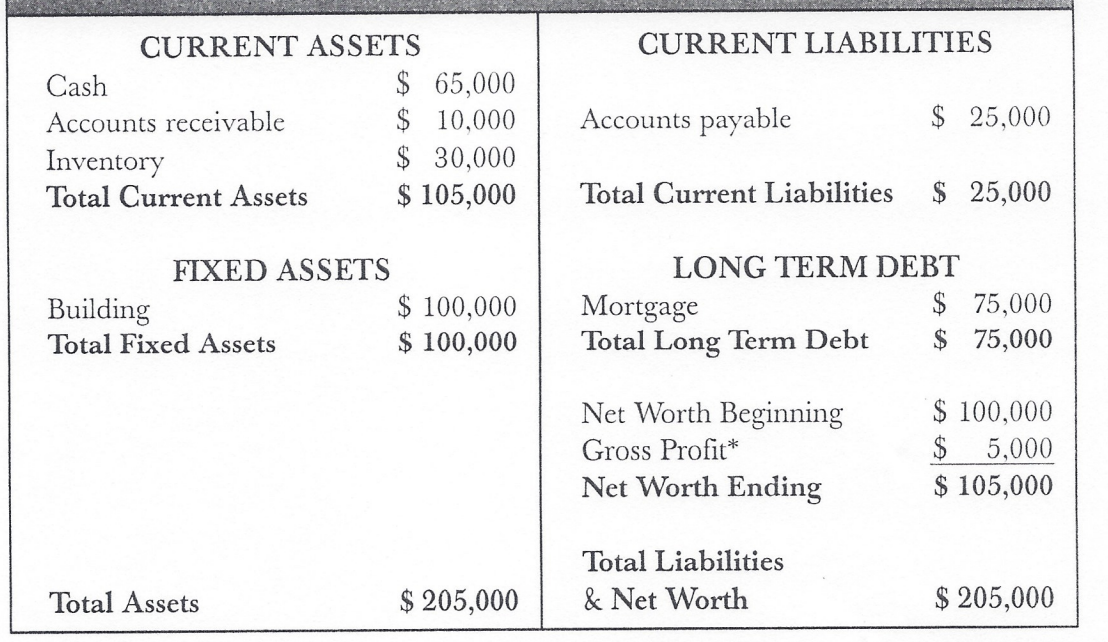

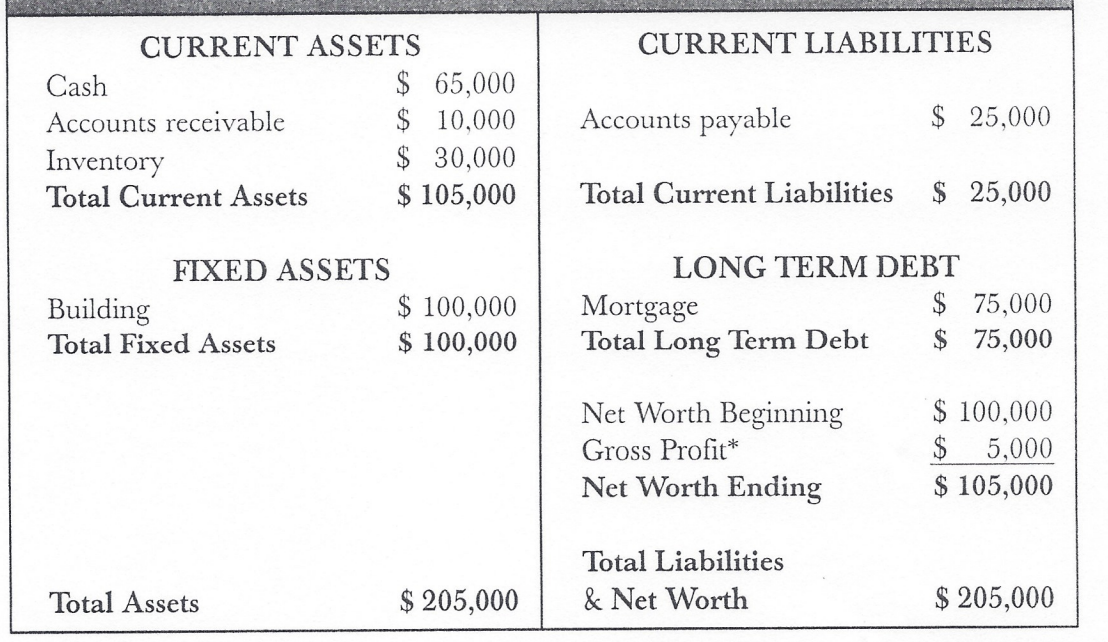

Statements". Please prepare a balance sheet for the end of week 2, 3, 4, & 5 (four balance sheets). Assumptions: 1) Assume that $25,000 of inventory will be sold in week 2, and the gross margin is now 40%. (you might need to lookup how to calculate gross margin. I show it in the lecture) 2) Inventory sales increase by $10000 each week for the following three weeks. Sales proportion of credit vs. cash will be 60% cash vs 40% credit. For simplicity, assume sales are made on the first day of the week. You might need to replenish inventory at times. 2) Add a weekly expenses of $4,000 for wages and other expenses. This will be paid from the cash account at the end of each week. 3) The receivables will arrive 2 weeks after being sold. The inventory purchases (payables) are due 1 weeks after being purchased. CURRENT ASSETS Cash Accounts receivable Inventory Total Current Assets FIXED ASSETS Building Total Fixed Assets Total Assets $ 65,000 $ 10,000 $ 30,000 $ 105,000 $ 100,000 $ 100,000 $ 205,000 CURRENT LIABILITIES Accounts payable Total Current Liabilities $ 25,000 LONG TERM DEBT Mortgage Total Long Term Debt $ 25,000 Net Worth Beginning Gross Profit* Net Worth Ending Total Liabilities & Net Worth $ 75,000 $ 75,000 $ 100,000 $ 5,000 $ 105,000 $ 205,000 Statements". Please prepare a balance sheet for the end of week 2, 3, 4, & 5 (four balance sheets). Assumptions: 1) Assume that $25,000 of inventory will be sold in week 2, and the gross margin is now 40%. (you might need to lookup how to calculate gross margin. I show it in the lecture) 2) Inventory sales increase by $10000 each week for the following three weeks. Sales proportion of credit vs. cash will be 60% cash vs 40% credit. For simplicity, assume sales are made on the first day of the week. You might need to replenish inventory at times. 2) Add a weekly expenses of $4,000 for wages and other expenses. This will be paid from the cash account at the end of each week. 3) The receivables will arrive 2 weeks after being sold. The inventory purchases (payables) are due 1 weeks after being purchased. CURRENT ASSETS Cash Accounts receivable Inventory Total Current Assets FIXED ASSETS Building Total Fixed Assets Total Assets $ 65,000 $ 10,000 $ 30,000 $ 105,000 $ 100,000 $ 100,000 $ 205,000 CURRENT LIABILITIES Accounts payable Total Current Liabilities $ 25,000 LONG TERM DEBT Mortgage Total Long Term Debt $ 25,000 Net Worth Beginning Gross Profit* Net Worth Ending Total Liabilities & Net Worth $ 75,000 $ 75,000 $ 100,000 $ 5,000 $ 105,000 $ 205,000