Question

Statement of partnership liquidation Eli, Joe, and Ned agree to liquidate their consulting practice as soon as possible after the close of business on July

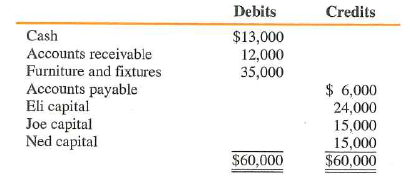

Statement of partnership liquidation Eli, Joe, and Ned agree to liquidate their consulting practice as soon as possible after the close of business on July 31, 2016. The trial balance on that date shows the following account balances:

The partners share profits and losses 20 percent, 30 percent, and 50 percent to Eli, Joe, and Ned, respectively, after Ned is allowed a monthly salary of $4,000. August transactions and events are as follows:

1. The accounts payable are paid.

2. Accounts receivable of $8,000 are collected in full. Ned accepts accounts receivable with a face value and fair value of $3,000 in partial satisfaction of his capital balance. The remaining accounts receivable are written off as uncollectible.

3. Furniture with a book value of $25,000 is sold for $15,000.

4. Furniture with a book value of $4,000 and an agreed-upon fair value of $1,000 is taken by Joe in partial settlement of his capital balance. The remaining furniture and fixtures are donated to Goodwill Industries.

5. Liquidation expenses of $3,000 are paid.

6. Available cash is distributed to partners on August 31.

REQUIRED:

Prepare a statement of partnership liquidation for the Eli, Joe, and Ned partnership for August.

Cash Accounts receivable Furniture and fixtures Accounts payable Eli capital Joe capital Ned capital Debits $13,000 12,000 35,000 $60,000 Credits $ 6,000 24,000 15,000 15,000 $60,000

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Partnership Liquidation It is the process of closing do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started