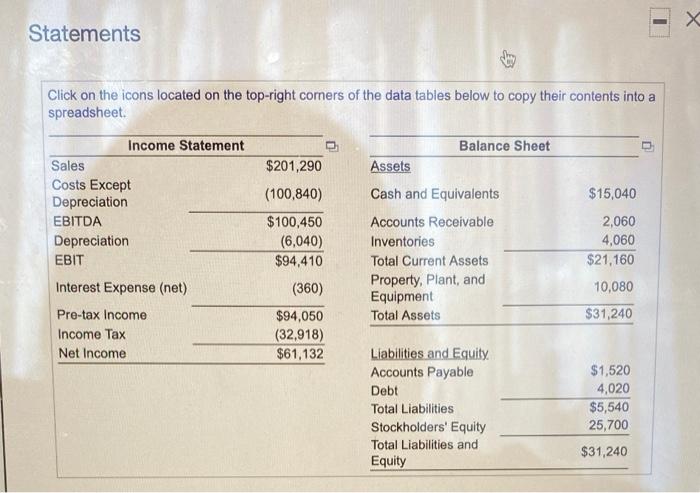

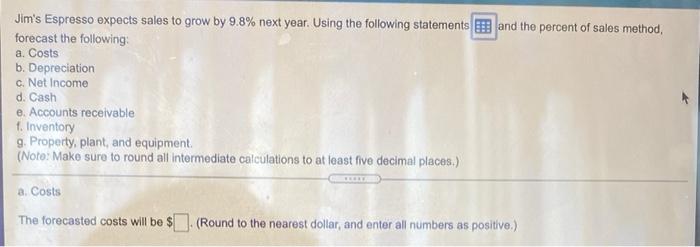

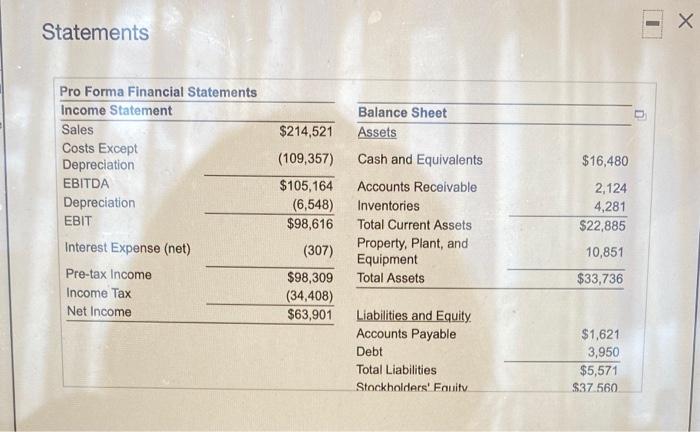

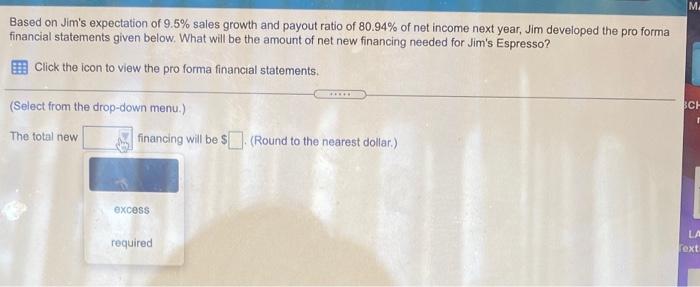

Statements day Click on the icons located on the top-right corners of the data tables below to copy their contents into a spreadsheet Balance Sheet $201,290 Assets Cash and Equivalents $15,040 Income Statement Sales Costs Except Depreciation EBITDA Depreciation EBIT Interest Expense (net) Pre-tax Income Income Tax Net Income (100,840) $100,450 (6,040) $94,410 2,060 4,060 $21,160 Accounts Receivable Inventories Total Current Assets Property, plant, and Equipment Total Assets 10,080 (360) $94,050 (32,918) $61,132 $31,240 Liabilities and Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity $1,520 4,020 $5,540 25,700 $31,240 Jim's Espresso expects sales to grow by 9.8% next year. Using the following statements and the percent of sales method, forecast the following: a. Costs b. Depreciation c. Net Income d. Cash e. Accounts receivable f. Inventory 9. Property, plant, and equipment (Noto: Make sure to round all intermediate calculations to at least five decimal places.) a Costs The forecasted costs will be $(Round to the nearest dollar, and enter all numbers as positive.) Statements $16,480 Pro Forma Financial Statements Income Statement Sales Costs Except Depreciation EBITDA Depreciation EBIT Interest Expense (net) Pre-tax Income Income Tax Net Income $214,521 (109,357) $105,164 (6,548) $98,616 (307) $98,309 (34,408) $63,901 Balance Sheet Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Total Assets 2,124 4,281 $22,885 10,851 $33,736 Liabilities and Equity Accounts Payable Debt Total Liabilities Stockholders' Fauit $1,621 3,950 $5,571 $37.560 M Based on Jim's expectation of 9.5% sales growth and payout ratio of 80.94% of net income next year, Jim developed the pro forma financial statements given below. What will be the amount of net new financing needed for Jim's Espresso? 2 Click the icon to view the pro forma financial statements. SCH (Select from the drop-down menu.) The total new financing will be $(Round to the nearest dollar) excess required LA ext