Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Statement? onf he following equals income from Continuing Operations' on the Income A. Net sales- cost of goods sold- operating expenses B. Net sales-cost of

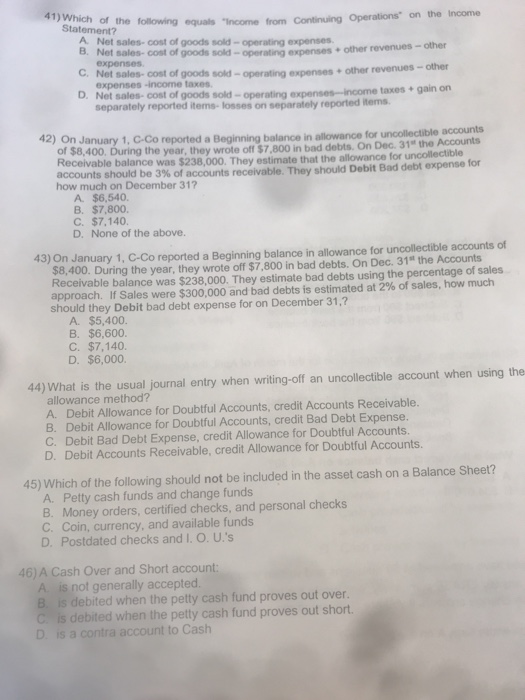

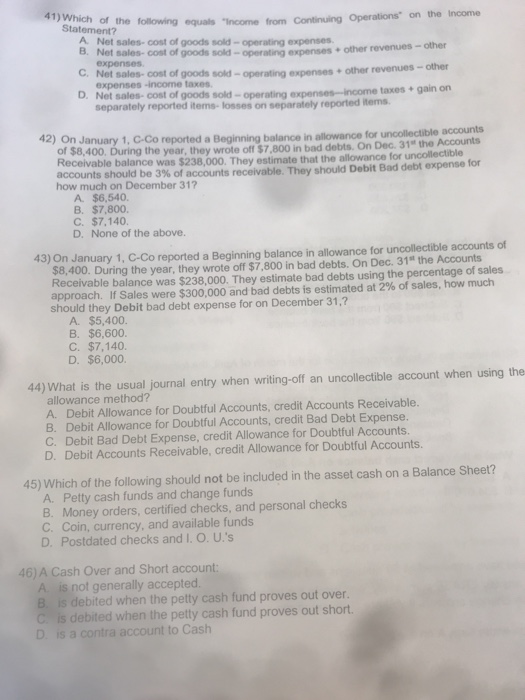

Statement? onf he following equals "income from Continuing Operations' on the Income A. Net sales- cost of goods sold- operating expenses B. Net sales-cost of goods sold-operating expenses C. Net sales- cost of goods sold-operating expenses D. Net sales- cost of goods sold-operating expenses-income taxes+ gain on expenses expenses -income taxes separately reported items- losses on separately reported items. other revenues-other other revenues-other 42) On January 1, C-Co reported a Beginning balance in allowance for uncollectible of $8,400. During the year, they wrote off Receivable balance was $238,000. They estimate that the allowance for uncollectible accounts should be 3% of accounts how much on December 31? $7,800 in bad debts. On Dec. 31 the Accounts receivable. They should Debit Bad debt expense for A $6,540 B. $7,800 C. $7,140. D. None of the above. 43) On January 1, C-Co reported a Beginning balance in allowance for uncollectible accounts of $8,400. During the year, they wrote off $7,800 in bad debts. On Dec. 31 the Accounts Receivable balance was $238,000. They estimate bad debts using the percentage of sales approach. If Sales were $300,000 and bad debts is estimated at 2% of sales, how much should they Debit bad debt expense for on December 31,? A. $5,400. B. $6,600. C. $7,140 D. $6,000. 44) What is the usual journal entry when writing-off an uncollectible account when using the allowance method? A. Debit Allowance for Doubtful Accounts, credit Accounts Receivable. B. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. C. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts D. Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 45) Which of the following should not be included in the asset cash on a Balance Sheet? A. Petty cash funds and change funds B. Money orders, certified checks, and personal checks C. Coin, currency, and available funds D. Postdated checks and I. O. U.'s 46) A Cash Over and Short account: not generally accepted B is debited when the petty cash fund proves out over C is debited when the petty cash fund proves out short. D is a contra account to Cash

Statement? onf he following equals "income from Continuing Operations' on the Income A. Net sales- cost of goods sold- operating expenses B. Net sales-cost of goods sold-operating expenses C. Net sales- cost of goods sold-operating expenses D. Net sales- cost of goods sold-operating expenses-income taxes+ gain on expenses expenses -income taxes separately reported items- losses on separately reported items. other revenues-other other revenues-other 42) On January 1, C-Co reported a Beginning balance in allowance for uncollectible of $8,400. During the year, they wrote off Receivable balance was $238,000. They estimate that the allowance for uncollectible accounts should be 3% of accounts how much on December 31? $7,800 in bad debts. On Dec. 31 the Accounts receivable. They should Debit Bad debt expense for A $6,540 B. $7,800 C. $7,140. D. None of the above. 43) On January 1, C-Co reported a Beginning balance in allowance for uncollectible accounts of $8,400. During the year, they wrote off $7,800 in bad debts. On Dec. 31 the Accounts Receivable balance was $238,000. They estimate bad debts using the percentage of sales approach. If Sales were $300,000 and bad debts is estimated at 2% of sales, how much should they Debit bad debt expense for on December 31,? A. $5,400. B. $6,600. C. $7,140 D. $6,000. 44) What is the usual journal entry when writing-off an uncollectible account when using the allowance method? A. Debit Allowance for Doubtful Accounts, credit Accounts Receivable. B. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. C. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts D. Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 45) Which of the following should not be included in the asset cash on a Balance Sheet? A. Petty cash funds and change funds B. Money orders, certified checks, and personal checks C. Coin, currency, and available funds D. Postdated checks and I. O. U.'s 46) A Cash Over and Short account: not generally accepted B is debited when the petty cash fund proves out over C is debited when the petty cash fund proves out short. D is a contra account to Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started