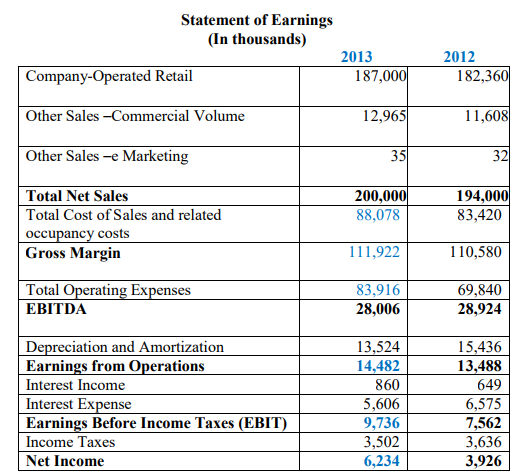

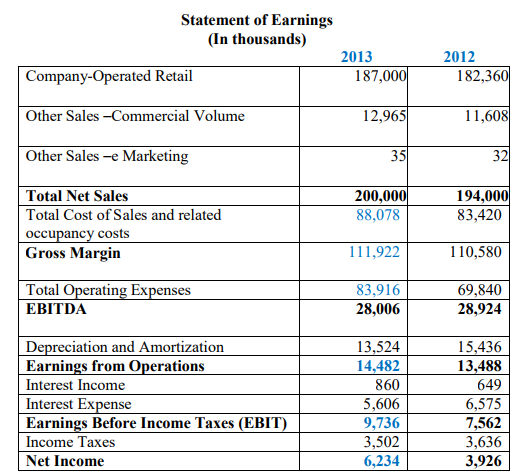

Statement of Earnings

Section 3: Financial Analysis

- Access the financial statements for GCC.

- Conduct a financial analysis of the firm including calculating ratios in the following areas:

- Liquidity

- Asset management

- Debt Management

- Profitability

- Internal and Sustainable Growth

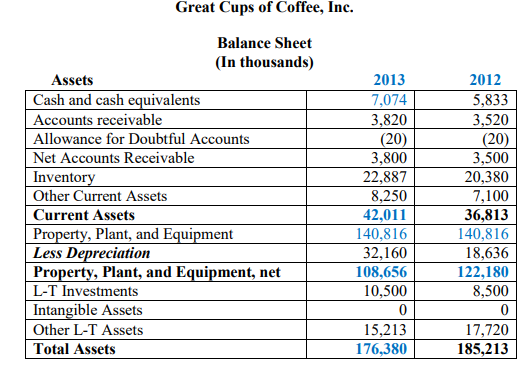

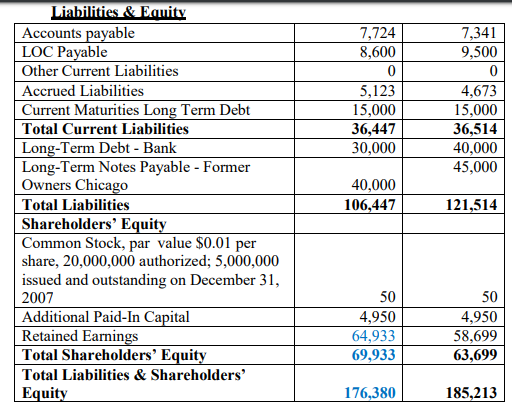

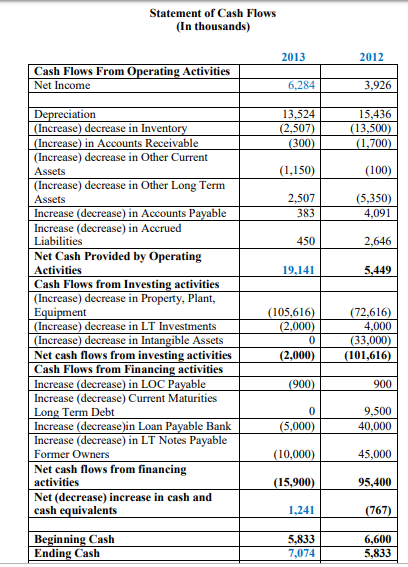

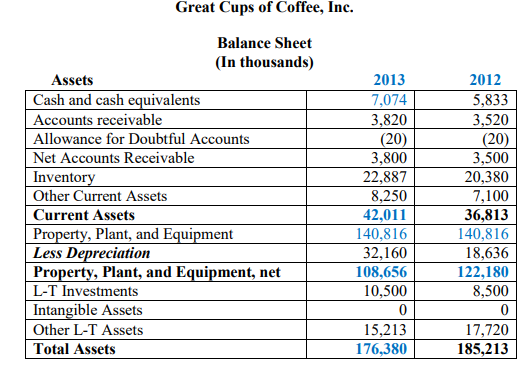

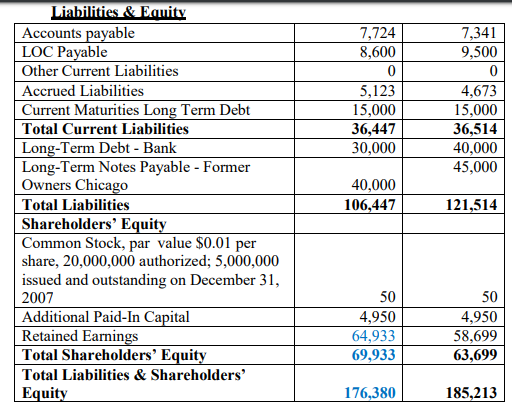

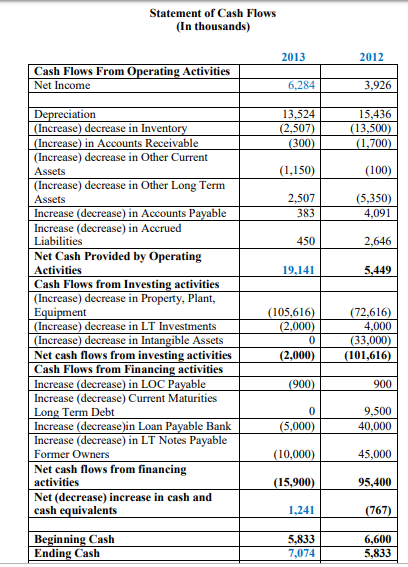

Great Cups of Coffee, Inc. Balance Sheet (In thousands) Assets Cash and cash equivalents Accounts receivable Allowance for Doubtful Accounts Net Accounts Receivable Inventory Other Current Assets Current Assets Property, Plant, and Equipment Less Depreciation Property, Plant, and Equipment, net L-T Investments Intangible Assets Other L-T Assets Total Assets 2013 7,074 3,820 (20) 3,800 22,887 8,250 42,011 140,816 32,160 108,656 10,500 2012 5,833 3,520 (20) 3,500 20,380 7,100 36,813 140,816 18,636 122,180 8,500 15,213 176,380 17,720 1 85,213 7,724 8,600 7,341 9,500 0 5,123 15,000 36,447 30,000 4,673 15,000 36,514 40,000 45,000 Liabilities & Equity Accounts payable LOC Payable Other Current Liabilities Accrued Liabilities Current Maturities Long Term Debt Total Current Liabilities Long-Term Debt - Bank Long-Term Notes Payable - Former Owners Chicago Total Liabilities Shareholders' Equity Common Stock, par value $0.01 per share, 20,000,000 authorized; 5,000,000 issued and outstanding on December 31, 2007 Additional Paid-In Capital Retained Earnings Total Shareholders' Equity Total Liabilities & Shareholders' Equity 40,000 106,447 121,514 so 4,950 64,933 69,933 4,950 58,699 63,699 176,380 185,213 Statement of Cash Flows (In thousands) 2013 2012 Cash Flows From Operating Activities Net Income 6,2841 3.926 15,436 13.524 (2,507) (300) (13,500) (1.700) (1,150) (100) 2,507 383 (5.350) 4,091 450 2,646 19,141 5,449 Depreciation (Increase) decrease in Inventory (Increase) in Accounts Receivable (Increase) decrease in Other Current Assets (Increase) decrease in Other Long Term Assets Increase (decrease) in Accounts Payable Increase (decrease) in Accrued Liabilities Net Cash Provided by Operating Activities Cash Flows from Investing activities (Increase) decrease in Property, Plant, Equipment (Increase) decrease in LT Investments (Increase) decrease in Intangible Assets Net cash flows from investing activities Cash Flows from Financing activities Increase (decrease in LOC Payable Increase (decrease) Current Maturities Long Term Debt Increase (decrease in Loan Payable Bank Increase (decrease) in LT Notes Payable Former Owners Net cash flows from financing activities Net (decrease) increase in cash and cash equivalents (105.616) (2.000) 0 (2.000) (72,616) 4,000 (33,000) (101,616) (900) 900 9,500 40.000 (5.000) (10.000) 45,000 (15,900) 95,400 1.241 (767) 5.833 Beginning Cash Ending Cash 6,600 5,833 7.074 Statement of Earnings (In thousands) 2013 Company-Operated Retail 187,000 2012 182,360 Other Sales -Commercial Volume 12,965 11,608 Other Sales -e Marketing 35 32 200.000 88,078 194,000 83,420 Total Net Sales Total Cost of Sales and related occupancy costs Gross Margin 111,922 110,580 Total Operating Expenses EBITDA 83,916 28,006 69,840 28,924 Depreciation and Amortization Earnings from Operations Interest Income Interest Expense Earnings Before Income Taxes (EBIT) Income Taxes Net Income 13,524 14,482 860 5,606 9,736 3,502 6,234 15,436 13,488 649 6,575 7,562 3,636 3,926