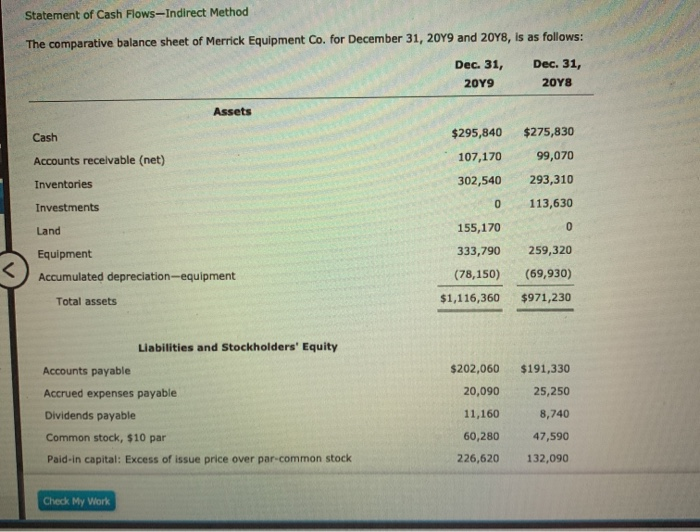

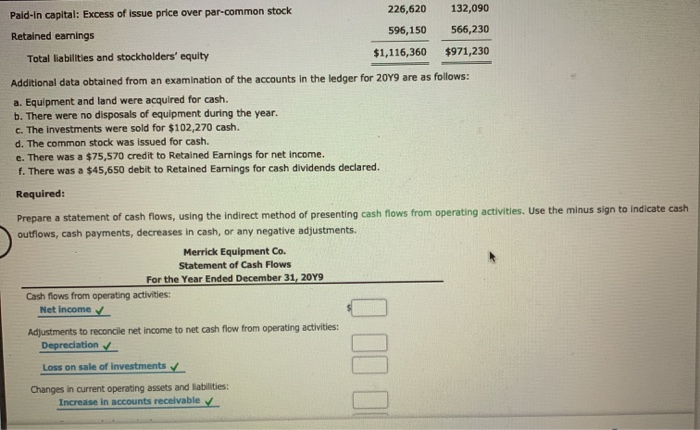

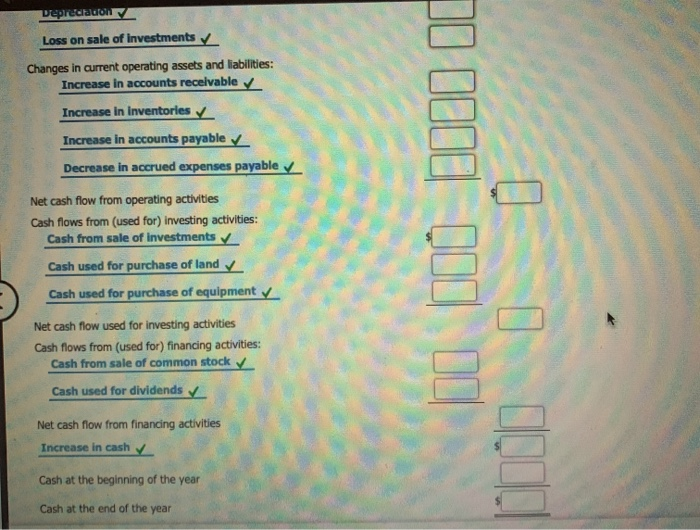

Statement of Cash Flows-Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31, 2019 and 20Y8, is as follows: Dec 31, Dec. 31, 2019 2018 Assets Cash Accounts receivable (net) Inventories Investments $295,840 107,170 302,540 $275,830 99,070 293,310 113,630 Land 259,320 Equipment Accumulated depreciation-equipment 155,170 333,790 (78,150) $1,116,360 (69,930) $971,230 Total assets Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Dividends payable $202,060 20,090 11,160 60,280 226,620 $191,330 25,250 8,740 47,590 132,090 Common stock, $10 par Paid-in capital: Excess of issue price over par.common stock Check My Work Pald-in capital: Excess of issue price over par-common stock Retained earnings 226,620 596,150 $1,116,360 132,090 566,230 $971,230 Total liabilities and stockholders' equity Additional data obtained from an examination of the accounts in the ledger for 2049 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $102,270 cash. d. The common stock was issued for cash. e. There was a $75,570 credit to Retained Earnings for net income. f. There was a $45,650 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 2049 Cash flows from operating activities: Net Income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Loss on sale of investments Changes in current operating assets and liabilities: Increase in accounts receivable Colecon Loss on sale of investments Changes in current operating assets and liabilities: Increase in accounts receivable Increase in Inventories Increase in accounts payable Decrease in accrued expenses payable Net cash flow from operating activities Cash flows from (used for) investing activities: Cash from sale of investments Cash used for purchase of land Cash used for purchase of equipment Net cash flow used for investing activities Cash flows from (used for) financing activities: Cash from sale of common stock Cash used for dividends Net cash flow from financing activities Increase in cash Cash at the beginning of the year Cash at the end of the year