Question

Statement of Facts Taxpayer John Doe has the following personal information: Name: John Doe SSN: 555-55-5555 Address: 123 Main Street, Anytown, CA 90000 Marital Status:

Statement of Facts

Taxpayer John Doe has the following personal information:

Name: John Doe

SSN: 555-55-5555

Address: 123 Main Street, Anytown, CA 90000

Marital Status: Never married

Minor Children: None

Elections: Standard deduction (Note: DOE has never elected to itemize, including in prior years)

Summary:

John Doe (DOE) is an employee at ABC, Inc. (Payer #1 - benefit details below). Additionally, DOE receives monthly annuity payments from an fixed term annuity he received as a gift from his mother (Payer #2 - annuity details below). DOE has no sources of investment or passive income. During the tax year, DOE received the following:

- $15,000 in prize money from a game show (Payer #3); and

- $2,000 from an income tax refund (Payer #4).

With regard to DOE's job at ABC, Inc., DOE receives an annual salary of $50,000. ABC, Inc. withheld: 1) $5,000 of federal income taxes; and 2) $2,000 of state income taxes on DOE's salary. ABC, Inc. also withheld the required amount of Social Security and Medicare taxes. In addition to his salary, DOE received the following employee benefits from ABC, Inc.:

- Employer paid health insurance premiums of $8,000;

- Employer paid SEP IRA contributions of $5,000;

- Employer paid group term life insurance with $40,000 in coverage.

With regard to DOE's annuity, DOE receives $500 per month. DOE's mother purchased the 10 year fixed term annuity contact five years ago for $30,000. Assume DOE receives all annuity payments for each year of his ownership and there are a full 5 years left on the contract when he receives the annuity from his mother.

Payer #1: ABC, Inc.

EIN: 99-9999999

State TIN: 2222-222-22-1

Address: 111 Corp. Blvd. Ste 100, Anytown, CA 90000

Payer #2: Anytown Financial, LLC

EIN: 99-9999998

Address: 444 Financial Blvd. Ste 305, Anytown, CA 90000

Payer #3: Anytown Productions, LLC

EIN: 99-9999997

Address: 123 Spotlight Blvd. Ste 105, Anytown, CA 90000

Payer #4: State of California

EIN: 99-9999996

Address: P.O. Box 111, Anytown, CA 90000

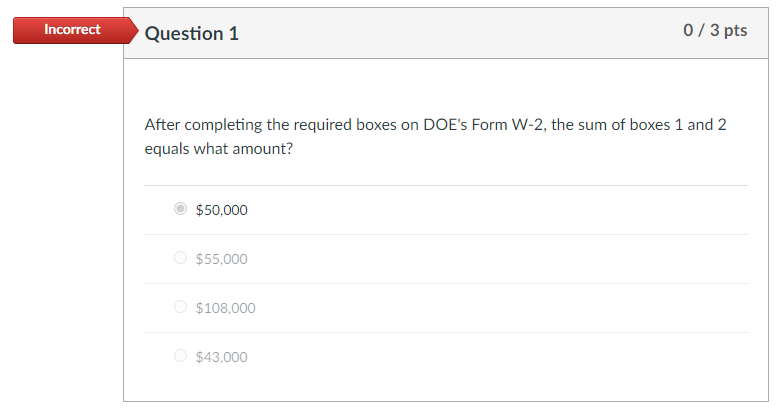

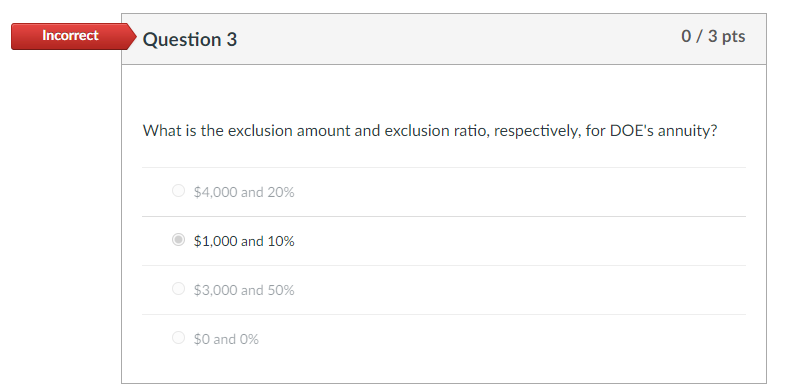

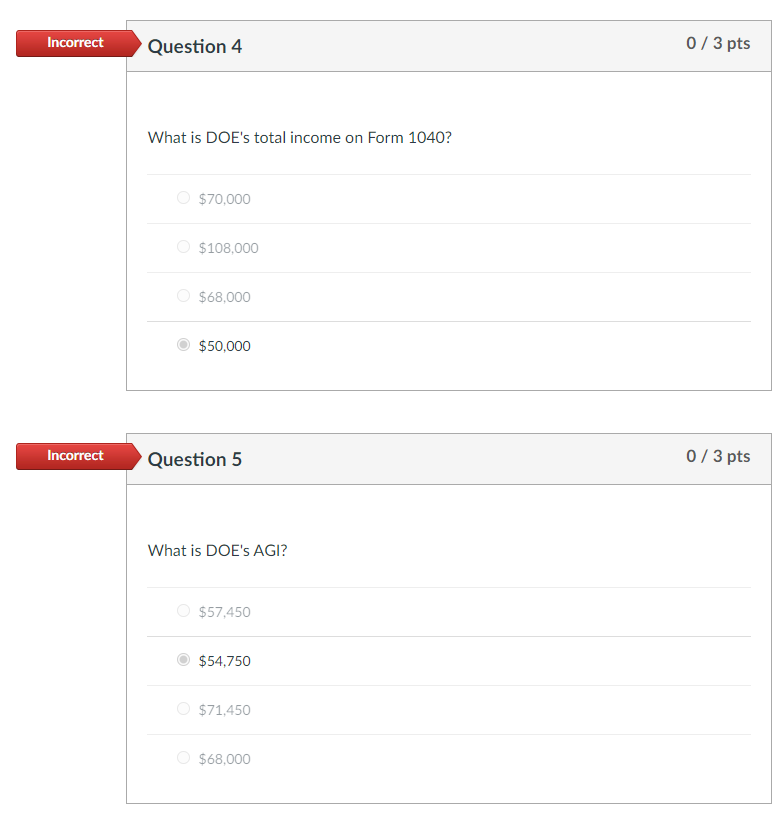

After completing the required boxes on DOE's Form W-2, the sum of boxes 1 and 2 equals what amount? $50,000 $55,000 $108,000 $43,000 What is the exclusion amount and exclusion ratio, respectively, for DOE's annuity? $4,000 and 20% $1,000 and 10% $3,000 and 50% $0 and 0% What is DOE's total income on Form 1040? $70,000 $108,000 $68,000 $50,000 Question 5 What is DOE's AGI? $57,450 $54,750 $71,450 $68,000

After completing the required boxes on DOE's Form W-2, the sum of boxes 1 and 2 equals what amount? $50,000 $55,000 $108,000 $43,000 What is the exclusion amount and exclusion ratio, respectively, for DOE's annuity? $4,000 and 20% $1,000 and 10% $3,000 and 50% $0 and 0% What is DOE's total income on Form 1040? $70,000 $108,000 $68,000 $50,000 Question 5 What is DOE's AGI? $57,450 $54,750 $71,450 $68,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started