Answered step by step

Verified Expert Solution

Question

1 Approved Answer

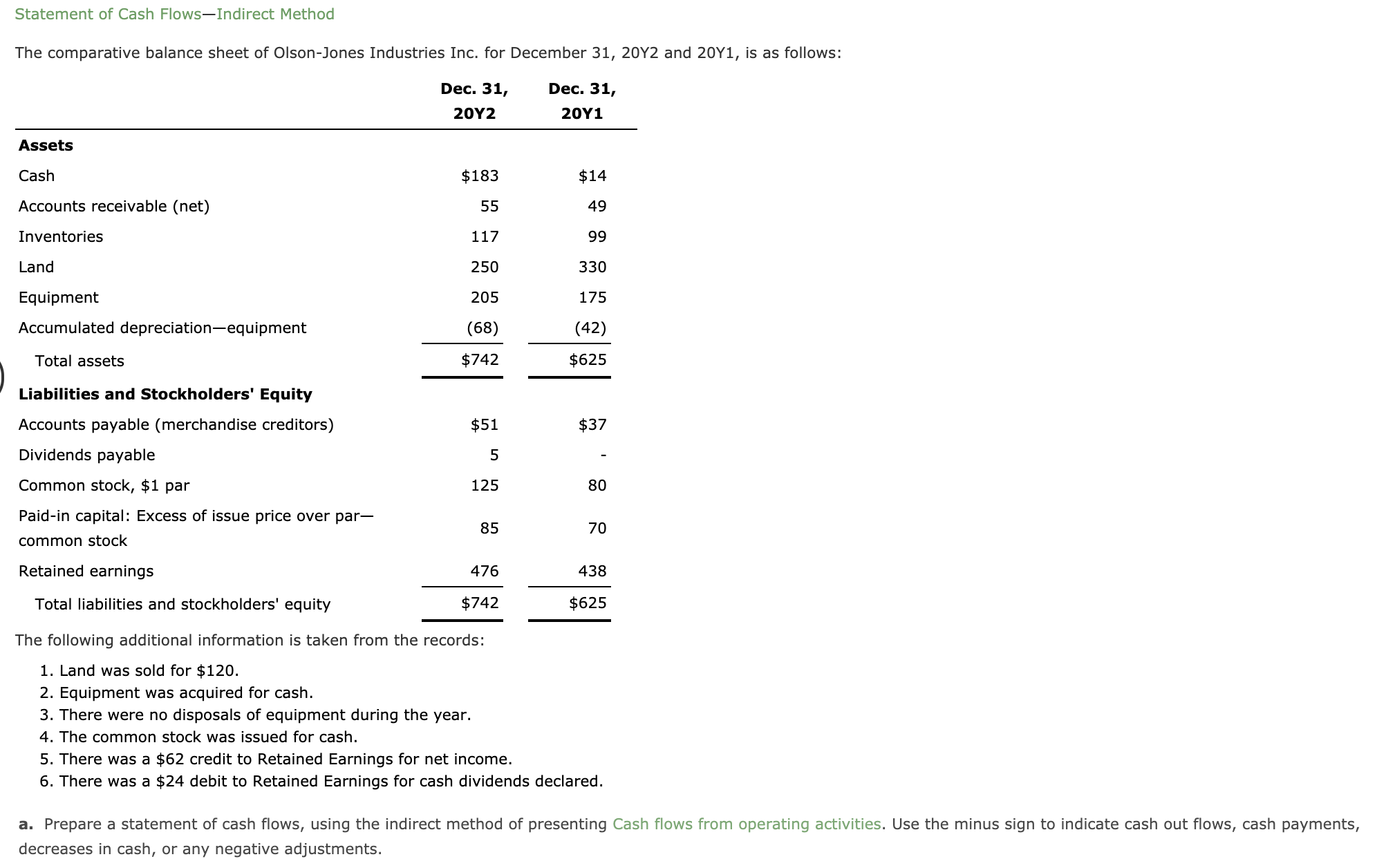

Statement of Cash Flows-Indirect Method The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 2041, is as follows: Dec. 31, Dec.

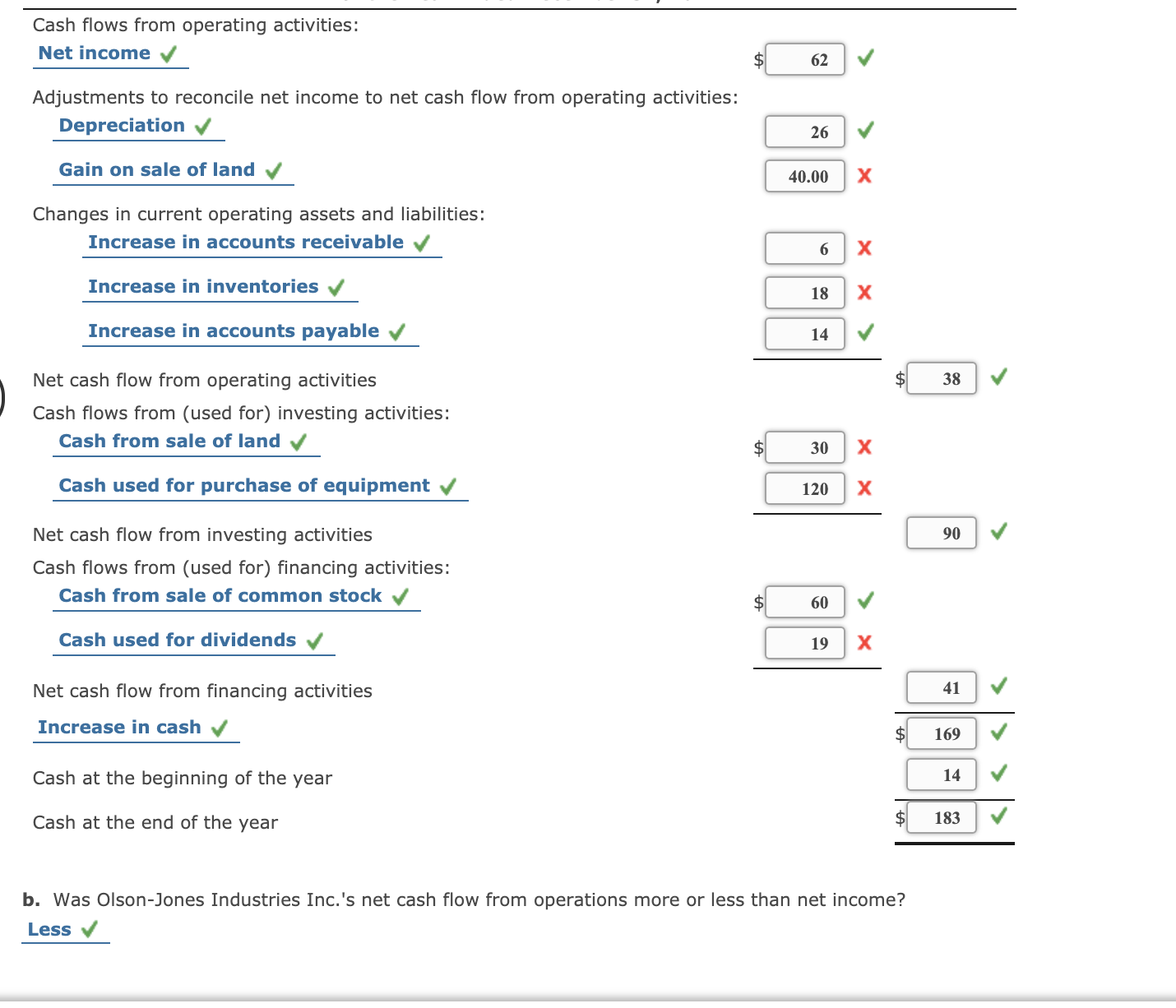

Statement of Cash Flows-Indirect Method The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 2041, is as follows: Dec. 31, Dec. 31, 2012 20Y1 Assets Cash $183 $14 Accounts receivable (net) 55 49 Inventories 117 99 Land 250 330 205 175 Equipment Accumulated depreciation-equipment (68) (42) Total assets $742 $625 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Dividends payable $51 $37 5 Common stock, $1 par 125 80 Paid-in capital: Excess of issue price over par- 85 70 common stock Retained earnings 476 438 Total liabilities and stockholders' equity $742 $625 The following additional information is taken from the records: 1. Land was sold for $120. 2. Equipment was acquired for cash. 3. There were no disposals of equipment during the year. 4. The common stock was issued for cash. 5. There was a $62 credit to Retained Earnings for net income. 6. There was a $24 debit to Retained Earnings for cash dividends declared. a. Prepare a statement of cash flows, using the indirect method of presenting Cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Cash flows from operating activities: Net income 62 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation 26 Gain on sale of land 40.00 Changes in current operating assets and liabilities: Increase in accounts receivable 6 Increase in inventories 18 Increase in accounts payable 14 38 Net cash flow from operating activities Cash flows from (used for) investing activities: Cash from sale of land $ 30 Cash used for purchase of equipment 120 90 Net cash flow from investing activities Cash flows from (used for) financing activities: Cash from sale of common stock 60 Cash used for dividends 19 41 Net cash flow from financing activities Increase in cash $ 169 Cash at the beginning of the year 14 Cash at the end of the year 183 b. Was Olson-Jones Industries Inc.'s net cash flow from operations more or less than net income? Less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started