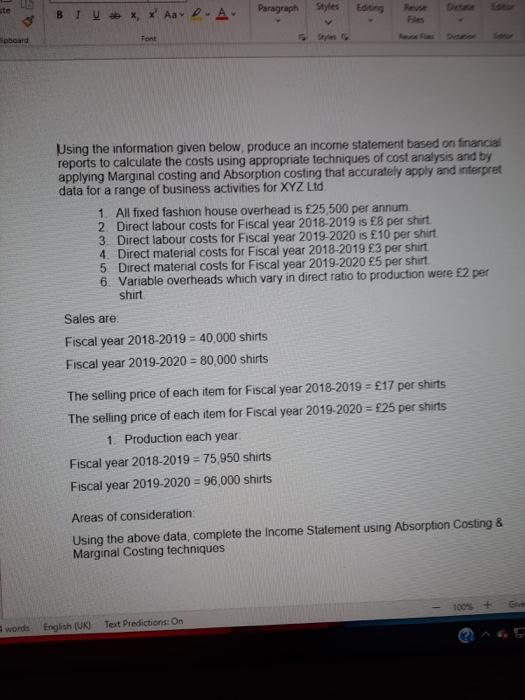

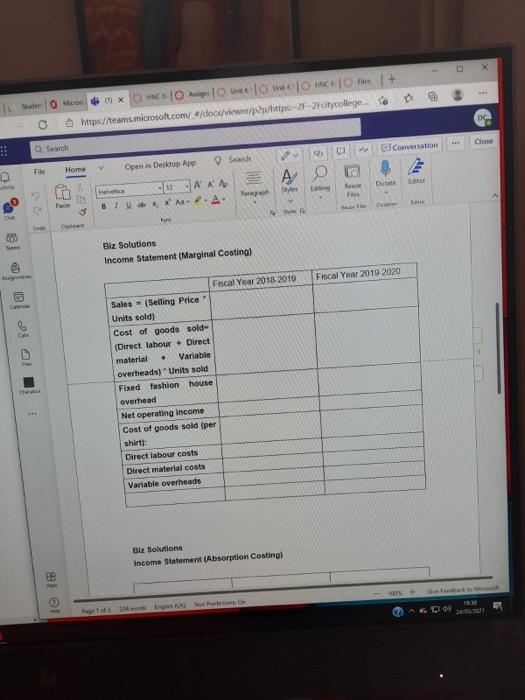

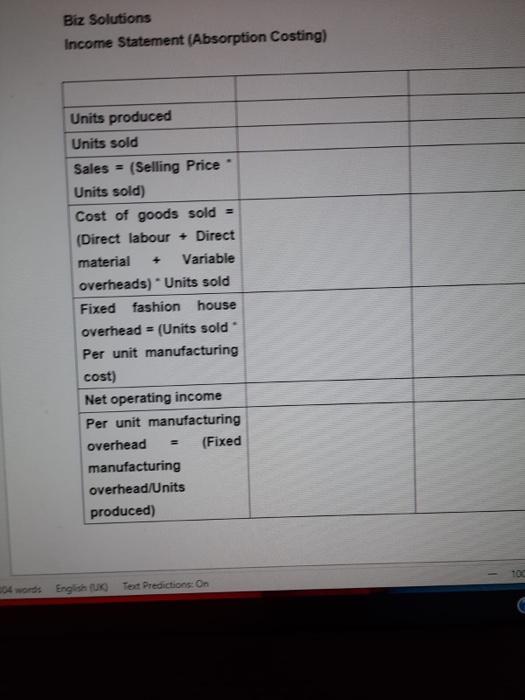

ste BI x = Aa P A- Styles Paragraph board Font Using the information given below, produce an income statement based on financial reports to calculate the costs using appropriate techniques of cost analysis and by applying Marginal costing and Absorption costing that accurately apply and interpret data for a range of business activities for XYZ Ltd 1. All fixed fashion house overhead is f25,500 per annum 2. Direct labour costs for Fiscal year 2018-2019 is 8 per shirt 3. Direct labour costs for Fiscal year 2019-2020 is 10 per shirt. 4. Direct material costs for Fiscal year 2018-2019 3 per shirt 5 Direct material costs for Fiscal year 2019-2020 5 per shirt 6. Variable overheads which vary in direct ratio to production were 2 per shirt Sales are Fiscal year 2018-2019 = 40,000 shirts Fiscal year 2019-2020 = 80,000 shirts The selling price of each item for Fiscal year 2018-2019 = 17 per shirts The selling price of each item for Fiscal year 2019-2020 = 25 per shirts 1. Production each year Fiscal year 2018-2019 = 75,950 shirts Fiscal year 2019-2020 = 96,000 shirts Areas of consideration Using the above data, complete the Income Statement using Absorption Costing & Marginal Costing techniques 100% English (UK) Text Predictions: On X 0 mesajes o lloc. OT+ https://teams.microsoft.com/_/doc/viewet/p2p/pe-21-2icitycollege to od 0 Close Conversation Search File Home Open in Descop App Dictate Editor Style 2 BADA Biz Solutions Income Statement (Marginal Costinal Fiscal Year 2019-2020 Fiscal Year 2018 2019 + Sales - (Selling Price Units sold) Cost of goods sold- (Direct labour - Direct material Variable overheads) Units sold Fixed fashion house overhead Net operating income Cost of goods sold (per shirt Direct labour costs Direct material costs Variable overheads Biz Solutions Income Statement(Absorption Costing + 0 290 Biz Solutions Income Statement (Absorption Costing) Units produced Units sold Sales = (Selling Price Units sold) Cost of goods sold = (Direct labour - Direct material Variable overheads) Units sold Fixed fashion house overhead = (Units sold Per unit manufacturing cost) Net operating income Per unit manufacturing overhead (Fixed manufacturing overhead/Units produced) 04 word English Text Predictions: ste BI x = Aa P A- Styles Paragraph board Font Using the information given below, produce an income statement based on financial reports to calculate the costs using appropriate techniques of cost analysis and by applying Marginal costing and Absorption costing that accurately apply and interpret data for a range of business activities for XYZ Ltd 1. All fixed fashion house overhead is f25,500 per annum 2. Direct labour costs for Fiscal year 2018-2019 is 8 per shirt 3. Direct labour costs for Fiscal year 2019-2020 is 10 per shirt. 4. Direct material costs for Fiscal year 2018-2019 3 per shirt 5 Direct material costs for Fiscal year 2019-2020 5 per shirt 6. Variable overheads which vary in direct ratio to production were 2 per shirt Sales are Fiscal year 2018-2019 = 40,000 shirts Fiscal year 2019-2020 = 80,000 shirts The selling price of each item for Fiscal year 2018-2019 = 17 per shirts The selling price of each item for Fiscal year 2019-2020 = 25 per shirts 1. Production each year Fiscal year 2018-2019 = 75,950 shirts Fiscal year 2019-2020 = 96,000 shirts Areas of consideration Using the above data, complete the Income Statement using Absorption Costing & Marginal Costing techniques 100% English (UK) Text Predictions: On X 0 mesajes o lloc. OT+ https://teams.microsoft.com/_/doc/viewet/p2p/pe-21-2icitycollege to od 0 Close Conversation Search File Home Open in Descop App Dictate Editor Style 2 BADA Biz Solutions Income Statement (Marginal Costinal Fiscal Year 2019-2020 Fiscal Year 2018 2019 + Sales - (Selling Price Units sold) Cost of goods sold- (Direct labour - Direct material Variable overheads) Units sold Fixed fashion house overhead Net operating income Cost of goods sold (per shirt Direct labour costs Direct material costs Variable overheads Biz Solutions Income Statement(Absorption Costing + 0 290 Biz Solutions Income Statement (Absorption Costing) Units produced Units sold Sales = (Selling Price Units sold) Cost of goods sold = (Direct labour - Direct material Variable overheads) Units sold Fixed fashion house overhead = (Units sold Per unit manufacturing cost) Net operating income Per unit manufacturing overhead (Fixed manufacturing overhead/Units produced) 04 word English Text Predictions