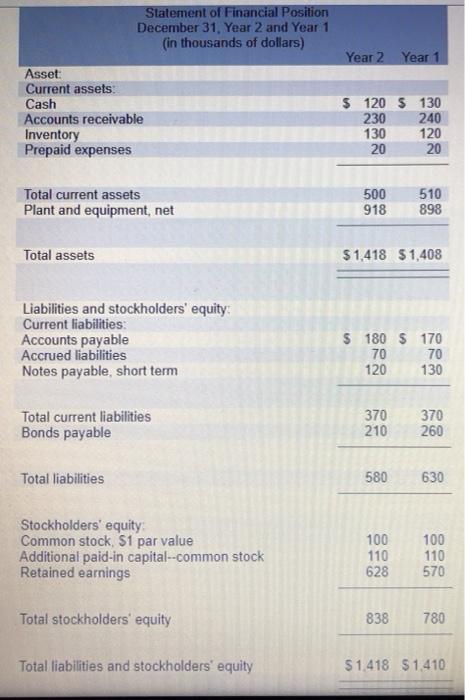

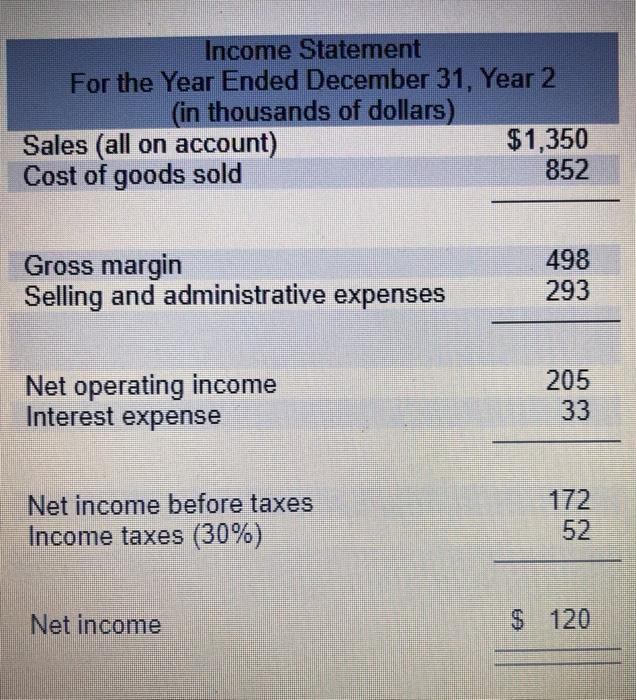

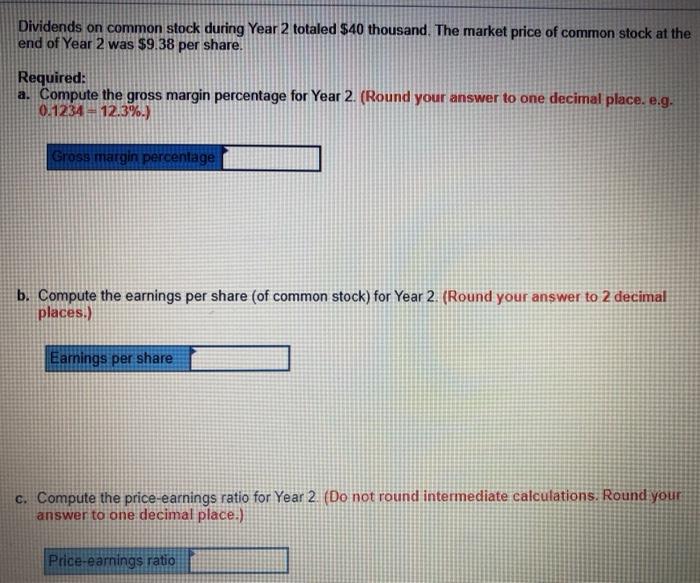

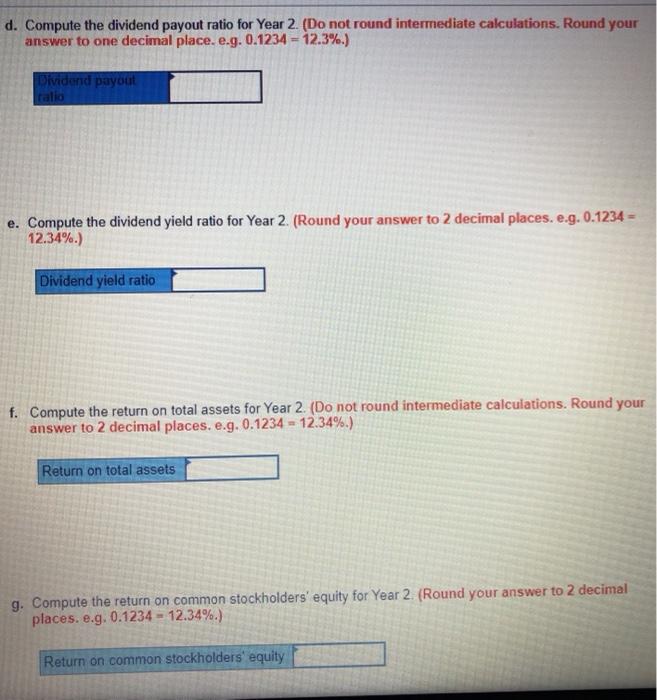

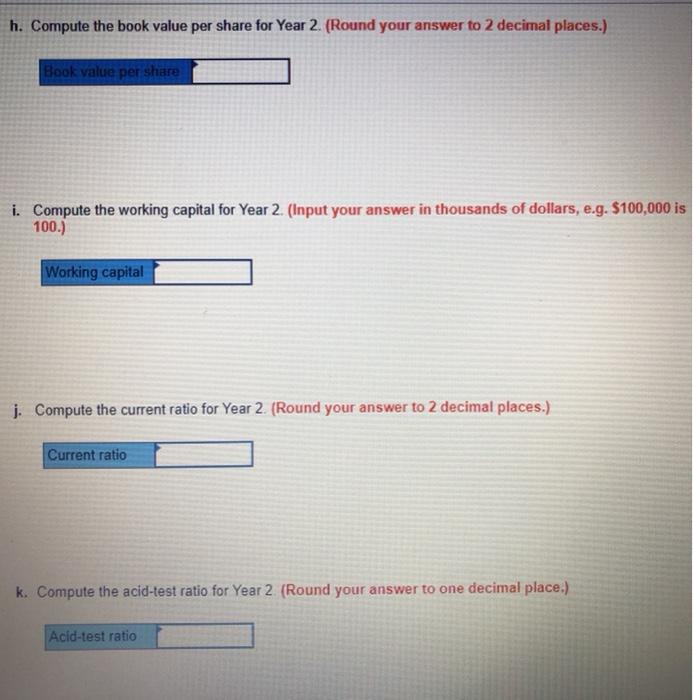

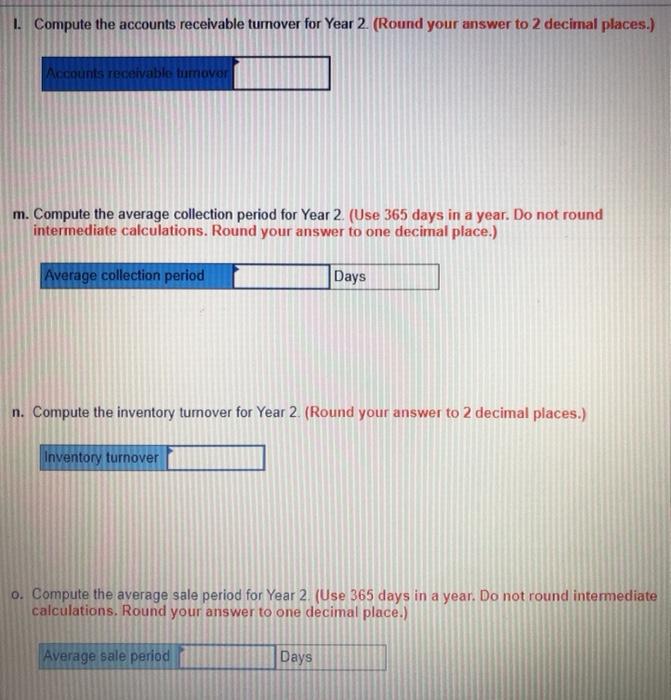

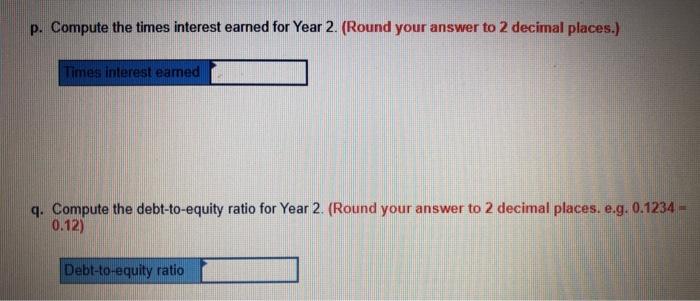

Statement of Financial Position December 31, Year 2 and Year 1 (in thousands of dollars) Year 2 Year 1 Asset Current assets Cash Accounts receivable Inventory Prepaid expenses $ 120 $ 130 230 240 130 120 20 20 Total current assets Plant and equipment, net 500 918 510 898 Total assets $ 1.418 $1,408 Liabilities and stockholders' equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term $ 180 $ 170 70 70 130 120 Total current liabilities Bonds payable 370 210 370 260 Total liabilities 580 630 Stockholders' equity Common stock, S1 par value Additional paid-in capital--common stock Retained earnings 100 110 628 100 110 570 Total stockholders' equity 838 780 Total liabilities and stockholders' equity $1.418 $1.410 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars) Sales (all on account) $1,350 Cost of goods sold 852 Gross margin Selling and administrative expenses 498 293 Net operating income Interest expense 205 33 Net income before taxes Income taxes (30%) 172 52 Net income $ 120 Dividends on common stock during Year 2 totaled $40 thousand. The market price of common stock at the end of Year 2 was $9.38 per share. Required: a. Compute the gross margin percentage for Year 2. (Round your answer to one decimal place. e.g. 0.1234 = 12.3%) Gross margin percentage b. Compute the earnings per share (of common stock) for Year 2. (Round your answer to 2 decimal places.) Earnings per share c. Compute the price-earnings ratio for Year 2. (Do not round intermediate calculations. Round your answer to one decimal place.) Price-earnings ratio d. Compute the dividend payout ratio for Year 2. (Do not round intermediate calculations. Round your answer to one decimal place. e.g. 0.1234 - 12.3%.) Dividend payout rallo e. Compute the dividend yield ratio for Year 2. (Round your answer to 2 decimal places. e.g. 0.1234 - 12.34%.) Dividend yield ratio f. Compute the return on total assets for Year 2. (Do not round intermediate calculations. Round your answer to 2 decimal places. e.g. 0.1234 - 12.34%.) Return on total assets g. Compute the return on common stockholders' equity for Year 2. (Round your answer to 2 decimal places. e.g. 0.1234 - 12.34%.) Return on common stockholders' equity h. Compute the book value per share for Year 2. (Round your answer to 2 decimal places.) Book value per share i. Compute the working capital for Year 2. (Input your answer in thousands of dollars, e.g. $100,000 is 100.) Working capital j. Compute the current ratio for Year 2. (Round your answer to 2 decimal places.) Current ratio k. Compute the acid-test ratio for Year 2 (Round your answer to one decimal place.) Acid-test ratio 1. Compute the accounts receivable tumover for Year 2 (Round your answer to 2 decimal places.) Accounts receivable tumovor m. Compute the average collection period for Year 2 (Use 365 days in a year. Do not round intermediate calculations. Round your answer to one decimal place.) Average collection period Days n. Compute the inventory tumover for Year 2. (Round your answer to 2 decimal places.) Inventory turnover o. Compute the average sale period for Year 2 (Use 365 days in a year. Do not round intermediate calculations. Round your answer to one decimal place.) Average sale period Days p. Compute the times interest earned for Year 2. (Round your answer to 2 decimal places.) Times interest eamed 4. Compute the debt-to-equity ratio for Year 2. (Round your answer to 2 decimal places. e.g. 0.1234 - 0.12) Debt-to-equity ratio