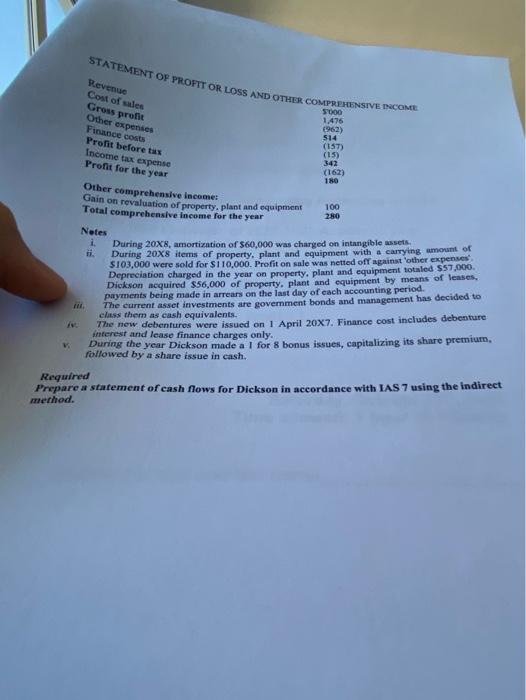

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME 1.476 1962) 514 (15) (15) 342 (162) 180 5000 Revenue Cost of sales Gross profit Other expenses Finance costs Profit before tas Income tax expense Profit for the year Other comprehensive income Gain on revaluation of property, plant and equipment Total comprehensive income for the year 100 280 Notes During 20x8, amortization of $60,000 was charged on intangible assets During 20x8 items of property, plant and equipment with a carrying amount of S103,000 were sold for $110,000. Profit on sale was netted off against other expenses Depreciation charged in the year on property, plant and equipment totaled $57.000 Dickson acquired $56,000 of property, plant and equipment by means of leases payments being made in arrears on the last day of each accounting period. The current asset investments are government bonds and management has decided to class them as cash equivalents. The new debentures were issued on 1 April 20x7. Finance cost includes debenture interest and lease finance charges only. During the year Dickson made a I for 8 bonus issues, capitalizing its share premium, followed by a share issue in cash. Required Prepare a statement of cash Nows for Dickson in accordance with IAS 7 using the indirect method. STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME 1.476 1962) 514 (15) (15) 342 (162) 180 5000 Revenue Cost of sales Gross profit Other expenses Finance costs Profit before tas Income tax expense Profit for the year Other comprehensive income Gain on revaluation of property, plant and equipment Total comprehensive income for the year 100 280 Notes During 20x8, amortization of $60,000 was charged on intangible assets During 20x8 items of property, plant and equipment with a carrying amount of S103,000 were sold for $110,000. Profit on sale was netted off against other expenses Depreciation charged in the year on property, plant and equipment totaled $57.000 Dickson acquired $56,000 of property, plant and equipment by means of leases payments being made in arrears on the last day of each accounting period. The current asset investments are government bonds and management has decided to class them as cash equivalents. The new debentures were issued on 1 April 20x7. Finance cost includes debenture interest and lease finance charges only. During the year Dickson made a I for 8 bonus issues, capitalizing its share premium, followed by a share issue in cash. Required Prepare a statement of cash Nows for Dickson in accordance with IAS 7 using the indirect method