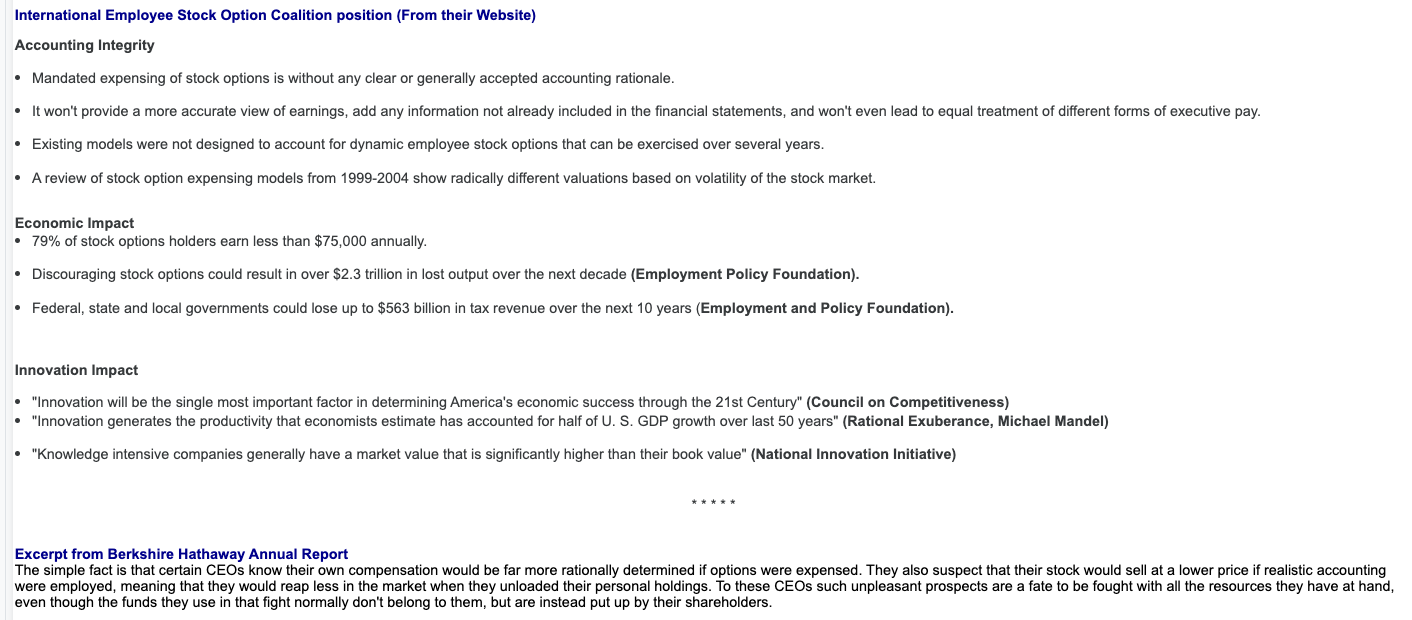

statement requiring this disclose) will seriously hamper how certain companies compensate employees (young, technology, etc.) by making stock options too expensive to grant. to whether stock options should or should not be considered as a company expense that needs disclosure on corporate income statements. Financial Accounting Standards Board (from its FAQ for SFAS 123R) Q3. Why does an employee share option have value? An employee share option has value because it gives the employee the right to benefit from increases in the share price over the exercise price during the option's contractual term. . drawing because the value of the share can change, making the share option more or less valuable). Q11), both types of options have value for the same reason. International Employee Stock Option Coalition position (From their Website) Accounting Integrity - Mandated expensing of stock options is without any clear or generally accepted accounting rationale. - Existing models were not designed to account for dynamic employee stock options that can be exercised over several years. - A review of stock option expensing models from 1999-2004 show radically different valuations based on volatility of the stock market. Economic Impact - 79% of stock options holders earn less than $75,000 annually. - Discouraging stock options could result in over $2.3 trillion in lost output over the next decade (Employment Policy Foundation). - Federal, state and local governments could lose up to $563 billion in tax revenue over the next 10 years (Employment and Policy Foundation). Innovation Impact - "Innovation will be the single most important factor in determining America's economic success through the 21st Century" (Council on Competitiveness) - "Innovation generates the productivity that economists estimate has accounted for half of U. S. GDP growth over last 50 years" (Rational Exuberance, Michael Mandel) - "Knowledge intensive companies generally have a market value that is significantly higher than their book value" (National Innovation Initiative) Excerpt from Berkshire Hathaway Annual Report even though the funds they use in that fight normally don't belong to them, but are instead put up by their shareholders. statement requiring this disclose) will seriously hamper how certain companies compensate employees (young, technology, etc.) by making stock options too expensive to grant. to whether stock options should or should not be considered as a company expense that needs disclosure on corporate income statements. Financial Accounting Standards Board (from its FAQ for SFAS 123R) Q3. Why does an employee share option have value? An employee share option has value because it gives the employee the right to benefit from increases in the share price over the exercise price during the option's contractual term. . drawing because the value of the share can change, making the share option more or less valuable). Q11), both types of options have value for the same reason. International Employee Stock Option Coalition position (From their Website) Accounting Integrity - Mandated expensing of stock options is without any clear or generally accepted accounting rationale. - Existing models were not designed to account for dynamic employee stock options that can be exercised over several years. - A review of stock option expensing models from 1999-2004 show radically different valuations based on volatility of the stock market. Economic Impact - 79% of stock options holders earn less than $75,000 annually. - Discouraging stock options could result in over $2.3 trillion in lost output over the next decade (Employment Policy Foundation). - Federal, state and local governments could lose up to $563 billion in tax revenue over the next 10 years (Employment and Policy Foundation). Innovation Impact - "Innovation will be the single most important factor in determining America's economic success through the 21st Century" (Council on Competitiveness) - "Innovation generates the productivity that economists estimate has accounted for half of U. S. GDP growth over last 50 years" (Rational Exuberance, Michael Mandel) - "Knowledge intensive companies generally have a market value that is significantly higher than their book value" (National Innovation Initiative) Excerpt from Berkshire Hathaway Annual Report even though the funds they use in that fight normally don't belong to them, but are instead put up by their shareholders