation-equipment (55,380) (42,680) Total assets $387,290 $367,930 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $81,330 $76,900 Mortgage note payable 0 110,380 Common stock, $1 par 13,000 8,000 Paid-in capital: Excess of issue price over par-common stock 199,000 104,000 Retained earnings 93,960 68,650 Total liabilities and stockholders equity $387,290 $367,930

Statement of Cash FlowsIndirect Method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31, 20Y8 Dec. 31, 20Y7 Assets Cash $47,640 $58,130 Accounts receivable (net) 73,200 78,370 Inventories 104,560 97,140 Prepaid expenses 4,260 2,940 Equipment 213,010 174,030 Accumulated depreciation-equipment (55,380) (42,680) Total assets $387,290 $367,930 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $81,330 $76,900 Mortgage note payable 0 110,380 Common stock, $1 par 13,000 8,000 Paid-in capital: Excess of issue price over par-common stock 199,000 104,000 Retained earnings 93,960 68,650 Total liabilities and stockholders equity $387,290 $367,930

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started