Answered step by step

Verified Expert Solution

Question

1 Approved Answer

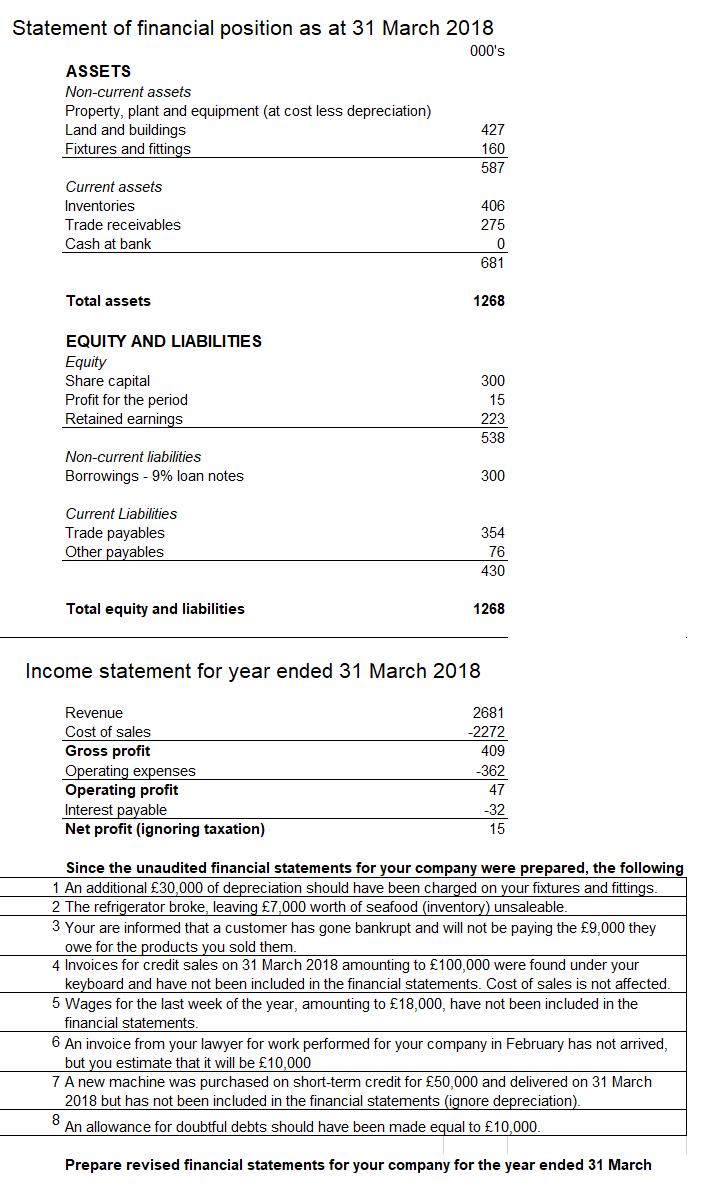

Statement of financial position as at 31 March 2018 000's ASSETS Non-current assets Property, plant and equipment (at cost less depreciation) Land and buildings

Statement of financial position as at 31 March 2018 000's ASSETS Non-current assets Property, plant and equipment (at cost less depreciation) Land and buildings Fixtures and fittings Current assets Inventories Trade receivables Cash at bank Total assets EQUITY AND LIABILITIES Equity Share capital Profit for the period Retained earnings Non-current liabilities Borrowings - 9% loan notes Current Liabilities Trade payables Other payables Total equity and liabilities Revenue Cost of sales Gross profit Operating expenses Operating profit 427 160 587 Interest payable Net profit (ignoring taxation) 406 275 0 681 1268 300 15 223 538 300 Income statement for year ended 31 March 2018 354 76 430 1268 2681 -2272 409 -362 47 -32 15 Since the unaudited financial statements for your company were prepared, the following 1 An additional 30,000 of depreciation should have been charged on your fixtures and fittings. 2 The refrigerator broke, leaving 7,000 worth of seafood (inventory) unsaleable. 3 Your are informed that a customer has gone bankrupt and will not be paying the 9,000 they owe for the products you sold them. 4 Invoices for credit sales on 31 March 2018 amounting to 100,000 were found under your keyboard and have not been included in the financial statements. Cost of sales is not affected. 5 Wages for the last week of the year, amounting to 18,000, have not been included in the financial statements. 6 An invoice from your lawyer for work performed for your company in February has not arrived, but you estimate that it will be 10,000 7 A new machine was purchased on short-term credit for 50,000 and delivered on 31 March 2018 but has not been included in the financial statements (ignore depreciation). 8 An allowance for doubtful debts should have been made equal to 10,000. Prepare revised financial statements for your company for the year ended 31 March

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Revised Statement of Financial Position as on 31st March 2018 Assets Non Current Assets Propert Plan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started