Answered step by step

Verified Expert Solution

Question

1 Approved Answer

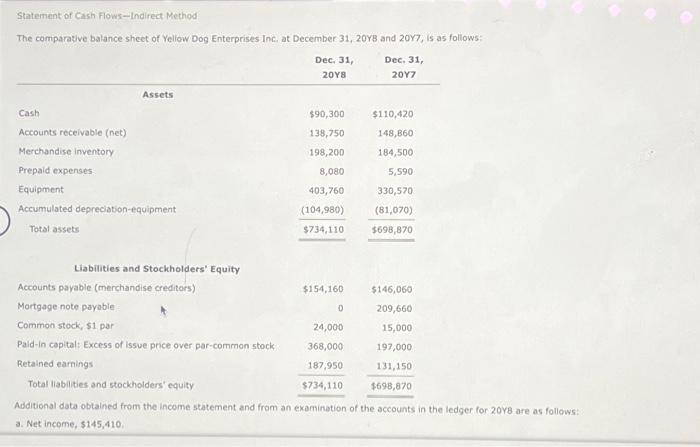

Statement of Cash Flows-Indirect Method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31,

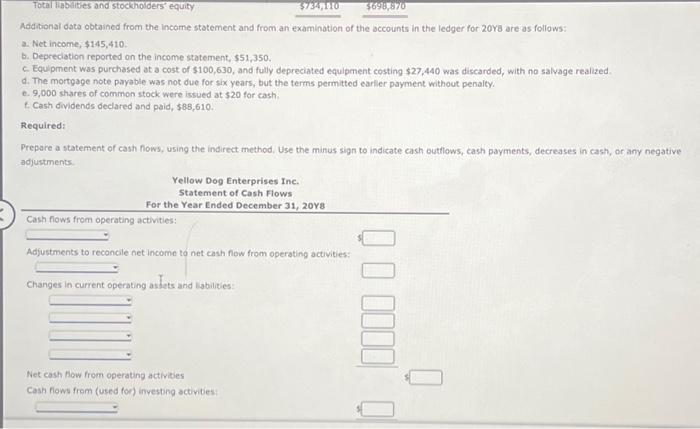

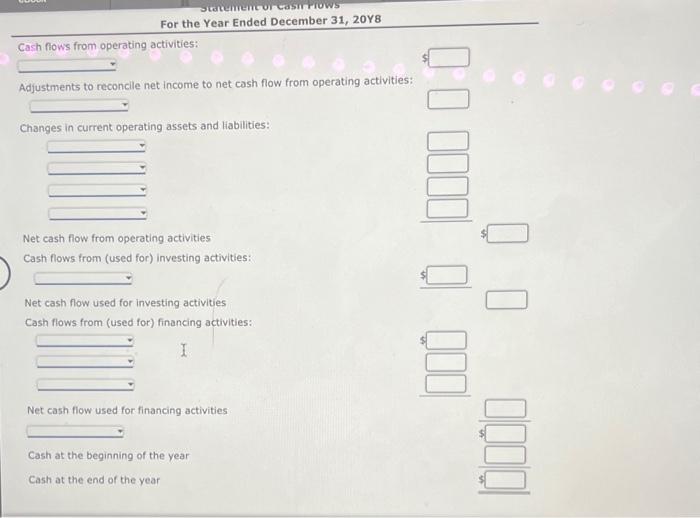

Statement of Cash Flows-Indirect Method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31, 20Y8 Dec. 31, 20Y7 Cash Assets Accounts receivable (net) Merchandise inventory Prepaid expenses Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Mortgage note payable Common stock, $1 par Paid-in capital: Excess of issue price over par-common stock Retained earnings Total liabilities and stockholders' equity $90,300 138,750 198,200 8,080 403,760 (104,980) $734,110 $154,160 0 24,000 368,000 187,950 $734,110 $110,420 148,860 184,500 5,590 330,570 (81,070) $698,870 $146,060 209,660 15,000 197,000 131,150 $698,870 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $145,410.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started