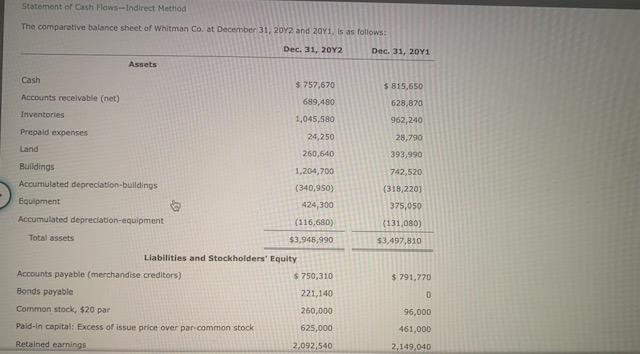

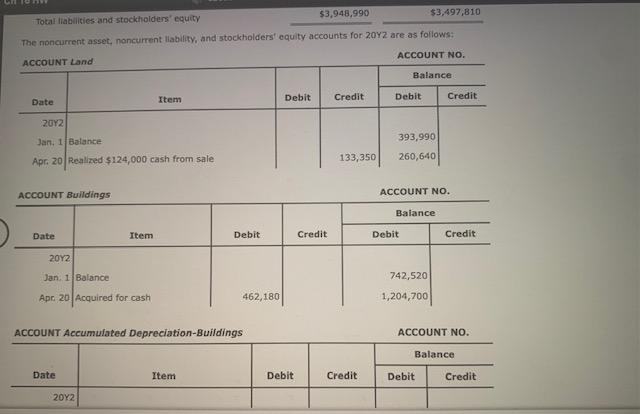

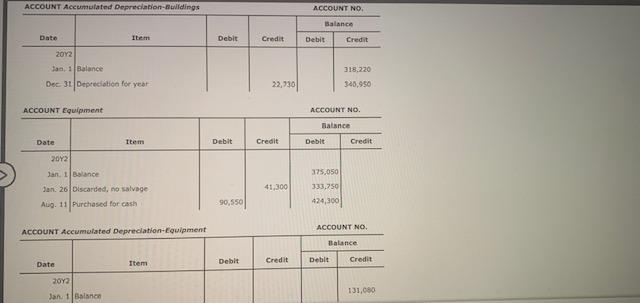

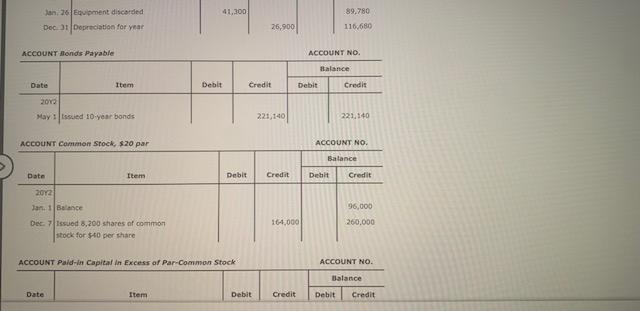

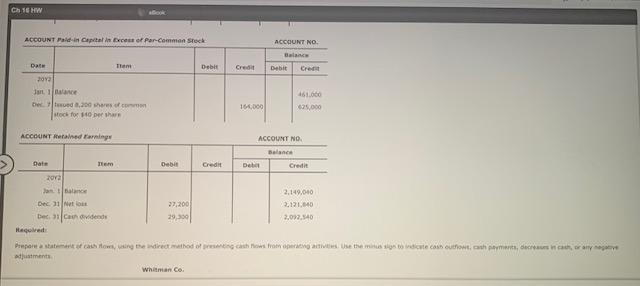

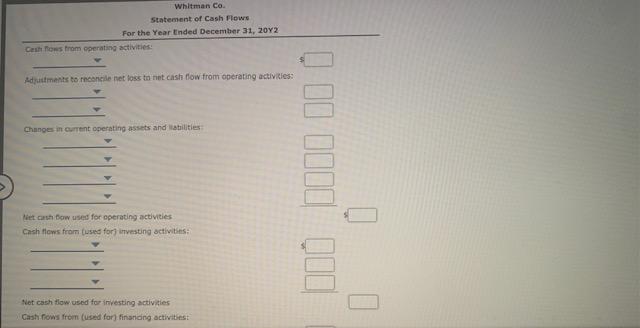

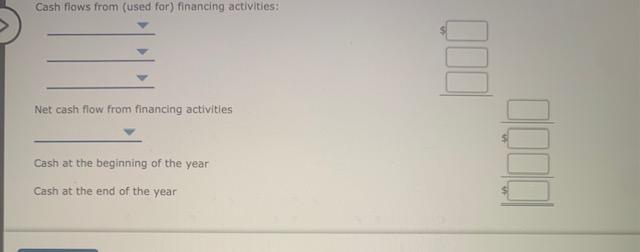

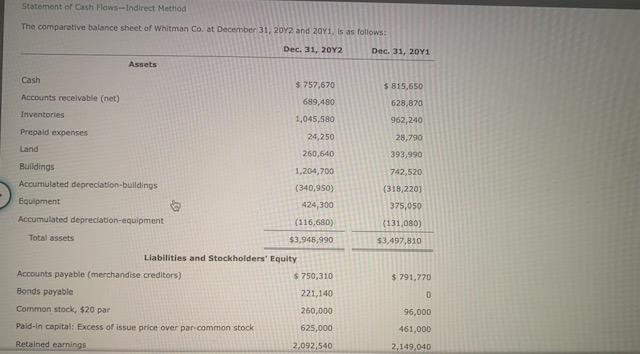

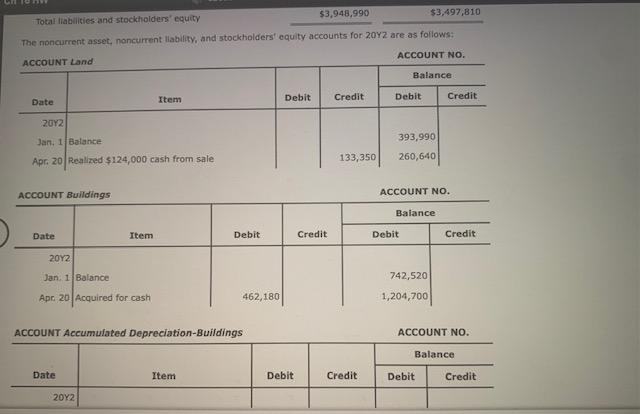

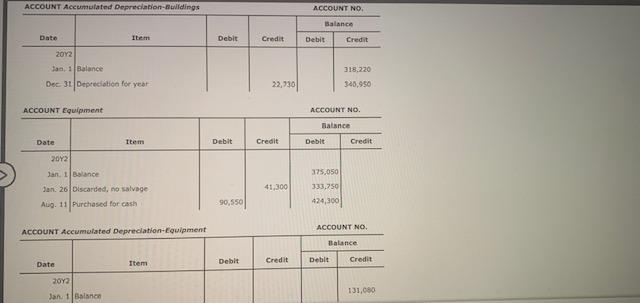

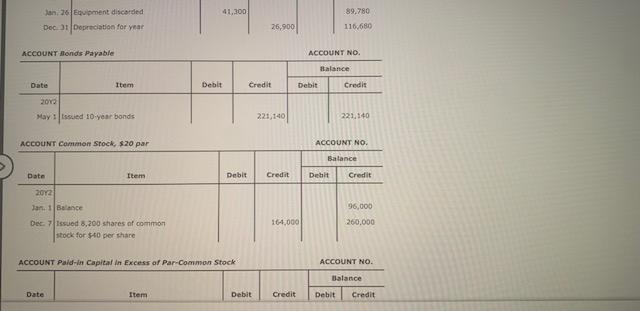

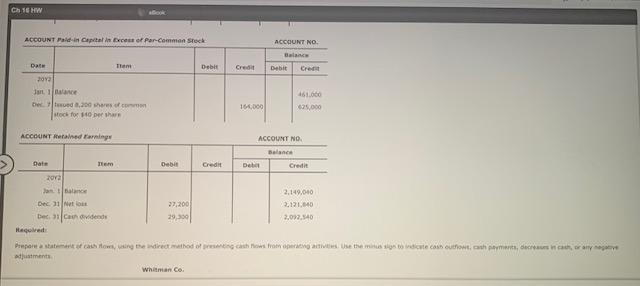

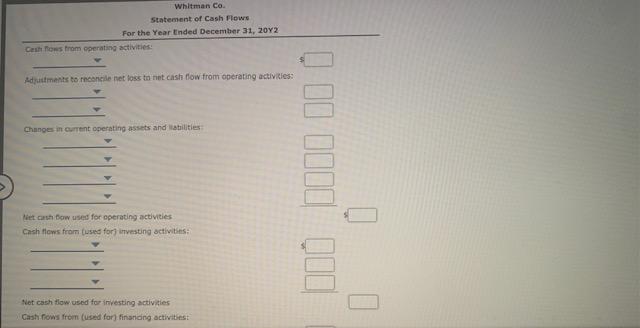

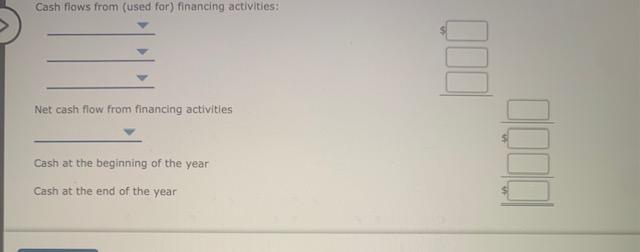

Statement of Cash Flows-Indirect Method The comparative balance sheet of Whitman Co. at December 31, 2012 and 2041, is as follows: Dec 31, 2012 Dec 31, 2011 5 815,650 628,870 962,240 28,790 393,990 Assets Cash $757,670 Accounts receivable (net) 689,480 Inventories 1,045,580 Prepaid expenses 24,250 Land 260,640 Buildings 1,204,700 Accumulated depreciation buildings (340,950) Equipment & 424,300 Accumulated depreciation-equipment (116,680) Total assets $3,945,990 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $750,310 Bonds payable 221.140 Common stock, $20 par 260,000 Pald-in capital: Excess of issue price over par common stock 625,000 Retained earnings 2.092,540 742,520 (318,220) 375,050 (131,080) $3,497,810 $ 791,770 0 96,000 461,000 2,149,040 $3,948,990 $3,497,810 Total liabilities and stockholders' equity The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 2012 are as follows: ACCOUNT NO. ACCOUNT Land Balance Item Debit Credit Date Debit Credit 2012 393,990 Jan, 1 Balance Apr. 20 Realized $124,000 cash from sale 133,350 260,640 ACCOUNT Buildings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. 1 Balance 742,520 Apr 20 Acquired for cash 462,180 1,204,700 ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO Balance Item Debit Credit Debit Credit 2012 Jan, 1 Balance Dec 31 Depreciation for year 22,730 315.220 345,950 ACCOUNT Equipment ACCOUNT NO Balance Debit Credit Date Item Debit Credit 2092 375,050 41,300 Jan. Ilance Jan. 26 Discarded, no salvage Aug. 11 Purchased for cash 333,750 424,300 90,550 ACCOUNT NO ACCOUNT Accumulated Depreciation Equipment Balance Date Debit Debit Credit Credit Item 2012 131,080 Jant Balanan 41.300 Jan 26 Equipment discarded Dec 31 Depreciation for year 89.780 116,680 26,900 ACCOUNT donds Payable ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 May issued 10-year bonds 221,140 221,140 ACCOUNT Common stock, $20 par ACCOUNT NO. Balance Date Item Debit Credit Credit Dehit Credit 2012 96,000 Jan. 1 Balance Dec 7 issued 8,200 shares of common stock for $40 per share 164,000 260.000 ACCOUNT Pald-in Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Chi H ACCOUNT Paldin Capital in Ecose of Per-Comman Stock ACCOUNT NO Date Debit Det Cream al 461.00 Jante bewed 3.200 shares of Hoc for Hope 164.000 625.000 ACCOUNT Retained in ACCOUNT NO Balance Date Debi Credit De Credit zova 2.149,000 Dec 1 27,200 2.121.640 Deccan dividende 29.09 2,082.540 Heuvede Prepare a statement of cow in the directhod of shows from the Use the mission to indicate con outhont, chat, der er any ment Whimano Whitman Co. Statement of Cash Flows For the Year Ended December 31, 2012 Chrows from operating activities Adjustments to reconcile net loss to net cash flow from operating activities: Changes in current operating assets and abilities bi DIDI DIO 0 Met show used for operating activities Cash flows from used for investing activities: Net cash flow used for investing activities Cash flows from used for financing activitiest Cash flows from (used for) financing activities: 9 Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year