Answered step by step

Verified Expert Solution

Question

1 Approved Answer

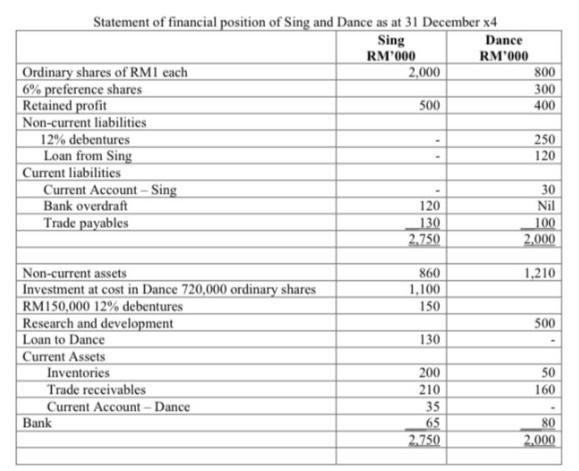

Statement of financial position of Sing and Dance as at 31 December x4 Sing RM'000 Ordinary shares of RM1 each 6% preference shares Retained

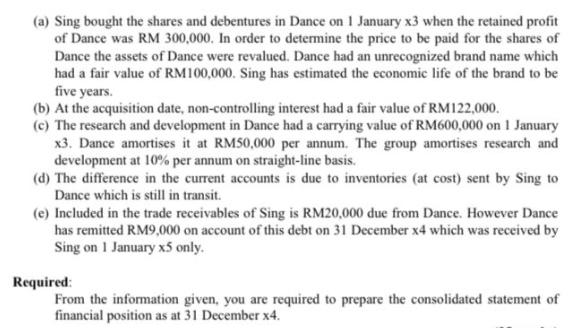

Statement of financial position of Sing and Dance as at 31 December x4 Sing RM'000 Ordinary shares of RM1 each 6% preference shares Retained profit Non-current liabilities 12% debentures Loan from Sing Current liabilities Current Account-Sing Bank overdraft Trade payables Non-current assets Investment at cost in Dance 720,000 ordinary shares RM150,000 12% debentures Research and development Loan to Dance Current Assets Inventories Trade receivables Current Account-Dance Bank 2,000 500 120 130 2.750 860 1,100 150 130 200 210 35 65 2.750 Dance RM'000 800 300 400 250 120 30 Nil 100 2.000 1,210 500 50 160 80 2.000 (a) Sing bought the shares and debentures in Dance on 1 January x3 when the retained profit of Dance was RM 300,000. In order to determine the price to be paid for the shares of Dance the assets of Dance were revalued. Dance had an unrecognized brand name which had a fair value of RM100,000. Sing has estimated the economic life of the brand to be five years. (b) At the acquisition date, non-controlling interest had a fair value of RM122,000. (c) The research and development in Dance had a carrying value of RM600,000 on 1 January x3. Dance amortises it at RM50,000 per annum. The group amortises research and development at 10% per annum on straight-line basis. (d) The difference in the current accounts is due to inventories (at cost) sent by Sing to Dance which is still in transit. (e) Included in the trade receivables of Sing is RM20,000 due from Dance. However Dance has remitted RM9,000 on account of this debt on 31 December x4 which was received by Sing on 1 January x5 only. Required: From the information given, you are required to prepare the consolidated statement of financial position as at 31 December x4.

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Financial Position as at 31 December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started