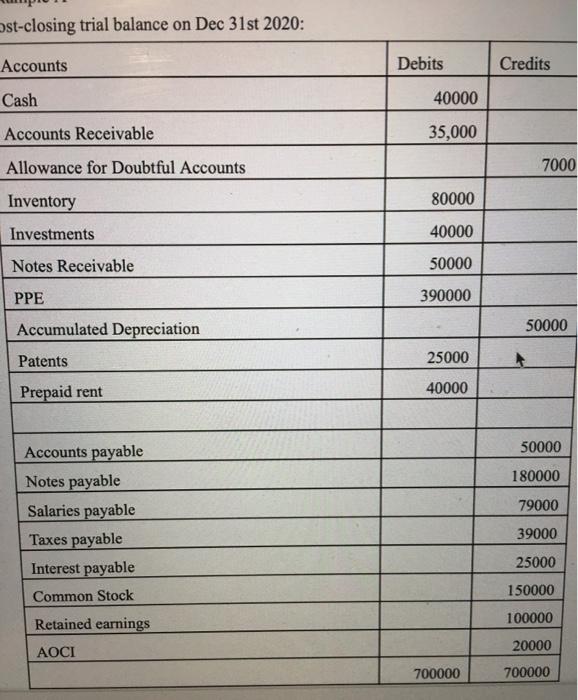

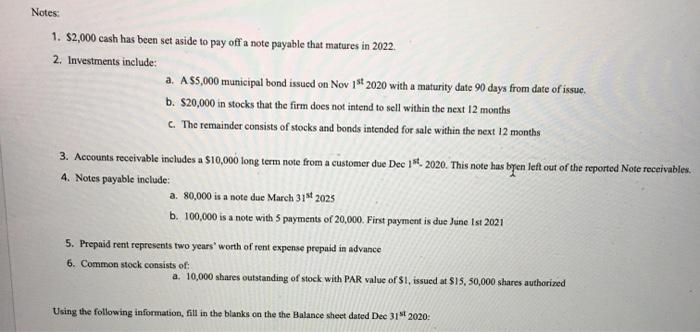

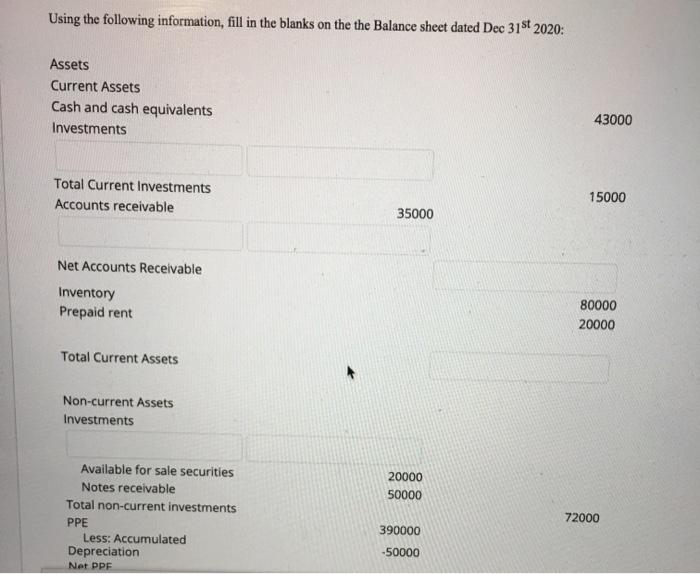

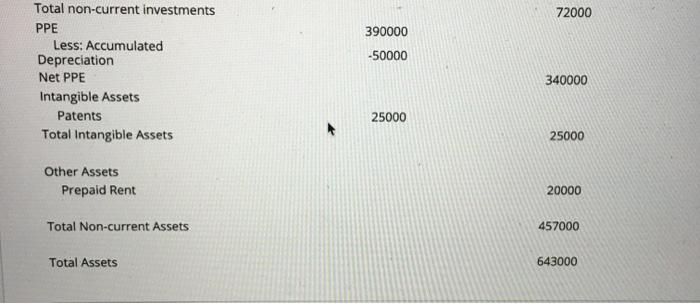

st-closing trial balance on Dec 31st 2020: Accounts Debits Credits Cash 40000 Accounts Receivable 35,000 Allowance for Doubtful Accounts 7000 Inventory 80000 Investments 40000 Notes Receivable 50000 PPE 390000 Accumulated Depreciation 50000 Patents 25000 Prepaid rent 40000 50000 180000 79000 Accounts payable Notes payable Salaries payable Taxes payable Interest payable Common Stock Retained earnings 39000 25000 150000 100000 20000 AOCI 700000 700000 Notes: 1. $2,000 cash has been set aside to pay off a note payable that matures in 2022 2. Investments include: a. A $5,000 municipal bond issued on Nov 1842020 with a maturity date 90 days from date of issue. b. $20,000 in stocks that the firm does not intend to sell within the next 12 months C. The remainder consists of stocks and bonds intended for sale within the next 12 months 3. Accounts receivable includes a $10,000 long term note from a customer due Dec 18-2020. This note has byen left out of the reported Note receivables. 4. Notes payable include: a. 80,000 is a note due March 31st 2025 b. 100,000 is a note with 5 payments of 20,000. First payment is due June Ist 2021 5. Prepaid rent represents two years' worth of rent expense prepaid in advance a. 10,000 shares outstanding of stock with PAR value of S1, issued at $15, 50,000 shares authorized 6. Common stock consists of: Using the following information, fill in the blanks on the the Balance sheet dated Dec 312020: Using the following information, fill in the blanks on the the Balance sheet dated Dec 31st 2020: Assets Current Assets Cash and cash equivalents Investments 43000 Total Current Investments Accounts receivable 15000 35000 Net Accounts Receivable Inventory Prepaid rent 80000 20000 Total Current Assets Non-current Assets Investments 20000 50000 Available for sale securities Notes receivable Total non-current investments PPE Less: Accumulated Depreciation Net PPE 72000 390000 -50000 72000 390000 -50000 Total non-current investments PPE Less: Accumulated Depreciation Net PPE Intangible Assets Patents Total Intangible Assets 340000 25000 25000 Other Assets Prepaid Rent 20000 Total Non-current Assets 457000 Total Assets 643000 st-closing trial balance on Dec 31st 2020: Accounts Debits Credits Cash 40000 Accounts Receivable 35,000 Allowance for Doubtful Accounts 7000 Inventory 80000 Investments 40000 Notes Receivable 50000 PPE 390000 Accumulated Depreciation 50000 Patents 25000 Prepaid rent 40000 50000 180000 79000 Accounts payable Notes payable Salaries payable Taxes payable Interest payable Common Stock Retained earnings 39000 25000 150000 100000 20000 AOCI 700000 700000 Notes: 1. $2,000 cash has been set aside to pay off a note payable that matures in 2022 2. Investments include: a. A $5,000 municipal bond issued on Nov 1842020 with a maturity date 90 days from date of issue. b. $20,000 in stocks that the firm does not intend to sell within the next 12 months C. The remainder consists of stocks and bonds intended for sale within the next 12 months 3. Accounts receivable includes a $10,000 long term note from a customer due Dec 18-2020. This note has byen left out of the reported Note receivables. 4. Notes payable include: a. 80,000 is a note due March 31st 2025 b. 100,000 is a note with 5 payments of 20,000. First payment is due June Ist 2021 5. Prepaid rent represents two years' worth of rent expense prepaid in advance a. 10,000 shares outstanding of stock with PAR value of S1, issued at $15, 50,000 shares authorized 6. Common stock consists of: Using the following information, fill in the blanks on the the Balance sheet dated Dec 312020: Using the following information, fill in the blanks on the the Balance sheet dated Dec 31st 2020: Assets Current Assets Cash and cash equivalents Investments 43000 Total Current Investments Accounts receivable 15000 35000 Net Accounts Receivable Inventory Prepaid rent 80000 20000 Total Current Assets Non-current Assets Investments 20000 50000 Available for sale securities Notes receivable Total non-current investments PPE Less: Accumulated Depreciation Net PPE 72000 390000 -50000 72000 390000 -50000 Total non-current investments PPE Less: Accumulated Depreciation Net PPE Intangible Assets Patents Total Intangible Assets 340000 25000 25000 Other Assets Prepaid Rent 20000 Total Non-current Assets 457000 Total Assets 643000