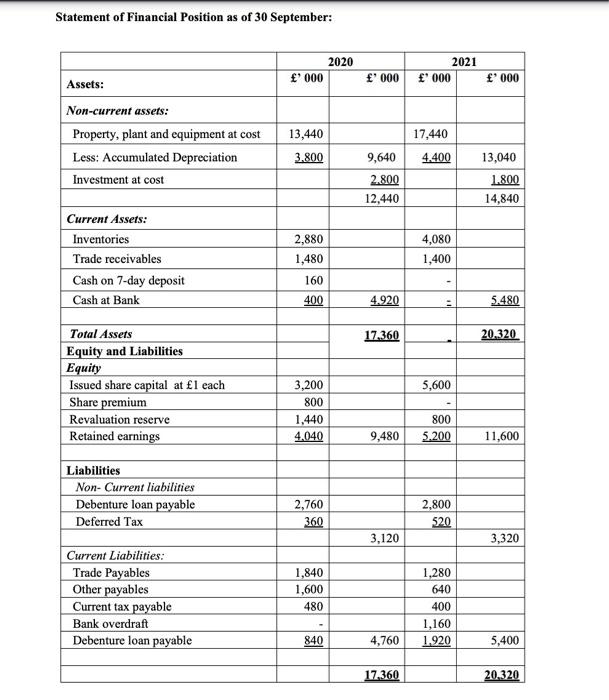

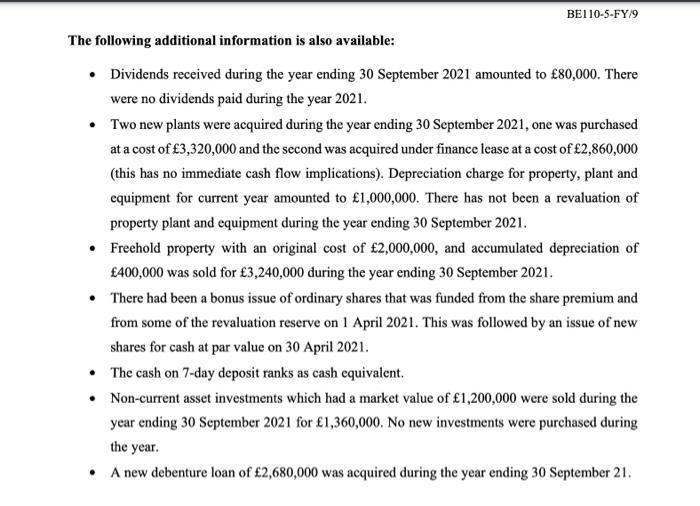

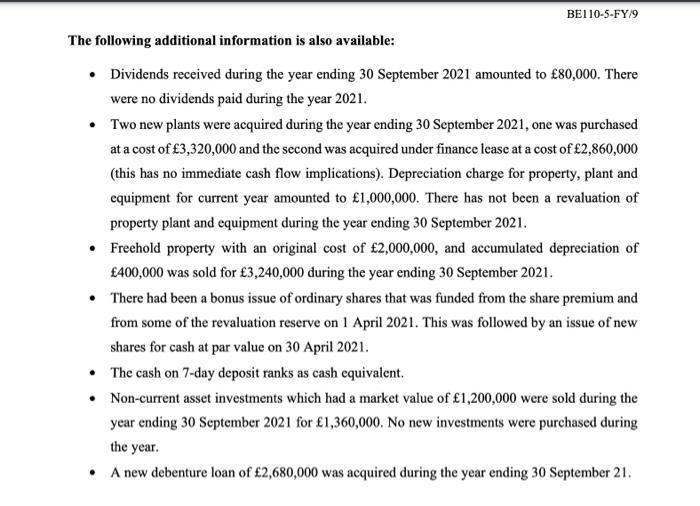

Statement of Financial Position as of 30 September: 2020 '000 2021 f' 000 ' 000 f' 000 Assets: Non-current assets: Property, plant and equipment at cost Less: Accumulated Depreciation Investment at cost 13,440 17,440 4.400 3.800 9,640 2.800 12,440 13,040 1.800 14,840 Current Assets: Inventories Trade receivables Cash on 7-day deposit Cash at Bank 2,880 1,480 4,080 1,400 160 400 4.920 2 5.480 17.360 20,320 Total Assets Equity and Liabilities Equity Issued share capital at 1 each Share premium Revaluation reserve Retained earnings 5,600 3,200 800 1,440 4,040 800 5.200 9,480 11,600 Liabilities Non-Current liabilities Debenture loan payable Deferred Tax 2,760 360 2,800 520 3,120 3,320 Current Liabilities: Trade Payables Other payables Current tax payable Bank overdraft Debenture loan payable 1,840 1,600 480 1,280 640 400 1,160 1.920 840 4,760 5,400 17.360 20.320 BEI 10-5-FY/9 The following additional information is also available: Dividends received during the year ending 30 September 2021 amounted to 80,000. There were no dividends paid during the year 2021. Two new plants were acquired during the year ending 30 September 2021, one was purchased at a cost of 3,320,000 and the second was acquired under finance lease at a cost of 2,860,000 (this has no immediate cash flow implications). Depreciation charge for property, plant and equipment for current year amounted to 1,000,000. There has not been a revaluation of property plant and equipment during the year ending 30 September 2021. Freehold property with an original cost of 2,000,000, and accumulated depreciation of 400,000 was sold for 3,240,000 during the year ending 30 September 2021. There had been a bonus issue of ordinary shares that was funded from the share premium and from some of the revaluation reserve on 1 April 2021. This was followed by an issue of new shares for cash at par value on 30 April 2021. The cash on 7-day deposit ranks as cash equivalent. Non-current asset investments which had a market value of 1,200,000 were sold during the year ending 30 September 2021 for 1,360,000. No new investments were purchased during the year. A new debenture loan of 2,680,000 was acquired during the year ending 30 September 21. Required: (a) Prepare the Statement of Cash Flows for the year ending 30 September 2021 for Danvers plc in accordance with IAS7, Statement of Cash Flows, using the indirect method. [Clearly state any assumptions you make.] (26 marks) (b) Critically discuss the significance of the information provided by the company's Statement of Cash Flows. (7 Marks) [TOTAL 33 MARKS Statement of Financial Position as of 30 September: 2020 '000 2021 f' 000 ' 000 f' 000 Assets: Non-current assets: Property, plant and equipment at cost Less: Accumulated Depreciation Investment at cost 13,440 17,440 4.400 3.800 9,640 2.800 12,440 13,040 1.800 14,840 Current Assets: Inventories Trade receivables Cash on 7-day deposit Cash at Bank 2,880 1,480 4,080 1,400 160 400 4.920 2 5.480 17.360 20,320 Total Assets Equity and Liabilities Equity Issued share capital at 1 each Share premium Revaluation reserve Retained earnings 5,600 3,200 800 1,440 4,040 800 5.200 9,480 11,600 Liabilities Non-Current liabilities Debenture loan payable Deferred Tax 2,760 360 2,800 520 3,120 3,320 Current Liabilities: Trade Payables Other payables Current tax payable Bank overdraft Debenture loan payable 1,840 1,600 480 1,280 640 400 1,160 1.920 840 4,760 5,400 17.360 20.320 BEI 10-5-FY/9 The following additional information is also available: Dividends received during the year ending 30 September 2021 amounted to 80,000. There were no dividends paid during the year 2021. Two new plants were acquired during the year ending 30 September 2021, one was purchased at a cost of 3,320,000 and the second was acquired under finance lease at a cost of 2,860,000 (this has no immediate cash flow implications). Depreciation charge for property, plant and equipment for current year amounted to 1,000,000. There has not been a revaluation of property plant and equipment during the year ending 30 September 2021. Freehold property with an original cost of 2,000,000, and accumulated depreciation of 400,000 was sold for 3,240,000 during the year ending 30 September 2021. There had been a bonus issue of ordinary shares that was funded from the share premium and from some of the revaluation reserve on 1 April 2021. This was followed by an issue of new shares for cash at par value on 30 April 2021. The cash on 7-day deposit ranks as cash equivalent. Non-current asset investments which had a market value of 1,200,000 were sold during the year ending 30 September 2021 for 1,360,000. No new investments were purchased during the year. A new debenture loan of 2,680,000 was acquired during the year ending 30 September 21. Required: (a) Prepare the Statement of Cash Flows for the year ending 30 September 2021 for Danvers plc in accordance with IAS7, Statement of Cash Flows, using the indirect method. [Clearly state any assumptions you make.] (26 marks) (b) Critically discuss the significance of the information provided by the company's Statement of Cash Flows. (7 Marks) [TOTAL 33 MARKS